NVIDIA 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other Than Temporary Impairment

We account for our investment instruments in accordance with Statement of Financial Accounting Standards No. 115, or SFAS

No. 115, Accounting for Certain Investments in Debt and Equity Securities. All of our cash equivalents and marketable securities are

treated as “available-for-sale” under SFAS No. 115. All of our available-for-sale investments are subject to a periodic impairment

review. Investments are considered to be impaired when a decline in fair value is judged to be other-than-temporary when the

resulting fair value is significantly below cost basis and/or the significant decline has lasted for an extended period of time. The

evaluation that we use to determine whether a marketable security is impaired is based on the specific facts and circumstances present

at the time of assessment, which include the consideration of general market conditions, the duration and extent to which fair value is

below cost, and our intent and ability to hold an investment for a sufficient period of time to allow for recovery in value. We also

consider specific adverse conditions related to the financial health of and business outlook for an investee, including industry and

sector performance, changes in technology, operational and financing cash flow factors, and changes in an investee’s credit rating.

Investments that we identify as having an indicator of impairment are subject to further analysis to determine if the investment is other

than temporarily impaired, in which case we write down the investment to its estimated fair value. During fiscal year 2009,

we recorded other than temporary impairment charges of $9.9 million. These charges include $5.6 million related to what we believe

is an other than temporary impairment of our investment in the money market funds held by the International Reserve Fund; $2.5

million related to a decline in the value of publicly traded equity securities and $1.8 million related to debt securities held by us that

were issued by companies that have filed for bankruptcy as of January 25, 2009.

Stock-based Compensation

Effective January 30, 2006, we adopted the provisions of SFAS No. 123(R), which establishes accounting for stock-based awards

exchanged for employee services. Accordingly, stock-based compensation cost is measured at grant date, based on the fair value of the

awards, and is recognized as expense over the requisite employee service period. Stock-based compensation expense recognized

during fiscal years 2009, 2008 and 2007 was $162.7 million, $133.4 million and $116.7 million, respectively, which consisted of

stock-based compensation expense related to stock options and our employee stock purchase plan. Please refer to Note 2 of the Notes

to the Consolidated Financial Statements in Part IV, Item 15 of this Form 10-K for further information.

We elected to adopt the modified prospective application method as provided by SFAS No. 123(R), beginning January 30, 2006.

We recognize stock-based compensation expense using the straight-line attribution method. We estimate the value of employee stock

options on the date of grant using a binomial model. The determination of fair value of share-based payment awards on the date of

grant using an option-pricing model is affected by our stock price as well as assumptions regarding a number of highly complex and

subjective variables. These variables include, but are not limited to, the expected stock price volatility over the term of the awards,

actual and projected employee stock option exercise behaviors, vesting schedules, death and disability probabilities, expected

volatility and risk-free interest. Our management determined that the use of implied volatility is expected to be more reflective of

market conditions and, therefore, could reasonably be expected to be a better indicator of our expected volatility than historical

volatility. The risk-free interest rate assumption is based upon observed interest rates appropriate for the term of our employee stock

options. The dividend yield assumption is based on the history and expectation of dividend payouts. We began segregating options

into groups for employees with relatively homogeneous exercise behavior in order to calculate the best estimate of fair value using the

binomial valuation model.

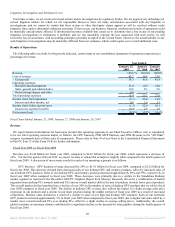

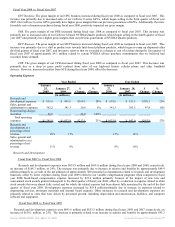

Using the binomial model, the fair value of the stock options granted under our stock option plans have been estimated using the

following assumptions during the year ended January 25, 2009:

Weighted average expected life of stock

options (in years) 3.6 - 5.8

Risk free interest rate 1.7% - 3.7%

Volatility 52% - 105%

Dividend yield -

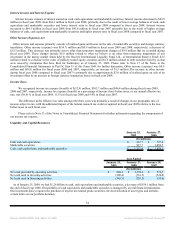

For our employee stock purchase plan we continue to use the Black-Scholes model. The fair value of the shares issued under the

employee stock purchase plan has been estimated using the following assumptions during year ended January 25, 2009:

Weighted average expected life of stock options (in years)

0.5 -

2.0

Risk free interest rate

1.6% -

2.4%

Volatility

62% -

68%

Dividend yield -

SFAS No. 123(R) also requires forfeitures to be estimated at the time of grant and revised, if necessary, in subsequent periods if

actual forfeitures differ from those estimates. Forfeitures were estimated based on historical experience. If factors change and we

employ different assumptions in the application of SFAS No. 123(R) in future periods, the compensation expense that we record under

SFAS No. 123(R) may differ significantly from what we have recorded in the current period.

Source: NVIDIA CORP, 10-K, March 13, 2009 Powered by Morningstar® Document Research℠