NVIDIA 2006 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136

|

|

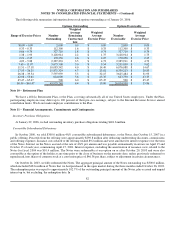

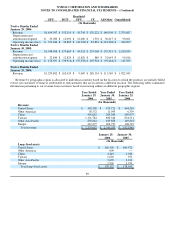

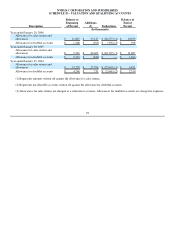

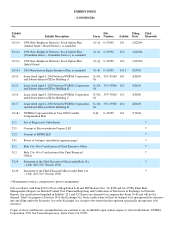

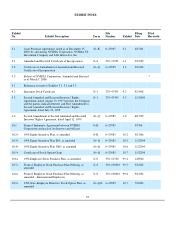

NVIDIA CORPORATION AND SUBSIDIARIES

SCHEDULE II − VALUATION AND QUALIFYING ACCOUNTS

Description

Balance at

Beginning

of Period Additions

(3) Deductions

Balance at

End of

Period

(In thousands)

Year ended January 29, 2006

Allowance for sales returns and

allowances $ 11,687 $ 35,127 $ (36,575) (1) $ 10,239

Allowance for doubtful accounts $ 1,466 $ (492) $ (376) (2) $ 598

Year ended January 30, 2005

Allowance for sales returns and

allowances $ 9,421 $ 22,463 $ (20,197) (1) $ 11,687

Allowance for doubtful accounts $ 2,310 $ (844) $ −− $ 1,466

Year ended January 25, 2004

Allowance for sales returns and

allowances $ 13,228 $ 23,796 $ (27,603) (1) $ 9,421

Allowance for doubtful accounts $ 4,240 $ 731 $ (2,661) (2) $ 2,310

(1) Represents amounts written off against the allowance for sales returns.

(2) Represents uncollectible accounts written off against the allowance for doubtful accounts.

(3) Allowances for sales returns are charged as a reduction to revenue. Allowances for doubtful accounts are charged to expenses.

92