NVIDIA 2006 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS − (Continued)

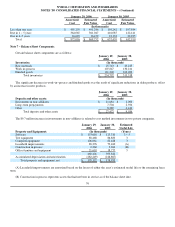

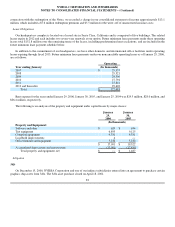

connection with the redemption of the Notes, we recorded a charge in our consolidated statement of income approximately $13.1

million, which included a $7.6 million redemption premium and $5.5 million for the write−off of unamortized issuance costs.

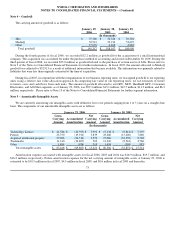

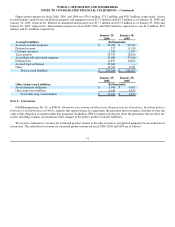

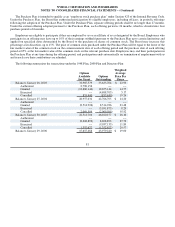

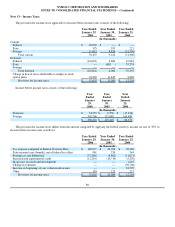

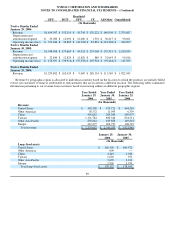

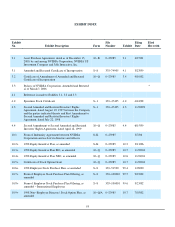

Lease Obligations

Our headquarters complex is located on a leased site in Santa Clara, California and is comprised of five buildings. The related

leases expire in 2012 and each includes two seven−year renewals at our option. Future minimum lease payments under these operating

leases total $152.8 million over the remaining terms of the leases, including predetermined rent escalations, and are included in the

future minimum lease payment schedule below.

In addition to the commitment of our headquarters, we have other domestic and international office facilities under operating

leases expiring through fiscal 2013. Future minimum lease payments under our noncancelable operating leases as of January 29, 2006,

are as follows:

Operating

Year ending January: (In thousands)

2007 $ 29,557

2008 29,321

2009 28,396

2010 27,794

2011 27,812

2012 and thereafter 29,603

Total $ 172,483

Rent expense for the years ended January 29, 2006, January 30, 2005, and January 25, 2004 was $29.5 million, $28.0 million, and

$26.4 million, respectively.

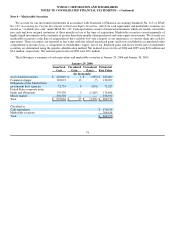

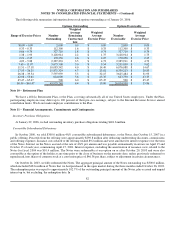

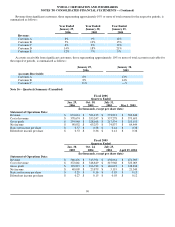

The following is an analysis of the property and equipment under capital leases by major classes:

January

29, January

30,

2006 2005

(In thousands)

Property and Equipment:

Software and other $ 629 $ 634

Test equipment 6,895 9,125

Computer equipment 4,331 4,331

Leasehold improvements 4 −−

Office furniture and equipment 5,232 5,232

$ 17,091 $ 19,322

Accumulated depreciation and amortization (17,091) (17,835)

Total property and equipment, net $ −− $ 1,487

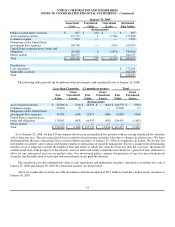

Litigation

3dfx

On December 15, 2000, NVIDIA Corporation and one of our indirect subsidiaries entered into an agreement to purchase certain

graphics chip assets from 3dfx. The 3dfx asset purchase closed on April 18, 2001.

83