NVIDIA 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

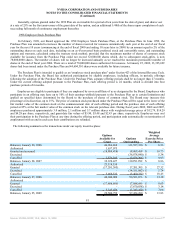

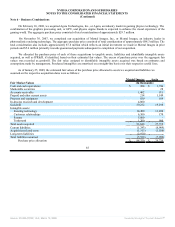

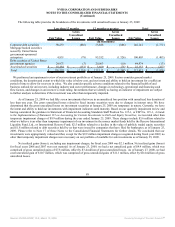

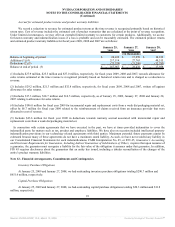

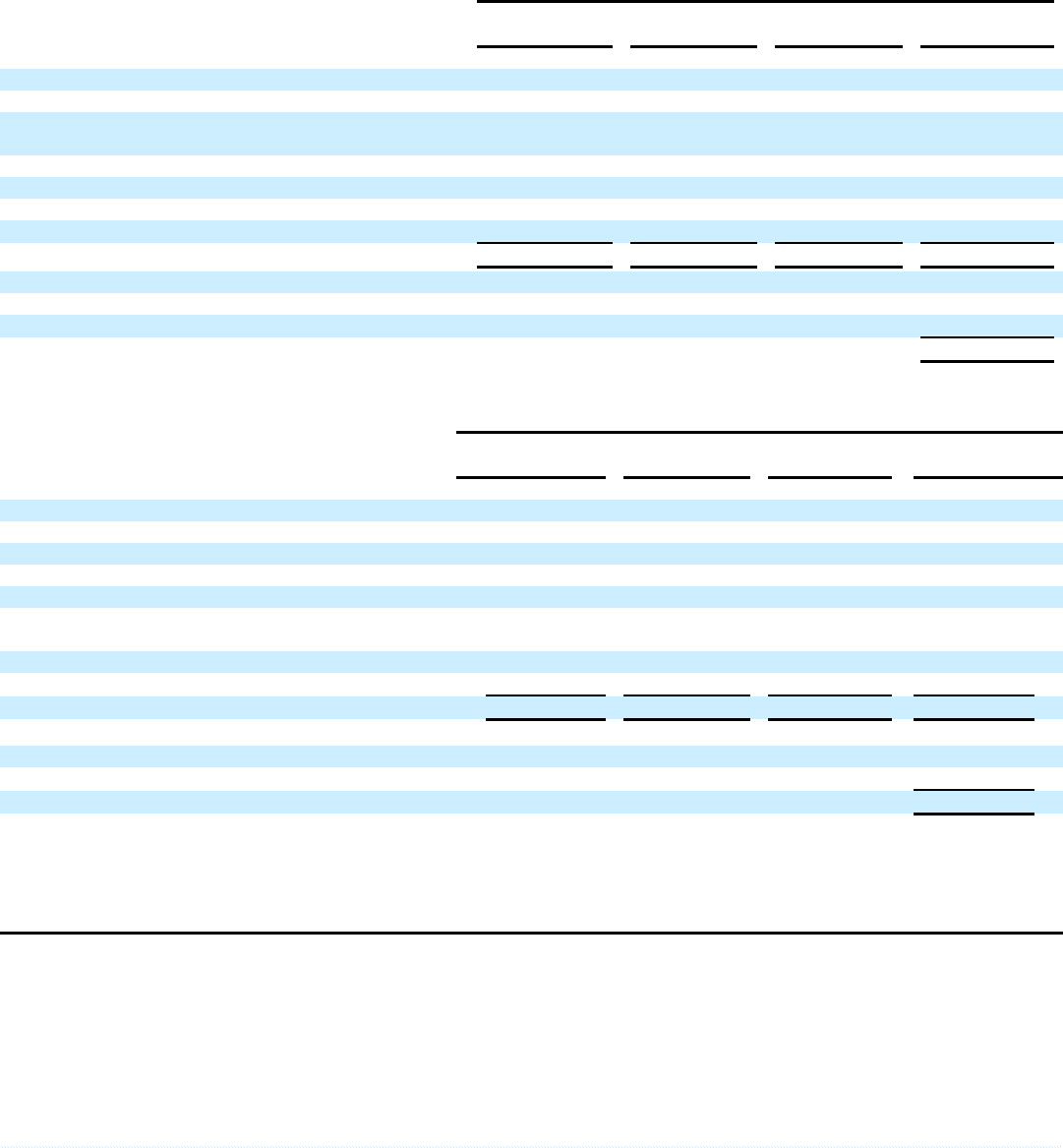

Note 9 - Marketable Securities

We account for our investment instruments in accordance with Statement of Financial Accounting Standards No. 115, or SFAS

No. 115, Accounting for Certain Investments in Debt and Equity Securities. All of our cash equivalents and marketable securities are

treated as “available-for-sale” under SFAS No. 115. Our investment policy requires the purchase of top-tier investment grade

securities, the diversification of asset type and certain limits on our portfolio duration, as specified in our investment policy guidelines.

These guidelines also limit the amount of credit exposure to any one issue, issuer or type of instrument. The following is a summary of

cash equivalents and marketable securities at January 25, 2009 and January 27, 2008:

January 25, 2009

Amortized

Cost

Unrealized

Gain

Unrealized

Loss

Estimated

Fair Value

(In thousands)

Debt securities of United States government agencies $ 313,319 $ 4,815 $ (13) $ 318,121

Corporate debt securities 252,265 680 (1,771) 251,174

Mortgage backed securities issued by United States

government-sponsored enterprises 162,243 361 (1,405) 161,199

Money market funds 139,046 - - 139,046

Commercial paper 56,995 2 - 56,997

Debt securities issued by United States Treasury 53,407 1,868 - 55,275

Asset-backed securities 39,014 71 (227) 38,858

Total $ 1,016,289 $ 7,797 $ (3,416) $ 1,020,670

Classified as:

Cash equivalents $ 182,968

Marketable securities 837,702

Total $ 1,020,670

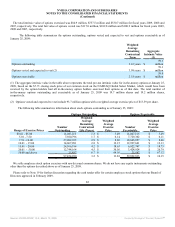

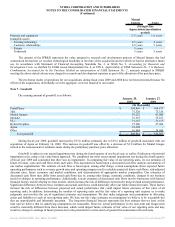

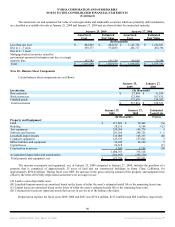

January 27, 2008

Amortized

Cost

Unrealized

Gain

Unrealized

Loss

Estimated

Fair Value

(In thousands)

Commercial paper $ 513,887 $ 31 $ (2) $ 513,916

Debt securities of United States government agencies 363,434 4,365 (69) 367,730

Corporate debt securities 361,452 2,844 (281) 364,015

Money market funds 218,055 - - 218,055

Asset-backed securities 110,287 1,232 (11) 111,508

Mortgage backed securities issued by United States

government-sponsored enterprises 69,620 769 (5) 70,384

Debt securities issued by United States Treasury 29,327 256 - 29,583

Equity securities 2,491 1,613 - 4,104

Total $ 1,668,553 $ 11,110 $ (368) $ 1,679,295

Classified as:

Cash equivalents $ 596,786

Marketable securities 1,082,509

Total $ 1,679,295

88

Source: NVIDIA CORP, 10-K, March 13, 2009 Powered by Morningstar® Document Research℠