NVIDIA 2006 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

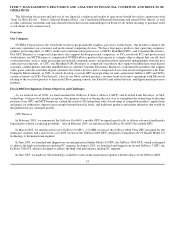

Share−Based Payment

Since inception, we have used stock options and our employee stock purchase program as fundamental components of our

employee compensation packages. To date we generally have not recognized compensation cost for employee stock options or shares

sold pursuant to our employee stock purchase program. We believe that these incentives directly motivate our employees and, through

the use of vesting, encourage our employees to remain with us. In December 2004, the Financial Accounting Standards Board, or

FASB, issued Statement of Financial Accounting Standards No. 123(R), or SFAS No. 123(R), Share−Based Payment, which requires

the measurement and recognition of compensation expense for all stock−based compensation payments. In April 2005, the SEC

delayed the effective date of SFAS No. 123(R), which is now effective for annual periods that begin after June 15, 2005. In March

2005, the SEC issued Staff Accounting Bulletin No. 107, or SAB No. 107, which includes interpretive guidance for the initial

implementation of SFAS No. 123(R). SFAS No. 123(R) allows for either prospective recognition of compensation expense or

retrospective recognition. We intend to adopt SFAS No. 123(R) using the modified prospective method, which requires the application

of the accounting standard as of January 30, 2006, the first day of our fiscal 2007. Expensing these incentives in future periods will

materially and adversely affect our reported operating results as the stock−based compensation expense would be charged directly

against our reported earnings. We anticipate that our stock−based compensation expense will be approximately $18 to $22 million for

the first quarter of fiscal 2007 and we are unsure how the market will react to this adverse affect on our operating results, which could

impact our stock price.

To the extent that SFAS No. 123(R) makes it more expensive to grant stock options or to continue to have an employee stock

purchase program, we may decide to incur increased cash compensation costs. In addition, actions that we may take to reduce

stock−based compensation expense that may be more severe than any actions our competitors may implement may make it difficult to

attract, retain and motivate employees, which could adversely affect our competitive position as well as our business and operating

results.

Repatriation Legislation

The American Jobs Creation Act of 2004, or Act, was signed into law on October 22, 2004. The Act provided a temporary

incentive for United States multinational corporations to repatriate accumulated income earned outside the United States at a federal

effective tax rate of 5.25%. In the fourth quarter of fiscal 2006, we repatriated $420 million in foreign earnings under the Act. The net

tax effect of this distribution was minimal because the current tax cost at a 5.25% tax rate was offset by the benefit attributable to

reducing our deferred tax liability for taxes on earnings previously provided at the statutory rate of 35%.

Subsequent Events

ULI Electronics, Inc. On February 20, 2006, we completed the acquisition of ULi Electronics, Inc., a leading developer of core

logic technology, for approximately $53 million paid in cash.

Stock Split. On March 6, 2006, we issued a press release announcing that our Board of Directors approved a two−for−one stock

split of our outstanding shares of common stock to be effected in the form of a 100% stock dividend. The stock split will be effective

on or about Thursday, April 6, 2006 for stockholders of record at the close of business on Friday, March 17, 2006 and will entitle each

stockholder to receive one additional share for every outstanding share of common stock held. Upon the completion of the stock split,

NVIDIA will have approximately 360 million shares of common stock outstanding.

Stock Repurchase. On March 6, 2006, we also announced that our Board of Directors approved an increase in our existing stock

repurchase program. We announced a $400 million increase to the original stock repurchase program we had announced in August

2004. As a result of this increase, the amount of common stock the Board of Directors has authorized to be repurchased has now been

increased to a total of $700 million. The repurchases will be made from time to time in the open market, in privately negotiated

transactions, or in structured stock repurchase transactions, in compliance with the Securities and Exchange Commission Rule

10b−18, subject to market conditions, applicable legal requirements, and other factors. The program does not obligate NVIDIA to

acquire any particular amount of common stock and the program may be suspended at any time at our discretion.

36