Office Depot 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

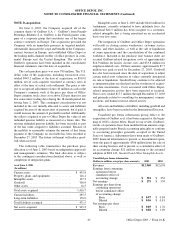

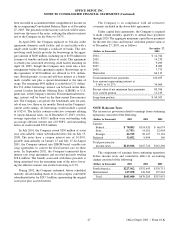

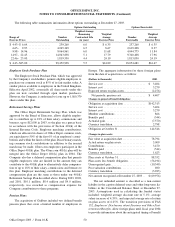

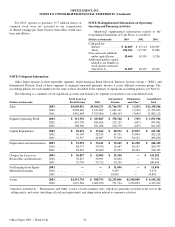

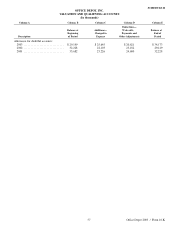

The following table summarizes information about options outstanding at December 27, 2003.

Options Outstanding Options Exercisable

Weighted Average

Remaining Weighted Weighted

Range of Number Contractual Life Average Number Average

Exercise Prices Outstanding (in years) Exercise Price Exercisable Exercise Price

$4.43–$ 6.64 . . . . . . . . . . . . . . . . 239,260 6.0 $ 6.35 237,260 $ 6.35

6.65– 9.97 . . . . . . . . . . . . . . . . 4,265,349 6.5 8.67 2,619,208 8.37

9.98– 14.96 . . . . . . . . . . . . . . . . 9,064,961 6.0 11.68 4,044,775 11.84

14.97– 22.45 . . . . . . . . . . . . . . . . 14,063,838 5.1 17.79 9,340,408 17.96

22.46– 25.00 . . . . . . . . . . . . . . . . 1,819,530 4.4 24.19 1,813,030 24.19

$ 4.43–$25.00 . . . . . . . . . . . . . . . . 29,452,938 5.5 $14.89 18,054,681 $16.67

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Employee Stock Purchase Plan

The Employee Stock Purchase Plan, which was approved

by the Company’s stockholders, permits eligible employees to

purchase our common stock at 85% of its fair market value. A

similar plan is available to employees in the United Kingdom.

Effective April 2002, essentially all share needs under this

plan are now satisfied through open market purchases.

However, the Company is authorized to issue up to 1,860,379

shares under this plan.

Retirement Savings Plans

The Office Depot Retirement Savings Plan, which was

approved by the Board of Directors, allows eligible employ-

ees to contribute up to 18% of their salary, commissions and

bonuses, up to $12,000 in 2003, to the plan on a pretax basis

in accordance with the provisions of Section 401(k) of the

Internal Revenue Code. Employer matching contributions,

which are allocated in shares of Office Depot common stock,

are equivalent to 50% of the first 6% of an employee’s contri-

butions and within the limits of the plan. Discretionary match-

ing common stock contributions in addition to the normal

match may be made. 4Sure.com employees participate in the

Office Depot 401(k) plan. The 4Sure.com 401(k) plan will be

merged into the Office Depot 401(k) plan in 2004. The

Company also has a deferred compensation plan that permits

eligible employees who are limited in the amount they can

contribute to the 401(k) plan to alternatively defer compensa-

tion of up to 18% of their salary, commissions and bonuses to

this plan. Employer matching contributions to the deferred

compensation plan are the same as those under our 401(k)

Retirement Savings Plan described above. During 2003, 2002,

and 2001, $10.1 million, $8.4 million and $4.0 million,

respectively, was recorded as compensation expense for

Company contributions to these programs.

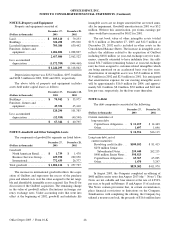

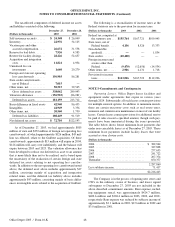

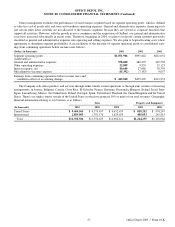

Pension Plans

The acquisition of Guilbert included two defined benefit

pension plans that cover a limited number of employees in

Europe. The aggregate information for these foreign plans

from the date of acquisition is as follows:

(Dollars in thousands) 2003

Service cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 3,404

Interest cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,279

Expected return on plan assets. . . . . . . . . . . . . . . (2,276)

Net periodic pension cost. . . . . . . . . . . . . . . . . $ 4,407

Changes in projected benefit obligation:

Obligation at acquisition date . . . . . . . . . . . . . . . $142,313

Service cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,404

Interest cost . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,279

Member contributions . . . . . . . . . . . . . . . . . . . . . 866

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . (544)

Actuarial gain. . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,570)

Currency translation. . . . . . . . . . . . . . . . . . . . . . . 2,798

Obligation at October 31 . . . . . . . . . . . . . . . . . . . 144,546

Changes in plan assets:

Fair value at acquisition date . . . . . . . . . . . . . . . . 78,794

Actual return on plan assets. . . . . . . . . . . . . . . . . 5,009

Contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,470

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . (544)

Currency translation. . . . . . . . . . . . . . . . . . . . . . . 1,623

Plan assets at October 31 . . . . . . . . . . . . . . . . . . . 88,352

Plan assets less benefit obligation . . . . . . . . . . . . (56,194)

Unrecognized gain . . . . . . . . . . . . . . . . . . . . . . . . (10,549)

Post-valuation contributions. . . . . . . . . . . . . . . . . 690

Currency translation. . . . . . . . . . . . . . . . . . . . . . . (3,923)

Net amount recognized at December 27, 2003 . . $ (69,976)

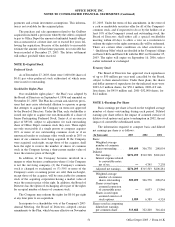

The net unfunded amount is classified as a non-current

liability in the caption deferred taxes and other long-term lia-

bilities in the Consolidated Balance Sheet at December 27,

2003. Assumptions used in calculating the funded status

included: weighted average discount rate of 5.1%; average

salary increase of 4.35%; and expected average rate of return

on plan assets of 6.25%. The transition provisions of FAS

132, Employers’ Disclosures about Pensions and Other Post-

retirement Benefits, allow foreign plans until fiscal year 2004

to provide information about the anticipated timing of benefit

Office Depot 2003 / Form 10-K 50