NVIDIA 2009 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2009 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

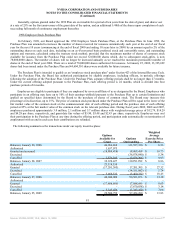

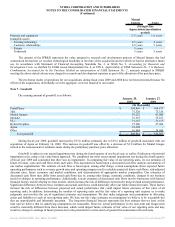

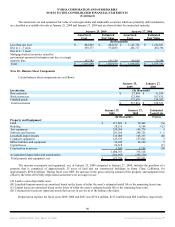

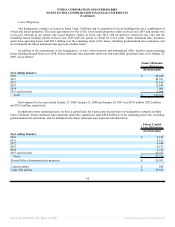

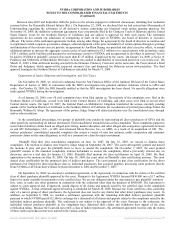

The following table provides the breakdown of the investments with unrealized losses at January 25, 2009:

Less than 12 months 12 months or greater Total

Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses

(In thousands)

Corporate debt securities 90,253 (885) 55,888 (886) 146,141 (1,771)

Mortgage backed securities

issued by United States

government-sponsored

enterprises 4,851 (79) 95,552 (1,326

) 100,403 (1,405)

Debt securities of United States

government agencies 24,971 (3) 20,003 (10) 44,974 (13)

Asset-backed securities $ 18,484 $ (151) $ 3,669 $ (76) $ 22,153 $ (227)

Total $ 138,559 $ (1,118) $ 175,112 $ (2,298) $ 313,671 $ (3,416)

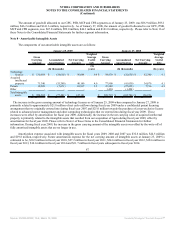

We performed an impairment review of our investment portfolio as of January 25, 2009. Factors consider general market

conditions, the duration and extent to which fair value is below cost, and our intent and ability to hold an investment for a sufficient

period of time to allow for recovery in value. We also consider specific adverse conditions related to the financial health of and

business outlook for an investee, including industry and sector performance, changes in technology, operational and financing cash

flow factors, and changes in an investee’s credit rating. Investments that we identify as having an indicator of impairment are subject

to further analysis to determine if the investment was other than temporarily impaired.

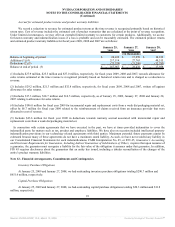

As of January 25, 2009 we had fifty seven investments that were in an unrealized loss position with unrealized loss duration of

less than one year. The gross unrealized losses related to fixed income securities were due to changes in interest rates. We have

determined that the gross unrealized losses on investment securities at January 25, 2009 are temporary in nature. Currently, we have

the intent and ability to hold our investments with impairment indicators until maturity. Based on our quarterly impairment review and

having considered the guidance in Statement of Financial Accounting Standards Staff Position No. 115-1, or FSP No. 115-1, A Guide

to the Implementation of Statement 115 on Accounting for Certain Investments in Debt and Equity Securities, we recorded other than

temporary impairment charges of $9.9 million during the year ended January 25, 2009. These charges include $5.6 million related to

what we believe is an other than temporary impairment of our investment in the money market funds held by the Reserve International

Liquidity Fund, Ltd., or International Reserve Fund; $2.5 million related to a decline in the value of publicly traded equity securities

and $1.8 million related to debt securities held by us that were issued by companies that have filed for bankruptcy as of January 25,

2009. Please refer to Note 17 of these Notes to the Consolidated Financial Statements for further details. We concluded that our

investments were appropriately valued and that, except for the $9.9 million impairment charges recognized during fiscal year 2009, no

other than temporary impairment charges were necessary on our portfolio of available for sale investments as of January 25, 2009.

Net realized gains (losses), excluding any impairment charges, for fiscal year 2009 was $2.1 million. Net realized gains (losses)

for fiscal years 2008 and 2007 were not material. As of January 25, 2009, we had a net unrealized gain of $4.4 million, which was

comprised of gross unrealized gains of $7.8 million, offset by $3.4 million of gross unrealized losses. As of January 27, 2008, we had

a net unrealized gain of $10.7 million, which was comprised of gross unrealized gains of $11.1 million, offset by $0.4 million of gross

unrealized losses.

89

Source: NVIDIA CORP, 10-K, March 13, 2009 Powered by Morningstar® Document Research℠