Office Depot 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

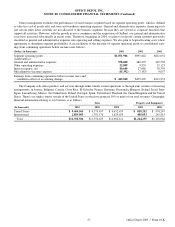

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

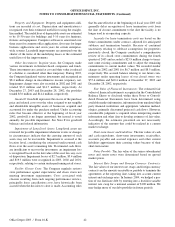

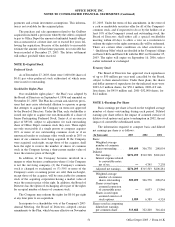

payments and certain investment assumptions. This informa-

tion is not available for the acquired plans.

The purchase and sale agreement related to the Guilbert

acquisition included a provision whereby the seller is required

to pay to Office Depot the amount of unfunded benefit obliga-

tion as measured at a future date, not to exceed five years fol-

lowing the acquisition. Because of the inability to reasonably

estimate the amount of that future payment, no receivable has

been recorded at December 27, 2003. The future settlement

will reduce goodwill when received.

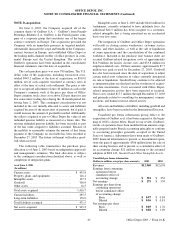

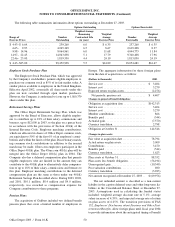

NOTE K—Capital Stock

Preferred Stock

As of December 27, 2003, there were 1,000,000 shares of

$0.01 par value preferred stock authorized of which none

were issued or outstanding.

Stockholder Rights Plan

Our stockholder rights plan (“ the Plan”) was adopted by

the Board of Directors on September 4, 1996 and amended on

November 25, 2003. The Plan has certain anti-takeover provi-

sions that may cause substantial dilution to a person or group

that attempts to acquire the Company on terms not approved

by the Board of Directors. Under the Plan, each stockholder is

issued one right to acquire one one-thousandth of a share of

Junior Participating Preferred Stock, Series A at an exercise

price of $95.00, subject to adjustment, for each outstanding

share of Office Depot common stock they own. These rights

are only exercisable if a single person or company acquires

20% or more of our outstanding common stock or if an

announced tender or exchange offer would result in 20% or

more of our common stock being acquired. If the Company

were acquired, each right, except those of the acquirer, shall

have the right to receive the number of shares of common

stock in the Company having a then-current market value of

twice the exercise price of the right.

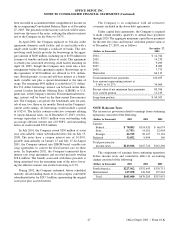

In addition, if the Company becomes involved in a

merger or other business combination where (1) the Company

is not the surviving company, (2) the Company’s common

stock is changed or exchanged, or (3) 50% or more of the

Company’s assets or earning power are sold, then each right,

except those of the acquirer, will be exercisable for common

stock of the acquiring corporation having a market value of

twice the exercise price of the right. In addition, the Board of

Directors has the option of exchanging all or part of the rights

for an equal number of shares of common stock.

The Company may redeem the rights for $0.01 per right

at any time prior to an acquisition.

In response to a shareholder vote at the Company’s 2003

Annual Meeting, the Board of Directors adopted certain

amendments to the Plan, which became effective on November

25, 2003. Under the terms of this amendment, in the event of

a cash or marketable securities offer for all of the Company’s

common stock, and if requested to do so by the holders of at

least 10% of the Company’s issued and outstanding stock, the

Board of Directors shall either call a special stockholder

meeting within 60 days to allow a vote on a resolution to

redeem the rights or the rights automatically will be redeemed.

There are certain other conditions on what constitutes a

“ Qualifying Offer”which are detailed in the Company’s filings

on Form 8-K/A and Form 8-K with the SEC on November 25,

2003. The rights will expire on September 16, 2006, unless

earlier redeemed or exchanged.

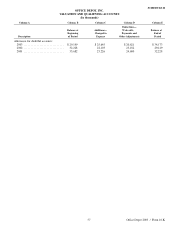

Treasury Stock

The Board of Directors has approved stock repurchases

of up to $50 million per year until cancelled by the Board,

subject to their annual review. Under these plans, the shares

and dollar amount of repurchases for the indicated years were:

2003—3.2 million shares, for $50.1 million; 2002—2.9 mil-

lion shares, for $45.9 million and; 2001—252,000 shares, for

$4.2 million.

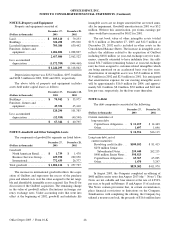

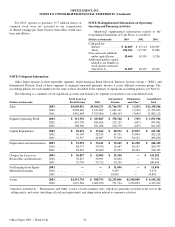

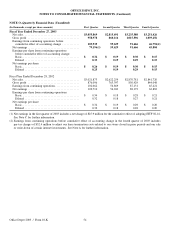

NOTE L—Earnings Per Share

Basic earnings per share is based on the weighted average

number of shares outstanding during each period. Diluted

earnings per share reflects the impact of assumed exercise of

dilutive stock options and, prior to redemption in 2002, the net

impact of convertible subordinated notes.

The information required to compute basic and diluted

net earnings per share is as follows:

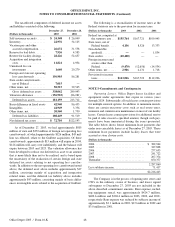

(In thousands) 2003 2002 2001

Basic:

Weighted average

number of common

shares outstanding . . . . . 309,699 306,778 298,054

Diluted:

Net earnings . . . . . . . . . $276,295 $310,708 $201,043

Interest expense related

to convertible notes,

net of tax. . . . . . . . . . —4,795 7,238

Adjusted net earnings . . $276,295 $315,503 $208,281

Weighted average

number of common

shares outstanding . . 309,699 306,778 298,054

Shares issued upon

assumed conversion

of convertible notes . . —9,033 13,846

Shares issued upon

assumed exercise of

stock options. . . . . . . 3,989 6,389 4,524

Shares used in computing

diluted net earnings

per common share . . . . 313,688 322,200 316,424

51 Office Depot 2003 / Form 10-K