NVIDIA 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS − (Continued)

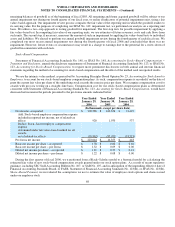

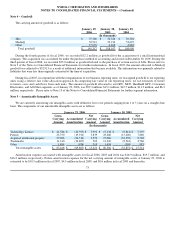

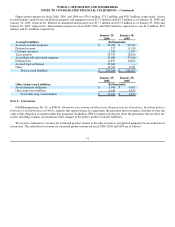

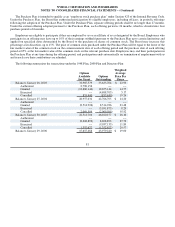

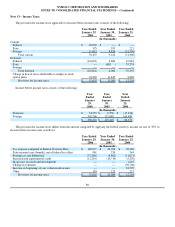

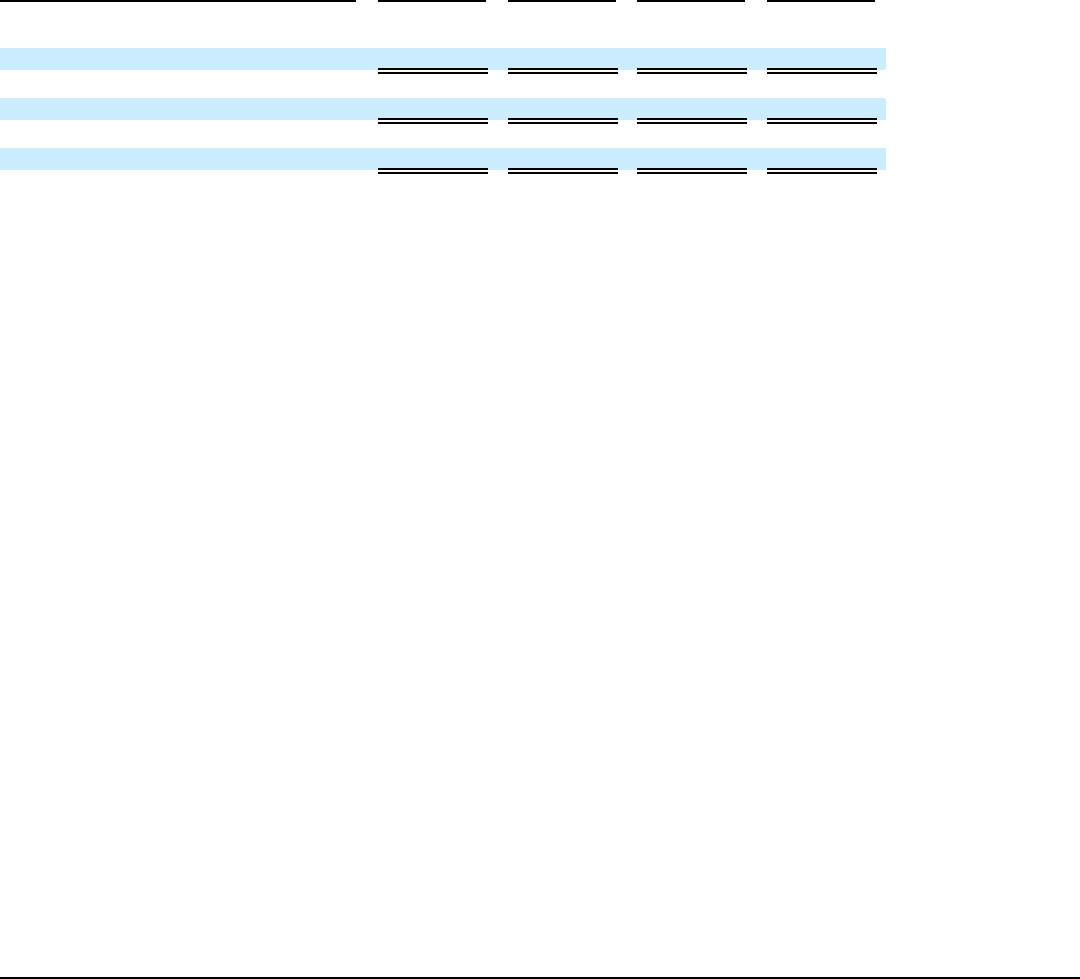

Description

Balance at

Beginning

of Period Additions

(1) Deductions

(2)

Balance at

End of

Period

(In thousands)

Year ended January 29, 2006

Allowance for sales returns $ 11,687 $ 35,127 $ (36,575) $ 10,239

Year ended January 30, 2005

Allowance for sales returns $ 9,421 $ 22,463 $ (20,197) $ 11,687

Year ended January 25, 2004

Allowance for sales returns $ 13,228 $ 23,796 $ (27,603) $ 9,421

(1) Allowances for sales returns are charged as a reduction to revenue.

(2) Represents amounts written off against the allowance for sales returns.

In connection with certain agreements that we have executed in the past, we have at times provided indemnities to cover the

indemnified party for matters such as tax, product and employee liabilities. We have also on occasion included intellectual property

indemnification provisions in our technology related agreements with third parties. Maximum potential future payments cannot be

estimated because many of these agreements do not have a maximum stated liability. As such, we have not recorded any liability in

our consolidated financial statements for such indemnifications.

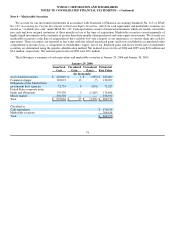

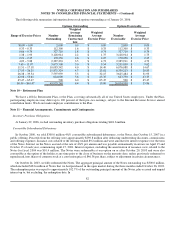

Note 9 − Stockholders' Equity

Stock Repurchase Program

On August 9, 2004 we announced that our Board of Directors, or the Board, had authorized a stock repurchase program to

repurchase shares of our common stock, subject to certain specifications, up to an aggregate maximum amount of $300.0 million. As

part of our share repurchase program, we have entered into and we may continue to enter into structured share repurchase transactions

with financial institutions. These agreements generally require that we make an up−front payment in exchange for the right to receive

a fixed number of shares of our common stock upon execution of the agreement, and a potential incremental number of shares of our

common stock, within a pre−determined range, at the end of the term of the agreement. During the fourth quarter of fiscal 2006, we

repurchased 1.3 million shares of our common stock for $50.0 million under a structured share repurchase transaction, which we

recorded on the trade date of the transaction. Through the end of the fourth quarter of fiscal 2006, we have repurchased 8.5 million

shares under our stock repurchase program for a total cost of $213.2 million. During the first quarter of fiscal 2007, we entered into a

structured share repurchase transaction to repurchase shares of our common stock for $50.0 million that we expect to settle prior to the

end of our first fiscal quarter.

On March 6, 2006, we announced that our Board of Directors had approved an increase in our existing stock repurchase program.

We announced a $400 million increase to the original stock repurchase program we had announced in August 2004. As a result of this

increase, the amount of common stock the Board of Directors has authorized to be repurchased has now been increased to a total of

$700 million. The repurchases will be made from time to time in the open market, in privately negotiated transactions, or in structured

stock repurchase transactions, in compliance with the Securities and Exchange Commission Rule 10b−18, subject to market

conditions, applicable legal requirements, and other factors. The program does not obligate NVIDIA to acquire any particular amount

of common stock and the program may be suspended at any time at our discretion.

78