NVIDIA 2009 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2009 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

(Continued)

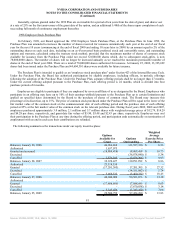

Note 6 – Business Combinations

On February 10, 2008, we acquired Ageia Technologies, Inc., or Ageia, an industry leader in gaming physics technology. The

combination of the graphics processing unit, or GPU, and physics engine brands is expected to enhance the visual experience of the

gaming world. The aggregate purchase price consisted of total consideration of approximately $29.7 million.

On November 30, 2007, we completed our acquisition of Mental Images, Inc., or Mental Images, an industry leader in

photorealistic rendering technology. The aggregate purchase price consisted of total consideration of approximately $88.3 million. The

total consideration also includes approximately $7.8 million which reflects an initial investment we made in Mental Images in prior

periods and $5.6 million primarily towards guaranteed payments subsequent to completion of our acquisition.

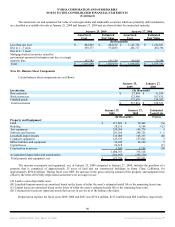

We allocated the purchase price of each of these acquisitions to tangible assets, liabilities and identifiable intangible assets

acquired, as well as IPR&D, if identified, based on their estimated fair values. The excess of purchase price over the aggregate fair

values was recorded as goodwill. The fair value assigned to identifiable intangible assets acquired was based on estimates and

assumptions made by management. Purchased intangibles are amortized on a straight-line basis over their respective useful lives.

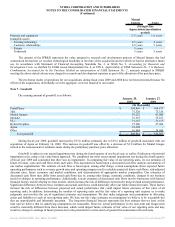

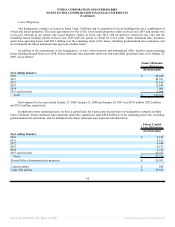

As of January 25, 2009, the estimated fair values of the purchase price allocated to assets we acquired and liabilities we

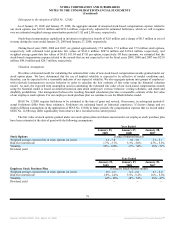

assumed on the respective acquisition dates were as follows:

Mental Images Ageia

Fair Market Values (In thousands)

Cash and cash equivalents $ 988 $ 1,744

Marketable securities - 28

Accounts receivable 1,462 911

Prepaid and other current assets 214 1,149

Property and equipment 830 169

In-process research and development 4,000 -

Goodwill 59,252 19,198

Intangible assets:

Existing technology 14,400 13,450

Customer relationships 6,500 170

Patents 5,000 -

Trademark 1,200 900

Total assets acquired 93,846 37,719

Current liabilities (1,243) (6,969)

Acquisition related costs (1,313) (1,030)

Long-term liabilities (2,970) -

Total liabilities assumed (5,526) (7,999)

Purchase price allocation $ 88,320 $ 29,720

85

Source: NVIDIA CORP, 10-K, March 13, 2009 Powered by Morningstar® Document Research℠