NVIDIA 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS − (Continued)

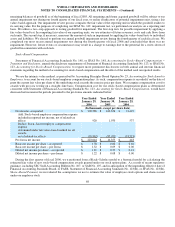

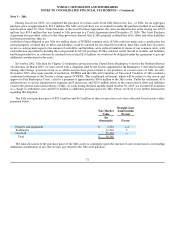

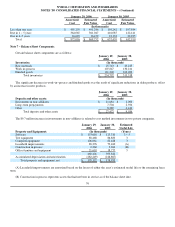

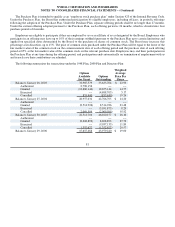

Note 4 − Goodwill

The carrying amount of goodwill is as follows:

January 29, January 30, January 25,

2006 2005 2004

(In thousands)

3dfx $ 75,326 $ 50,326 $ 50,326

MediaQ 52,913 52,913 53,695

Other 17,078 4,868 4,888

Total goodwill $ 145,317 $ 108,107 $ 108,909

During the fourth quarter of fiscal 2006, we recorded $12.2 million as goodwill for the acquisition of a small international

company. The acquisition was accounted for under the purchase method of accounting and closed on December 30, 2005. During the

third quarter of fiscal 2006, we recorded $25.0 million as goodwill related to the purchase of certain assets of 3dfx. Please refer to

Note 3 of the Notes to Consolidated Financial Statements for further information. In fiscal 2005, the amount allocated to MediaQ

goodwill was adjusted to $52,913 as a result of additional information that became available. This information was primarily related to

liabilities that were less than originally estimated at the time of acquisition.

During fiscal 2005, in conjunction with the reorganization of our business reporting units, we reassigned goodwill to our reporting

units using a relative fair value allocation approach. In computing fair value of our reporting units, we use estimates of future

revenues, costs and cash flows from such units. The amount of goodwill allocated to our GPU, MCP, Handheld GPU, Consumer

Electronics, and All Other segments as of January 29, 2006, was $99.3 million, $15.1 million, $12.7 million, $11.9 million, and $6.3

million, respectively. Please refer to Note 15 of the Notes to Consolidated Financial Statements for further segment information.

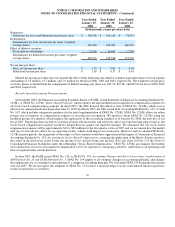

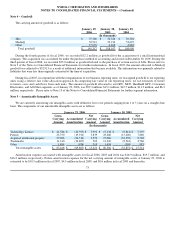

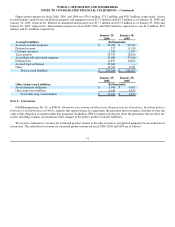

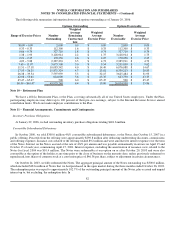

Note 5 − Amortizable Intangible Assets

We are currently amortizing our intangible assets with definitive lives over periods ranging from 1 to 5 years on a straight−line

basis. The components of our amortizable intangible assets are as follows:

January 29, 2006 January 30, 2005

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Amount

Gross

Carrying

Amount Accumulated

Amortization

Net

Carrying

Amount

(In thousands)

Technology licenses $ 21,586 $ (13,595) $ 7,991 $ 17,236 $ (9,841) $ 7,395

Patents 23,750 (19,911) 3,839 23,260 (15,400) 7,860

Acquired intellectual property 27,086 (24,516) 2,570 27,086 (18,578) 8,508

Trademarks 11,310 (10,807) 503 11,310 (8,544) 2,766

Other 1,494 (976) 518 1,494 (509) 985

Total intangible assets $ 85,226 $ (69,805) $ 15,421 $ 80,386 $ (52,872) $ 27,514

Amortization expense associated with intangible assets for fiscal 2006, 2005 and 2004 was $16.9 million, $19.7 million, and

$16.2 million, respectively. Future amortization expense for the net carrying amount of intangible assets at January 29, 2006 is

estimated to be $10.5 million in fiscal 2007, $4.3 million in fiscal 2008, and $0.6 million in fiscal 2009 and thereafter.

73