NVIDIA 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

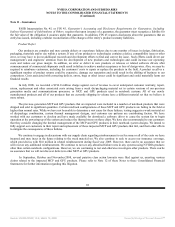

Litigation

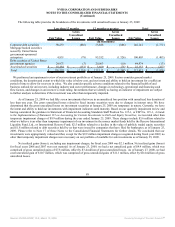

3dfx

On December 15, 2000, NVIDIA and one of our indirect subsidiaries entered into an Asset Purchase Agreement, or APA, to

purchase certain graphics chip assets from 3dfx. The transaction closed on April 18, 2001. That acquisition, and 3dfx's October 2002

bankruptcy filing, led to four lawsuits against NVIDIA: two brought by 3dfx's former landlords, one by 3dfx's bankruptcy trustee and

the fourth by a committee of 3dfx's equity security holders in the bankruptcy estate.

Landlord Lawsuits

In May 2002, we were served with a California state court complaint filed by the landlord of 3dfx’s San Jose, California

commercial real estate lease, Carlyle Fortran Trust, or Carlyle. In December 2002, we were served with a California state court

complaint filed by the landlord of 3dfx’s Austin, Texas commercial real estate lease, CarrAmerica Realty Corporation, or

CarrAmerica. The landlords both asserted claims for, among other things, interference with contract, successor liability and fraudulent

transfer. The landlords sought to recover damages in the aggregate amount of approximately $15 million, representing amounts then

owed on the 3dfx leases. The cases were later removed to the United States Bankruptcy Court for the Northern District of California

when 3dfx filed its bankruptcy petition and consolidated for pretrial purposes with an action brought by the bankruptcy trustee.

In 2005, the U.S. District Court for the Northern District of California withdrew the reference to the Bankruptcy Court for the

landlords’ actions, and on November 10, 2005, granted our motion to dismiss both landlords’ complaints. The landlords filed

amended complaints in early February 2006, and NVIDIA again filed motions to dismiss those claims. On September 29, 2006, the

District Court dismissed the CarrAmerica action in its entirety and without leave to amend. On December 15, 2006, the District Court

also dismissed the Carlyle action in its entirety. Both landlords filed timely notices of appeal from those orders.

On July 17, 2008, the United States Court of Appeals for the Ninth Circuit held oral argument on the landlords' appeals. On

November 25, 2008, the Court of Appeals issued its opinion affirming the dismissal of Carlyle’s complaint in its entirety. The Court

of Appeals also affirmed the dismissal of most of CarrAmerica’s complaint, but reversed the District Court’s dismissal of

CarrAmerica’s claims for interference with contractual relations and fraud. On December 8, 2008, Carlyle filed a Request for

Rehearing En Banc, which CarrAmerica joined. That same day, Carlyle also filed a Motion for Clarification of the Court’s

Opinion. On January 22, 2009, the Court of Appeals denied the Request for Rehearing En Banc, but clarified its opinion affirming

dismissal of the claims by stating that CarrAmerica had standing to pursue claims for interference with contractual relations, fraud,

conspiracy and tort of another, and remanding Carlyle’s case with instructions that the District Court evaluate whether the Trustee had

abandoned any claims, which Carlyle might have standing to pursue.

The District Court held a status conference in the CarrAmerica and Carlyle cases on March 9, 2009. That same day, 3dfx’s

bankruptcy Trustee filed in the bankruptcy court a Notice of Trustee’s Intention to Compromise Controversy with Carlyle Fortran

Trust. According to that Notice, the Trustee would abandon any claims it has against us for intentional interference with contract,

negligent interference with prospective economic advantage, aiding and abetting breach of fiduciary duty, declaratory relief, unfair

business practices and tort of another, in exchange for which Carlyle will withdraw irrevocably its Proof of Claim against the 3dfx

bankruptcy estate and waive any further right of distribution from the estate. In light of the Trustee’s notice, the District Court ordered

the parties to seek a hearing on the Notice on or before April 24, 2009, ordered Carlyle and CarrAmerica to file amended complaints

by May 10, 2009, and set a further Case Management Conference for May 18, 2009. We continue to believe that there is no merit to

Carlyle or CarrAmerica’s remaining claims.

Trustee Lawsuit

In March 2003, the Trustee appointed by the Bankruptcy Court to represent 3dfx’s bankruptcy estate served his complaint on

NVIDIA. The Trustee’s complaint asserts claims for, among other things, successor liability and fraudulent transfer and seeks

additional payments from us. The Trustee's fraudulent transfer theory alleged that NVIDIA had failed to pay reasonably equivalent

value for 3dfx's assets, and sought recovery of the difference between the $70 million paid and the alleged fair value, which the

Trustee estimated to exceed $50 million. The Trustee's successor liability theory alleged NVIDIA was effectively 3dfx's legal

successor and was therefore responsible for all of 3dfx's unpaid liabilities. This action was consolidated for pretrial purposes with the

landlord cases, as noted above.

On October 13, 2005, the Bankruptcy Court heard the Trustee’s motion for summary adjudication, and on December 23, 2005,

denied that motion in all material respects and held that NVIDIA may not dispute that the value of the 3dfx transaction was less than

$108 million. The Bankruptcy Court denied the Trustee’s request to find that the value of the 3dfx assets conveyed to NVIDIA was at

least $108 million.

95

Source: NVIDIA CORP, 10-K, March 13, 2009 Powered by Morningstar® Document Research℠