Office Depot 2003 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

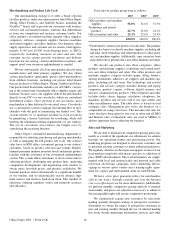

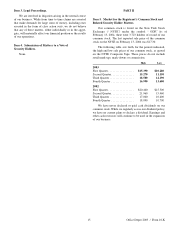

QUARTERLY STOCK PRICE RANGE

The following table sets forth, for the periods indicated, the high and low sales prices of the Company’s common stock quoted on the

NYSE Composite Tape. These prices do not include retail mark-ups, mark-downs or commissions:

2003 High Low

First Quarter $15.390 $10.280

Second Quarter $15.270 $11.150

Third Quarter $18.500 $14.190

Fourth Quarter $16.990 $13.600

2002 High Low

First Quarter $20.400 $15.500

Second Quarter $21.960 $15.460

Third Quarter $17.000 $10.600

Fourth Quarter $18.090 $10.700

FINANCIAL HIGHLIGHTS

OFFICE DEPOT 2003 ANNUAL REPORT

5

The following table sets forth the consolidated historical selected financial data of the Company:

(In thousands, except per share

amounts and statistical data) 2003 2002 2001 (1) 2000 (1) (4) 1999 (1)

Statements of Earnings Data:

Sales (2). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12,358,566 $11,356,633 $11,082,112 $11,495,493 $10,197,373

Cost of goods sold and occupancy costs . . . . . . . . . . . . . . 8,484,420 8,022,663 7,940,067 8,435,928 7,405,870

Gross profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,874,146 3,333,970 3,142,045 3,059,565 2,791,503

Store and warehouse operating and

selling expenses (2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,802,240 2,338,128 2,331,013 2,498,146 2,040,216

General and administrative expenses (2) . . . . . . . . . . . . . . 578,840 486,279 445,538 447,693 322,172

Other operating expenses. . . . . . . . . . . . . . . . . . . . . . . . . . 22,809 9,855 12,125 6,733 16,524

Operating profit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 470,257 499,708 353,369 106,993 412,591

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,196 18,509 12,980 11,345 30,043

Interest expense. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (54,805) (46,195) (43,339) (32,683) (24,852)

Miscellaneous income (expense), net . . . . . . . . . . . . . . . . . 15,392 7,183 (9,057) 4,632 (3,514)

Earnings from continuing operations

before income taxes and cumulative effect

of accounting change. . . . . . . . . . . . . . . . . . . . . . . . . . . 445,040 479,205 313,953 90,287 414,268

Income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 143,016 167,722 112,296 41,972 155,875

Earnings from continuing operations before

cumulative effect of accounting change . . . . . . . . . . . . . 302,024 311,483 201,657 48,315 258,393

Discontinued operations, net . . . . . . . . . . . . . . . . . . . . . . . 176 (775) (614) 1,017 (755)

Cumulative effect of accounting change, net . . . . . . . . . . . (25,905) — — ——

Net earnings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 276,295 $ 310,708 $ 201,043 $ 49,332 $ 257,638

Earnings per share from continuing operations

before cumulative effect of accounting change:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.98$1.02$0.68 $ 0.16 $ 0.72

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.96 0.98 0.66 0.16 0.69

Cumulative effect of accounting change:

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.08) — — ——

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (0.08) — — ——

Net earnings per share: . . . . . . . . . . . . . . . . . . . . . . . . . . .

Basic . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0.89$1.01$0.67 $ 0.16 $ 0.71

Diluted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 0.88 0.98 0.66 0.16 0.69

Statistical Data:

Facilities open at end of period:

United States and Canada:

Office supply stores . . . . . . . . . . . . . . . . . . . . . . . . . . 900 867 859 888 825

Customer service centers. . . . . . . . . . . . . . . . . . . . . . 22 24 24 25 30

Call centers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13 13 13 7 7

International (3):

Office supply stores . . . . . . . . . . . . . . . . . . . . . . . . . . 64 50 39 35 32

Customer service centers . . . . . . . . . . . . . . . . . . . . . 25 15 14 12 12

Call centers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 31 13 11 11 11

Balance Sheet Data:

Working capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,299,475 $1,217,706 $ 721,867 $ 790,752 $ 687,007

Total assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6,145,242 4,765,812 4,331,643 4,196,334 4,276,183

Long-term debt, excluding current maturities. . . . . . . . . . . 829,302 411,970 317,552 598,499 321,099

Common stockholders’ equity . . . . . . . . . . . . . . . . . . . . . . 2,794,087 2,297,112 1,848,438 1,601,251 1,907,720

(1) As applicable, amounts have been adjusted to reflect the Australian business as discontinued operations.

(2) Certain amounts in prior year financial statements have been reclassified to conform to current year presentation. Among other items, we have classified facility closure costs

from a separate line into store and warehouse operating and selling expenses.

(3) Company-owned facilities in our International Division.

(4) Includes 53 weeks in accordance with our 52–53 week reporting convention.