Office Depot 2003 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2003 Office Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

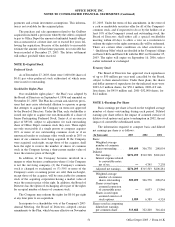

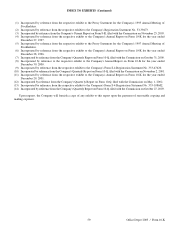

Office Depot 2003 / Form 10-K 52

For 2003, options to purchase 15.7 million shares of

common stock were not included in our computation

of diluted earnings per share because their effect would have

been anti-dilutive.

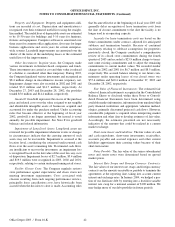

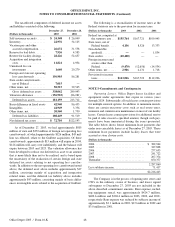

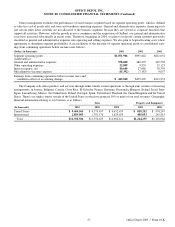

NOTE M—Supplemental Information on Operating,

Investing and Financing Activities

Additional supplemental information related to the

Consolidated Statements of Cash Flows is as follows:

(Dollars in thousands) 2003 2002 2001

Cash paid for:

Interest . . . . . . . . . . . . . $ 41,869 $ 47,114 $16,905

Taxes. . . . . . . . . . . . . . . 102,623 111,597 13,080

Non-cash asset additions

under capital leases . . . 10,664 10,395 8,256

Additional paid-in capital

related to tax benefit on

stock options exercised

(See Note J) . . . . . . . . . 11,059 20,453 10,218

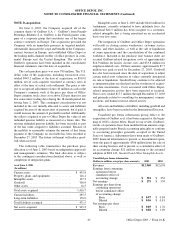

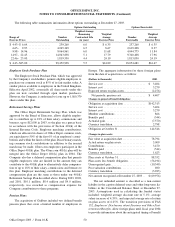

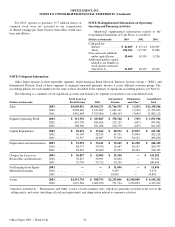

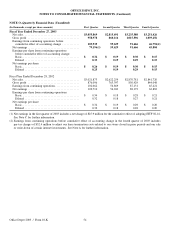

NOTE N—Segment Information

Office Depot operates in three reportable segments: North American Retail Division, Business Services Group (“ BSG”), and

International Division. Each of these segments is managed separately primarily because it serves different customer groups. The

accounting policies for each segment are the same as those described in the summary of significant accounting policies (see Note A).

The following is a summary of our significant accounts and balances by segment, reconciled to our consolidated totals.

North American International Eliminations Consolidated

(Dollars in thousands) Retail Division BSG Division and Other* Total

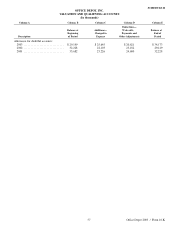

Sales 2003 . . . . . . . . $5,650,051 $3,965,271 $2,746,535 $ (3,291) $12,358,566

2002 . . . . . . . . 5,804,449 3,913,902 1,641,411 (3,129) 11,356,633

2001 . . . . . . . . 5,842,648 3,763,006 1,480,103 (3,645) 11,082,112

Segment Operating Profit 2003 . . . . . . . . $ 313,976 $ 387,887 $ 370,748 $ (705) $ 1,071,906

2002 . . . . . . . . 419,738 364,624 212,127 (647) 995,842

2001 . . . . . . . . 308,300 291,208 212,179 (655) 811,032

Capital Expenditures 2003 . . . . . . . . $ 58,272 $ 17,262 $ 68,532 $ 67,875 $ 211,941

2002 . . . . . . . . 50,149 28,524 67,551 55,994 202,218

2001 . . . . . . . . 76,337 44,087 57,509 30,123 208,056

Depreciation and Amortization 2003 . . . . . . . . $ 91,991 $ 35,411 $ 39,645 $ 81,298 $ 248,345

2002 . . . . . . . . 88,737 39,336 16,487 56,187 200,747

2001 . . . . . . . . 88,227 45,699 15,973 48,324 198,223

Charges for Losses on 2003 . . . . . . . . $ 56,857 $ 32,065 $ 29,360 — $ 118,282

Receivables and Inventories 2002 . . . . . . . . 36,627 36,991 19,602 — 93,220

2001 . . . . . . . . 35,739 53,712 19,239 — 108,690

Net Earnings from Equity 2003 . . . . . . . . ——$11,056 — $ 11,056

Method Investments 2002 . . . . . . . . — — 9,279 — 9,279

2001 . . . . . . . . — — 10,892 — 10,892

Assets 2003 . . . . . . . . $1,551,734 $ 988,753 $2,255,846 $1,348,909 $ 6,145,242

2002 . . . . . . . . 1,653,524 1,063,700 771,734 1,276,854 4,765,812

*Amounts included in “ Eliminations and Other”consist of inter-segment sales, which are generally recorded at the cost to the

selling entity, and assets (including all cash and equivalents) and depreciation related to corporate activities.

OFFICE DEPOT, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)