NVIDIA 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NVIDIA CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS − (Continued)

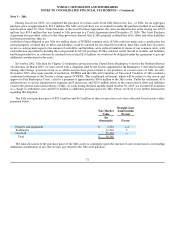

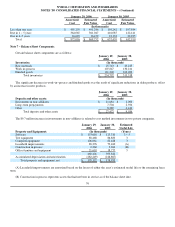

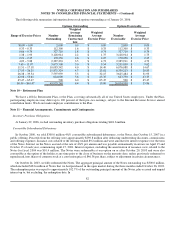

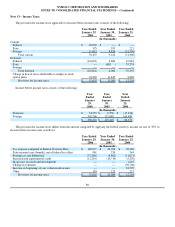

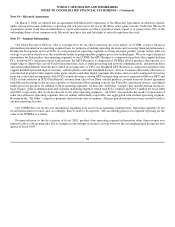

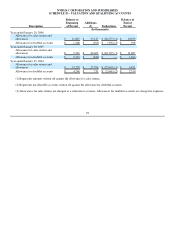

The following table summarizes information about stock options outstanding as of January 29, 2006:

Options Outstanding Options Exercisable

Range of Exercise Prices Number

Outstanding

Weighted

Average

Remaining

Contractual

Life

Weighted

Average

Exercise Price Number

Exercisable

Weighted

Average

Exercise Price

$0.09 − 0.09 2,000 0.9 $ 0.09 2,000 $ 0.09

0.33 − 0.33 112,300 1.6 $ 0.33 112,300 $ 0.33

0.66 − 0.79 327,710 1.8 $ 0.74 327,710 $ 0.74

1.38 − 1.93 3,128,914 2.2 $ 1.75 3,128,914 $ 1.75

2.21 − 2.25 170,250 2.6 $ 2.25 170,250 $ 2.25

4.09 − 5.88 2,387,233 3.5 $ 4.73 2,385,911 $ 4.73

7.65 − 11.07 3,673,508 5.0 $ 9.54 3,251,830 $ 9.62

11.51 − 17.18 10,083,542 4.0 $ 14.49 6,076,088 $ 14.67

17.53 − 26.25 15,871,324 4.7 $ 23.02 6,350,213 $ 20.85

26.38 − 39.54 7,597,959 5.3 $ 32.15 3,625,484 $ 31.93

42.98 − 53.61 624,000 5.6 $ 43.35 623,750 $ 43.35

65.47 − 65.47 500 6.0 $ 65.47 500 $ 65.47

$0.09 − $65.47 43,979,240 4.4 $ 19.00 26,054,950 $ 15.86

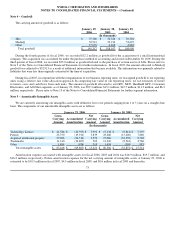

Note 10 − Retirement Plan

We have a 401(k) Retirement Plan, or the Plan, covering substantially all of our United States employees. Under the Plan,

participating employees may defer up to 100 percent of their pre−tax earnings, subject to the Internal Revenue Service annual

contribution limits. We do not make employer contributions to the Plan.

Note 11 − Financial Arrangements, Commitments and Contingencies

Inventory Purchase Obligations

At January 29, 2006, we had outstanding inventory purchase obligations totaling $401.6 million.

Convertible Subordinated Debentures

In October 2000, we sold $300.0 million 4¾% convertible subordinated debentures, or the Notes, due October 15, 2007 in a

public offering. Proceeds from the offering were approximately $290.8 million after deducting underwriting discounts, commissions

and offering expenses. Issuance costs related to the offering totaled $9.2 million and were amortized to interest expense over the term

of the Notes. Interest on the Notes accrued at the rate of 4¾% per annum and was payable semiannually in arrears on April 15 and

October 15 of each year, commencing April 15, 2001. Interest expense, excluding the amortization of issuance costs, related to the

Notes for fiscal 2004 was $10.4 million. The Notes were redeemable at our option on or after October 20, 2003 and were also

convertible at the option of the holder at any time prior to the close of business on the maturity date, unless previously redeemed or

repurchased, into shares of common stock at a conversion price of $46.36 per share, subject to adjustment in certain circumstances.

On October 24, 2003, we fully redeemed the Notes. The aggregate principal amount of the Notes outstanding was $300.0 million,

which included $18.6 million of Notes that we had purchased in the open market during the three months ended October 26, 2003.

The redemption price was equal to approximately 102.7% of the outstanding principal amount of the Notes, plus accrued and unpaid

interest up to, but excluding, the redemption date. In

82