Office Depot 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

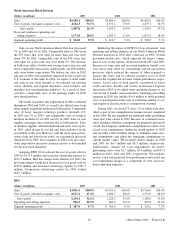

2002, personnel, facility-related, advertising, and delivery

expenses increased in total dollars because of the expansion of

our business in Europe. However, in 2003 operating and sell-

ing expenses as a percentage of sales decreased, primarily as a

result of the purchase of Guilbert’s large account customer

base, which requires less marketing and related costs. Also

favorably impacting operating and selling expenses was the

continued leverage of certain fixed operating expenses. As our

operations grow in a particular market, fixed operating

expenses decline relative to sales. For example, advertising

costs in the form of prospecting and delivery costs, which are

affected by the density of the delivery areas, decline as a per-

centage of sales as the market grows. Fiscal 2001 includes a

gain of $10.2 million from the sale of a warehouse in London.

As noted above, sales in local currencies have substantially

increased in recent years. For U.S. reporting, these sales are

translated into U.S. dollars at average exchange rates experi-

enced during the year. International Division sales were posi-

tively impacted by foreign exchange rates in 2003 by $253.2

million and $67.0 million in 2002. International Division seg-

ment operating profit also benefited from foreign exchange

rates by $32.7 million during 2003 and $9.0 million in 2002.

Future volatility in exchange rates could affect translated sales

and operating profit of our International operations.

In January 2003, we sold our operations in Australia with

no significant impact on earnings. The Australian operations

have been accounted for as discontinued operations and all

periods presented have been restated. In addition to Europe,

we continue to operate in Japan. We have focused our

Japanese business on a single brand offering and streamlined

operations; however, sales trends in Japan have been negative

for each of the periods presented.

Corporate and Other

Other Operating Expenses

Other operating expenses primarily reflect pre-opening

expenses and, in 2003, costs related to the integration of

Guilbert.

Pre-opening expenses consist of personnel, property and

advertising expenses incurred in opening or relocating stores

and CSCs. We typically incur pre-opening expenses during a

six-week period prior to a store opening. Because we expense

these items as they are incurred, the amount of pre-opening

expenses each year is generally proportional to the number of

new stores and CSCs opened during the period. Total

Company store openings and relocations were 64 in 2003, 42

in 2002 and 55 in 2001. We opened 3 CSCs in 2002 and 4 in

2001. For 2003, our pre-opening expenses were approximately

$150,000 per domestic office supply store and $75,000 per

international office supply store. Our cost to open a new CSC

varies significantly with the size and location of the facility.

Although no CSCs were opened in 2003, we estimate costs to

open a domestic or international CSC to be approximately

$1.0 million per facility.

In 2003, we incurred approximately $17.7 million of non-

capitalizable integration costs in connection with our acquisi-

tion of Guilbert in June 2003. These costs primarily relate to

professional consulting fees for assistance with integration,

management, internal communications plans, and human

resource aspects of the acquisition.

General and Administrative Expenses

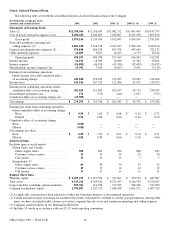

(Dollars in thousands) 2003 2002 2001

General and

administrative

expenses . . . . . . . . . . $578,840 $486,279 $445,538

Percentage of sales . . . . 4.7% 4.3% 4.0%

Our general and administrative expenses consist prima-

rily of personnel-related costs associated with support func-

tions. Because these functions typically support all segments

of our business, we have historically not considered these

costs in determining our segment profitability. However, with

the growth in our e-commerce and the acquisition of Guilbert,

our general and administrative costs have increased substan-

tially in recent years. Therefore, beginning in 2004, we plan to

reclassify certain amounts previously classified as general and

administrative expenses into operating and selling expenses.

We also plan to begin allocating costs where appropriate to

determine segment profitability.

The increase in 2003 reflects the inclusion of Guilbert

since its acquisition in June, the impact of exchange rates

on other international expenses, and costs relating to

finance, human resources and merchandising software appli-

cations. Employee-related costs declined in 2003 from lower

performance-based compensation, partially offset by higher

costs for healthcare and other employee benefits. The increase

in 2002 was attributable to additional professional fees to sup-

port operational process improvements, additional benefits

costs, and costs incurred to support expansion activities that

were not chargeable to segment operations.

The comments above and in the Overall section of MD&A

describe how our management has historically determined our

general and administrative expenses. Other companies may

charge more or less of their general and administrative costs to

their segments, and their results may not be comparable to ours.

Other Income and Expense

(Dollars in thousands) 2003 2002 2001

Interest income . . . . . . . $ 14,196 $ 18,509 $ 12,980

Interest expense . . . . . . (54,805) (46,195) (43,339)

Miscellaneous income

(expense), net . . . . . . 15,392 7,183 (9,057)

Average cash balances decreased slightly during 2003 after

a substantial increase in 2002; however, interest rates earned on

cash investments declined during the same time periods.

In August 2003 we issued $400 million of senior notes

that mature in 2013. The increase in interest expense in 2003

reflects the impact of a partial year of interest relating to this

21 Office Depot 2003 / Form 10-K