NVIDIA 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

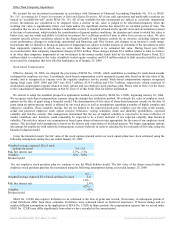

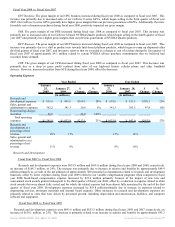

Revenue from significant customers, those representing approximately 10% or more of total revenue for the respective periods, is

summarized as follows:

Year Ended

January 25,

2009

January 27,

2008

January 28,

2007

Revenue:

Customer A 11% 7% 4%

Customer B 8% 10% 12%

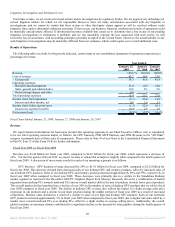

Gross Profit and Gross Margin

Gross profit consists of total revenue, net of allowances, less cost of revenue. Cost of revenue consists primarily of the cost of

semiconductors purchased from subcontractors, including wafer fabrication, assembly, testing and packaging, manufacturing support

costs, including labor and overhead associated with such purchases, final test yield fallout, inventory and warranty provisions, and

shipping costs. Cost of revenue also includes development costs for license and service arrangements.

Gross margin is the percentage of gross profit to revenue. Our gross margin was 34.3%, 45.6% and 42.4% for fiscal years 2009,

2008 and 2007, respectively. Our gross margin is significantly impacted by the mix of products we sell. Product mix is often difficult

to estimate with accuracy. Therefore, if we experience product transition or competitive challenges, if we achieve significant revenue

growth in our lower margin product lines, or if we are unable to earn as much revenue as we expect from higher margin product lines,

our gross margin may be negatively impacted.

We will continue to focus on improving our gross margin by delivering cost effective product architectures, enhancing business

processes and delivering profitable growth. A discussion of our gross margin results for each of our operating segments is as follows:

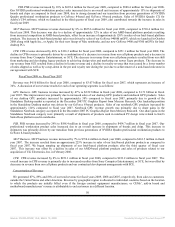

Fiscal Year 2009 vs. Fiscal Year 2008

Our gross margin declined to 34.3% in fiscal year 2009 from 45.6% for fiscal year 2008. The gross margin for fiscal year 2009

includes the impact of a $196.0 million charge against cost of revenue to cover anticipated customer warranty, repair, return,

replacement and associated costs arising from a weak die/packaging material set in certain versions of our previous generation MCP

and GPU products used in notebook systems offset by allocated insurance claim proceeds of $6.7 million from an insurance provider.

This warranty charge had an adverse impact of approximately 6.0% on our gross margin for fiscal year 2009. Additionally, inventory

reserves taken during fiscal year 2009 were approximately $50.0 million higher compared to fiscal year 2008, reflecting a significant

decline in our forecasted future demand for the related products and having a negative impact on our gross margin.

GPU Business. The gross margin of our GPU business decreased during fiscal year 2009 as compared to fiscal year 2008. This

decrease was due to a charge against cost of revenue to cover anticipated customer warranty, repair, return, replacement and

associated costs arising from a weak die/packaging material set in certain versions of our previous generation GPU products used in

notebook systems, the negative impact of inventory reserves taken during the fourth quarter of fiscal year 2009, and average sales

price regression in our GeForce 9-based and previous generations of desktop products resulting from increased competition. The

average sales price regression was also driven by a combination of market migration from desktop PCs towards notebook PCs and an

overall market shift in the mix of products towards lower priced products.

PSB. The gross margin of our PSB increased slightly during fiscal year 2009 as compared to fiscal year 2008. This increase

was primarily due to increased sales of our GeForce 9-based NVIDIA Quadro products, which began selling in the fourth quarter of

fiscal year 2008, and GeForce 8-based NVIDIA Quadro products, which generally have higher gross margins than our previous

generations of NVIDIA Quadro products.

MCP Business. The gross margin of our MCP business decreased during fiscal year 2009 as compared to fiscal year 2008, due

to decline in the margins of our AMD and Intel-based products. During fiscal year 2009, gross margins declined primarily due to a

charge against cost of revenue to cover anticipated customer warranty, repair, return, replacement and associated costs arising from a

weak die/packaging material set in certain versions of our previous generation MCP products used in notebook systems.

CPB. The gross margin of our CPB increased during fiscal year 2009 as compared to fiscal year 2008. This increase was

primarily due to changes in the product mix in our CPB product lines. We experienced greater revenue decline in our lower margin

cell phone and other handheld devices product lines as compared to higher margin SCE transactions in the current year.

51

Source: NVIDIA CORP, 10-K, March 13, 2009 Powered by Morningstar® Document Research℠