NVIDIA 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Income Taxes

Statement of Financial Accounting Standards No. 109, or SFAS No. 109, Accounting for Income Taxes, establishes financial

accounting and reporting standards for the effect of income taxes. In accordance with SFAS No. 109, we recognize federal, state and

foreign current tax liabilities or assets based on our estimate of taxes payable or refundable in the current fiscal year by tax

jurisdiction. We also recognize federal, state and foreign deferred tax assets or liabilities, as appropriate, for our estimate of future tax

effects attributable to temporary differences and carryforwards; and we record a valuation allowance to reduce any deferred tax assets

by the amount of any tax benefits that, based on available evidence and judgment, are not expected to be realized.

Our calculation of current and deferred tax assets and liabilities is based on certain estimates and judgments and involves dealing

with uncertainties in the application of complex tax laws. Our estimates of current and deferred tax assets and liabilities may change

based, in part, on added certainty or finality to an anticipated outcome, changes in accounting standards or tax laws in the United

States, or foreign jurisdictions where we operate, or changes in other facts or circumstances. In addition, we recognize liabilities for

potential United States and foreign income tax contingencies based on our estimate of whether, and the extent to which, additional

taxes may be due. If we determine that payment of these amounts is unnecessary or if the recorded tax liability is less than our current

assessment, we may be required to recognize an income tax benefit or additional income tax expense in our financial statements,

accordingly.

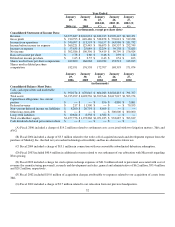

As of January 29, 2006, we had a valuation allowance of $230.7 million. Of the total valuation allowance, $182.2 million is

attributable to certain net operating loss and tax credit carryforwards resulting from the exercise of employee stock options. The tax

benefit of these net operating loss and tax credit carryforwards, if and when realized, will be accounted for as a credit to stockholders'

equity. Of the remaining valuation allowance at January 29, 2006, $19.5 million relates to federal and state tax attributes acquired in

certain acquisitions for which realization of the related deferred tax assets was determined not likely to be realized due, in part, to

potential utilization limitations as a result of ownership changes; and $29.0 million relates to certain state deferred tax assets that

management determined not likely to be realized due, in part, to projections of future taxable income. To the extent realization of the

deferred tax assets related to certain acquisitions becomes probable, recognition of these tax benefits would first reduce goodwill to

zero, then reduce other non−current intangible assets related to the acquisition to zero with any remaining benefit reported as a

reduction to income tax expense. To the extent realization of the deferred tax assets related to certain state tax benefits becomes

probable, we would recognize an income tax benefit in the period such asset is more likely than not to be realized.

Goodwill

Our impairment review process compares the fair value of the reporting unit in which the goodwill resides to its carrying value.

For the purposes of completing our Statement of Financial Accounting Standards No. 142, or SFAS No. 142, Goodwill and Other

Intangible Assets, impairment test, we performed our analysis on a reporting unit basis. We utilize a two−step approach to testing

goodwill for impairment. The first step tests for possible impairment by applying a fair value−based test. In computing fair value of

our reporting units, we use estimates of future revenues, costs and cash flows from such units. The second step, if necessary, measures

the amount of such an impairment by applying fair value−based tests to individual assets and liabilities. We elected to perform our

annual goodwill impairment review during the fourth quarter of each fiscal year. We completed our most recent annual impairment

test during the fourth quarter of fiscal 2006 and concluded that there was no impairment. However, future events or circumstances

may result in a charge to earnings in future periods due to the potential for a write−down of goodwill in connection with such tests.

39