NVIDIA 2009 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2009 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

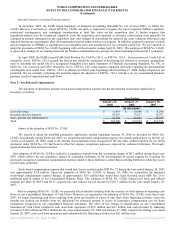

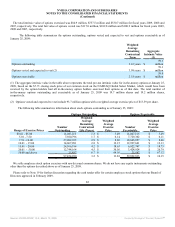

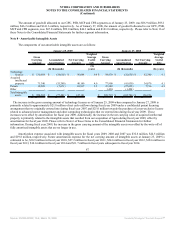

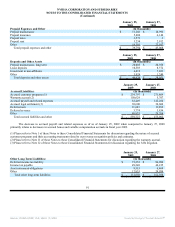

Mental

Images Ageia

(Straight-line

depreciation/amortization

period)

Property and equipment 2 -5 years 1-2 years

Intangible assets:

Existing technology 4-5 years 4 years

Customer relationships 4-5 years 5 years

Patents 5 years -

Trademark 5 years 5 years

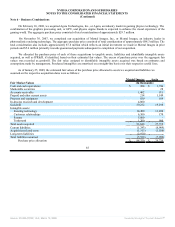

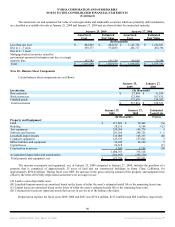

The amount of the IPR&D represents the value assigned to research and development projects of Mental Images that had

commenced but had not yet reached technological feasibility at the time of the acquisition and for which we had no alternative future

use. In accordance with Statement of Financial Accounting Standards No. 2, or SFAS No. 2, Accounting for Research and

Development Costs, as clarified by FASB issued Interpretation No. 4, or FIN 4, Applicability of FASB Statement No. 2 to Business

Combinations Accounted for by the Purchase Method an interpretation of FASB Statement No. 2 , amounts assigned to IPR&D

meeting the above-stated criteria were charged to research and development expenses as part of the allocation of the purchase price.

The pro forma results of operations for our acquisitions during fiscal years 2009 and 2008 have not been presented because the

effects of the acquisitions, individually or in the aggregate, were not material to our results.

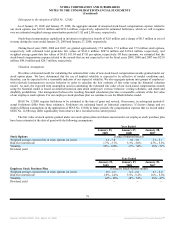

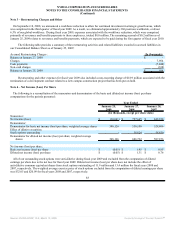

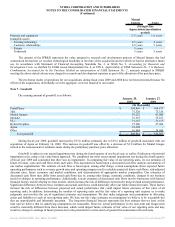

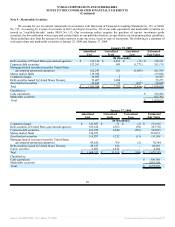

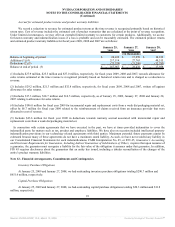

Note 7 - Goodwill

The carrying amount of goodwill is as follows:

January 25,

2009

January 27,

2008

(In thousands)

PortalPlayer $ 104,896 $ 104,473

3dfx 75,326 75,326

Mental Images 59,252 63,086

MediaQ 35,167 35,167

ULi 31,115 31,115

Hybrid Graphics 27,906 27,906

Ageia 19,198 -

Other 16,984 16,984

Total goodwill $ 369,844 $ 354,057

During fiscal year 2009, goodwill increased by $15.8 million, primarily due to $19.2 million of goodwill associated with our

acquisition of Ageia on February 10, 2008. This increase in goodwill was offset by a decrease of $3.8 million for Mental Images

related to the reassessment of estimates made during the preliminary purchase price allocation.

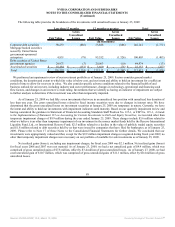

Goodwill is subject to our annual impairment test during the fourth quarter of our fiscal year, or earlier if indicators of potential

impairment exist, using a fair value-based approach. We completed our most recent annual impairment test during the fourth quarter

of fiscal year 2009 and concluded that there was no impairment. In computing fair value of our reporting units, we use estimates of

future revenues, costs and cash flows from such units. This assessment is based upon a discounted cash flow analysis and analysis of

our market capitalization. The estimate of cash flow is based upon, among other things, certain assumptions about expected future

operating performance such as revenue growth rates and operating margins used to calculate projected future cash flows, risk-adjusted

discount rates, future economic and market conditions, and determination of appropriate market comparables. Our estimates of

discounted cash flows may differ from actual cash flows due to, among other things, economic conditions, changes to our business

model or changes in operating performance. Additionally, certain estimates of discounted cash flows involve businesses with limited

financial history and developing revenue models, which increase the risk of differences between the projected and actual performance.

Significant differences between these estimates and actual cash flows could materially affect our future financial results. These factors

increase the risk of differences between projected and actual performance that could impact future estimates of fair value of all

reporting units. In addition, determining the number of reporting units and the fair value of a reporting unit requires us to make

judgments and involves the use of significant estimates and assumptions. We also make judgments and assumptions in allocating

assets and liabilities to each of our reporting units. We base our fair value estimates on assumptions we believe to be reasonable but

that are unpredictable and inherently uncertain. The long-term financial forecast represents the best estimate that we have at this

time and we believe that its underlying assumptions are reasonable. However, actual performance in the near-term and longer-term

could be materially different from these forecasts, which could impact future estimates of fair value of our reporting units and may

result in a charge to earnings in future periods due to the potential for a write-down of goodwill in connection with such tests.

Source: NVIDIA CORP, 10-K, March 13, 2009 Powered by Morningstar® Document Research℠