Office Depot 2003 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Office Depot 2003 / Proxy Statement 80

Holding Periods”), the grantee recognizes capital gain or loss,

as the case may be, measured by the difference between the

stock’s selling price and the exercise price. We are not entitled

to any tax deduction by reason of the grant or exercise of an

incentive option, or a disposition of stock received upon the

exercise of an incentive option after the Required Holding

Periods have been satisfied.

If a grantee disposes of shares of our common stock acquired

pursuant to the exercise of an incentive option before the expi-

ration of the Required Holding Periods (a “ Disqualifying

Disposition”), the difference between the exercise price of

such shares and the lesser of (i) the fair market value of such

shares upon the date of exercise or (ii) the selling price, will

constitute compensation taxable to the grantee as ordinary

income. We would be allowed a corresponding tax deduction

equal to the amount of compensation taxable to the grantee. If

the selling price of the stock exceeds the fair market value on

the exercise date, the excess will be taxable to the grantee as

capital gain. We are not allowed a tax deduction with respect

to any such capital gain recognized by the grantee.

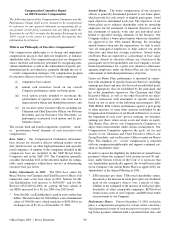

At the present time, it is the intention of our Compensation

Committee not to award any further incentive stock options

after February 19, 2004 and instead to award only non-quali-

fied stock options.

One Million Dollar Compensation Limit. If a covered

employee’s total compensation from our Company (including

compensation related to options) exceeds $1 million in any

given year, such compensation in excess of $1 million may

not be tax deductible by us under Section 162(m) of the Code.

The “ covered employees”for any given taxable year of Office

Depot are our Chief Executive Officer and the four other most

highly compensated executive officers at the end of the tax-

able year. Excluded from the calculation of total compensation

for this purpose is compensation that is “ performance-based”

within the meaning of Section 162(m) of the Code. We intend

that compensation realized upon the exercise of an option, SAR

or a performance award granted under the Plan be regarded as

“ performance-based” under Section 162(m) of the Code and

that such compensation be deductible without regard to the

limits of Section 162(m) of the Code.

Vote Required for the Plan Amendment

The affirmative vote of a majority of the votes cast by the

holders of shares of Office Depot Common stock represented

in person or by proxy at our Annual Meeting is required for

approval of the Plan Amendment.

Text of Proposed Plan Amendment

The Amendment to the Plan submitted for your approval is as

follows: The first sentence of Section 4 of the Long-Term

Equity Incentive Plan is hereby amended as follows:

Subject to adjustments as provided in Section 15, as of any date

the total number of shares of Common stock with respect to

which awards may be granted under the Plan (the “ Shares”)

shall equal the excess (if any) of 62,068,750 over (i) the number

of shares of Common stock subject to outstanding awards under

the Plan or the Prior Plans, (ii) the number of shares of

Common stock in respect of which options and stock appreciate

rights have been exercised under the Plan or the Prior Plans,

and (iii) the number of shares of Common stock issued pur-

suant to performance awards or issued subject to forfeiture

restrictions which have lapsed under the Plan or the Prior Plans.

Your Board of Directors Recommends a Vote FOR Item

Number 2 on your Proxy Card, Amending Our Long-

Term Equity Incentive Plan.

Item 3: Ratifying Our Audit Committee’s Appointment

of Deloitte & Touche LLP as Our Independent

Accounting Firm

Information About Our Independent Accountants

In accordance with the provisions of the Sarbanes-Oxley Act

of 2002 (“ SOA”), the Audit Committee of our Board has

appointed the certified public accounting firm of Deloitte &

Touche LLP (“ Deloitte”) as independent accountants to audit

our consolidated financial statements for the fiscal year end-

ing December 25, 2004. Deloitte has audited our consolidated

financial statements each year since 1990. Representatives of

Deloitte will be present at our Annual Meeting with the

opportunity to make a statement if they desire to do so, and

they will be available to respond to appropriate questions

from shareholders. Although our Audit Committee already

has appointed Deloitte as our independent accountants for

2004 and the vote of our shareholders is not required, we

request that the shareholders nevertheless ratify this appoint-

ment. Regardless of the vote of the shareholders, our Audit

Committee’s decision to appoint Deloitte as our independent

accountants for 2004 will not be changed, but our Audit

Committee may take into consideration the vote of our share-

holders on this matter in selecting independent accountants to

serve as our outside auditors in future years.