NVIDIA 2006 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS − (Continued)

remaining balances of goodwill as of the beginning of fiscal 2003. All remaining and future acquired goodwill will be subject to our

annual impairment test during our fourth quarter of our fiscal year, or earlier if indicators of potential impairment exist, using a fair

value−based approach. Our impairment review process compares the fair value of the reporting unit in which the goodwill resides to

its carrying value. For the purposes of completing our SFAS No. 142 impairment test, we performed our analysis on a reporting unit

basis. We utilize a two−step approach to testing goodwill for impairment. The first step tests for possible impairment by applying a

fair value−based test. In computing fair value of our reporting units, we use estimates of future revenues, costs and cash flows from

such units. The second step, if necessary, measures the amount of such an impairment by applying fair value−based tests to individual

assets and liabilities. We elected to perform our annual goodwill impairment review during the fourth quarter of each fiscal year. We

completed our most recent annual impairment test during the fourth quarter of fiscal 2006 and concluded that there was no

impairment. However, future events or circumstances may result in a charge to earnings due to the potential for a write−down of

goodwill in connection with such tests.

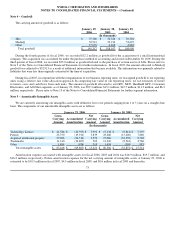

Stock−Based Compensation

Statement of Financial Accounting Standards No. 148, or SFAS No. 148, Accounting for Stock−Based Compensation −

Transition and Disclosure, amends the disclosure requirements of Statement of Financial Accounting Standards No. 123, or SFAS No.

123, Accounting for Stock−Based Compensation, to require more prominent disclosures in both annual and interim financial

statements regarding the method of accounting for stock−based compensation and the effect of the method used on reported results.

We use the intrinsic value method, as prescribed by Accounting Principles Board Opinion No. 25, Accounting for Stock Issued to

Employees, to account for our stock−based employee compensation plans. As such, compensation expense is recorded if on the date of

grant the current fair value per share of the underlying stock exceeds the exercise price per share. We recognize compensation cost for

awards with pro rata vesting on a straight−line basis. Compensation cost for our stock−based compensation plans as determined

consistent with Statement of Financial Accounting Standards No. 123, Accounting for Stock−Based Compensation, would have

decreased net income in the periods presented to the pro forma amounts indicated below:

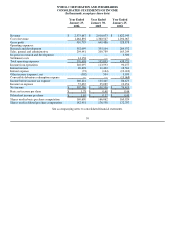

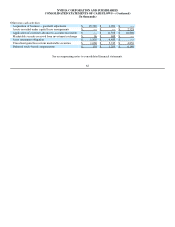

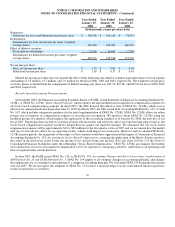

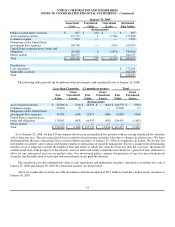

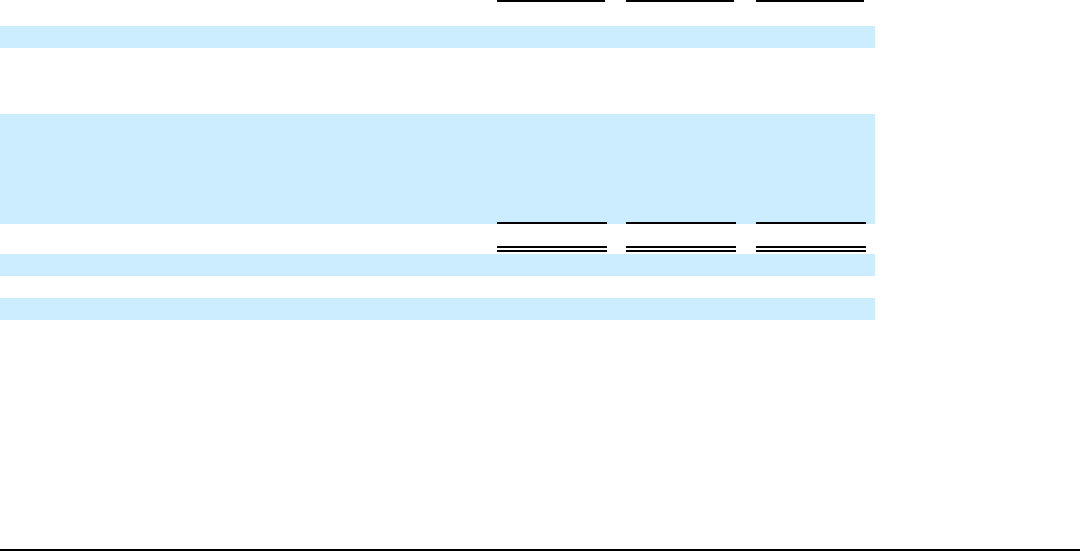

Year Ended Year Ended Year Ended

January 29, January 30, January 25,

2006 2005 2004

(In thousands, except per share data)

Net income, as reported $ 302,586 $ 100,356 $ 74,419

Add: Stock−based employee compensation expense

included in reported net income, net of related tax

effects 920 1,070 537

Deduct: Stock−based employee compensation

expense

determined under fair value−based method for all

awards,

net of related tax effects (79,862) (87,071) (74,513)

Pro forma net income $ 223,644 $ 14,355 $ 443

Basic net income per share − as reported $ 1.78 $ 0.60 $ 0.46

Basic net income per share − pro forma $ 1.32 $ 0.09 $ 0.00

Diluted net income per share − as reported $ 1.65 $ 0.57 $ 0.43

Diluted net income per share − pro forma $ 1.22 $ 0.08 $ 0.00

During the first quarter of fiscal 2006, we transitioned from a Black−Scholes model to a binomial model for calculating the

estimated fair value of new stock−based compensation awards granted under our stock option plans. As a result of recent regulatory

guidance, including SEC Staff Accounting Bulletin No. 107, or SAB No. 107, and in anticipation of the impending effective date of

Financial Accounting Standards Board, or FASB, Statement of Financial Accounting Standards No. 123(R), or SFAS No. 123(R),

Share−Based Payment, we reevaluated the assumptions we use to estimate the value of employee stock options and shares issued

under our employee stock

68