NVIDIA 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS − (Continued)

mandated mediation was held in January 2006 and did not resolve the matter. Discovery continues, as well as preparation for the

Markman hearing on claim construction. The Markman hearing is scheduled for April 13, 2006. We believe the claims asserted

against us are without merit and we will continue to defend ourselves vigorously. We do not have sufficient information to determine

whether a loss is probable. As such, we have not recorded any liability in our consolidated financial statements for such, if any, loss.

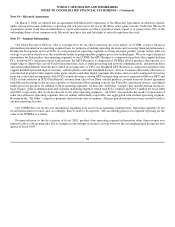

American Video Graphics

In August 2004, a Texas limited partnership named American Video Graphics, LP, or AVG, filed three separate complaints for

patent infringement against various corporate defendants, not including NVIDIA, in the United States District Court for the Eastern

District of Texas. AVG initially asserted that each of the approximately thirty defendants sells products that infringe one or more of

seven separate patents that AVG claims relate generally to graphics processing functionality. In November 2004, NVIDIA sought and

was granted permission to intervene in two of the three pending AVG lawsuits. Our complaint in intervention alleged that both of the

patents in suit were invalid and that, to the extent AVG's claims target NVIDIA products, the asserted patents were not infringed.

On December 19, 2005, AVG and substantially all of the named defendants and intervenors, including NVIDIA, settled all of

pending claims; the only surviving claims will relate solely to two non−settling defendants. As part of the settlement, the defendants

and intervenors paid an undisclosed aggregate amount to AVG. In exchange, all pending claims between the settling parties were

dismissed with prejudice, and AVG granted to all settling parties a full release of all claims for past damages and a full license for all

future sales of accused products under all of AVG's patents, including the patents in suit. In addition, as part of the settlement, all

settling defendants and intervenors fully and finally waived any claims for indemnification they may have had against any other

settling party.

We are subject to other legal proceedings, but we do not believe that the ultimate outcome of any of these proceedings will have a

material adverse effect on our financial position or overall trends in results of operations. However, if an unfavorable ruling were to

occur in any specific period, there exists the possibility of a material adverse impact on the results of operations of that period.

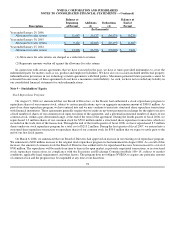

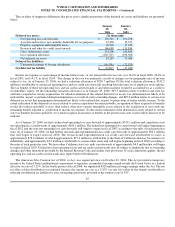

Note 12 − Settlement Costs

Settlement costs were $14.2 million for fiscal 2006. The settlement costs are associated with two litigation matters, 3dfx and

AVG. AVG is settled. The 3dfx matter is not finally settled and is subject to judicial review and the completion of appropriate

procedures and documents. However, based on the potential settlement in this case, we have concluded that a loss is probable and that

we can reasonably estimate the amount of loss. Please refer to Note 11 of the Notes to Consolidated Financial Statements for further

information.

85