NVIDIA 2006 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

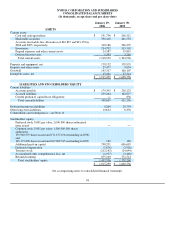

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1 − Organization and Summary of Significant Accounting Policies

Our Company

NVIDIA Corporation is the worldwide leader in programmable graphics processor technologies. Our products enhance the

end−user experience on consumer and professional computing devices. We have four major product−line operating segments:

graphics processing units, or GPUs, media and communications processors, or MCPs, Handheld GPUs, and Consumer Electronics.

Our GPU Business is composed of products that support desktop personal computers, or PCs, notebook PCs and professional

workstations; our MCP Business is composed of NVIDIA nForce products that operate as a single−chip or chipset that can off−load

system functions, such as audio processing and network communications, and perform these operations independently from the host

central processing unit, or CPU; our Handheld GPU Business is composed of products that support handheld personal digital

assistants, cellular phones and other handheld devices; and our Consumer Electronics Business is concentrated in products that support

video game consoles and other digital consumer electronics devices and is composed of our contractual arrangements with Sony

Computer Entertainment, or SCE, to jointly develop a custom GPU incorporating our next−generation GeForce GPU and SCE's

system solutions in SCE's PlayStation3, sales of our Xbox−related products, revenue from our license agreement with Microsoft

relating to the successor product to their initial Xbox gaming console, the Xbox360, and related devices, and digital media processor

products. We were incorporated in California in April 1993 and reincorporated in Delaware in April 1998. Our headquarter facilities

are in Santa Clara, California.

Fiscal year

We operate on a 52 or 53−week year, ending on the Sunday nearest January 31. Fiscal 2006 and 2004 were 52−week

years, compared to fiscal 2005 which was a 53−week year.

Reclassifications

Certain prior fiscal year balances were reclassified to conform to the current fiscal year presentation.

Principles of Consolidation

Our consolidated financial statements include the accounts of NVIDIA Corporation and its wholly owned subsidiaries. All

material intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States requires

management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent

assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting

period. Actual results could differ from those estimates. On an on−going basis, we evaluate our estimates, including those related to

revenue recognition, accounts receivable, inventories, income taxes and contingencies. These estimates are based on historical facts

and various other assumptions that we believe are reasonable.

Cash and Cash Equivalents

We consider all highly liquid investments purchased with an original maturity of three months or less at the time of purchase to be

cash equivalents. As of January 29, 2006, our cash and cash equivalents were $551.8 million, which includes $256.6 million invested

in money market funds.

63