NVIDIA 2006 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

In January 2006, we shipped the NVIDIA nForce 4 SLI XE and NVIDIA nForce4 Ultra Intel MCPs. These products represent

our first discrete chipsets targeted at mainstream Intel−based motherboards.

Our NVIDIA nForce product line has achieved record revenue for six consecutive quarters. We believe that Advanced Micro

Devices' transition to K8, our extension into new segments, and our entry into the Intel market with our first ever mainstream Intel

nForce4 MCPs will make our MCP Business one of our fastest growing businesses. Furthermore, we believe that our ability to

simultaneously innovate using our GPU, MCP, and software knowledge base will allow us to make additional platform innovations in

the future.

Handheld GPU Business

Our strategy in the Handheld GPU Business is to lead innovation and capitalize on the emergence of the mobile phone as a

versatile consumer lifestyle device. Our initial focus was on 3G cellular phones. Through the first half of fiscal 2006, our Handheld

GPU Business was heavily concentrated at one original equipment manufacturer, or OEM, and its products did not achieve the

anticipated level of commercial success. However, during the third quarter of fiscal 2006, Motorola Inc. and Sony Ericsson Mobile

Communications AB launched 3G models of their RAZR and Walkman portable phones, respectively, that are both powered by our

GoForce GPUs.

Our GoForce handheld GPUs are now shipping in the new Motorola 3G RAZR V3X and the new Sony Ericsson Walkman

phones. Our strategy is to build a new class of low power GPUs for multimedia rich devices like 3G cell phones, smart phones, and

portable media players. We believe that there will be an increase in demand for mobile video products that deliver compelling and

tangible improvements to the overall end user experience of these new services, and we believe that we are well positioned to increase

our share of the handheld segment in the upcoming year.

Consumer Electronics Business

In April 2005, we finalized our definitive agreement with SCE to jointly develop a custom GPU incorporating our

next−generation GeForce GPU and SCE's system solutions in SCE's PlayStation3. Our collaboration with SCE includes license fees

and royalties for the PlayStation3 and all derivatives, including next−generation digital consumer electronics devices. In addition, we

are licensing software development tools for creating shaders and advanced graphics capabilities to SCE. During fiscal 2006, we

recognized $49.0 million of revenue from our contractual arrangements with SCE to jointly develop a custom GPU incorporating our

next−generation GeForce GPU and SCE's system solutions in SCE's PlayStation3. Depending on the ultimate success of this

next−generation platform, we expect to generate, starting in fiscal 2007, revenue ranging from $50 million to $100 million annually

from license fees and royalties over the next five years with the possibility of additional royalties for several years thereafter. We have

successfully reached many development milestones and we believe that we are on target to achieve the goals set by SCE.

During the first quarter of fiscal 2006, Microsoft indicated that it would not order any more Xbox−related products from us after

our second fiscal quarter. As a result, the second quarter of fiscal 2006 was the last quarter during which we recognized revenue from

the sale of our Xbox−related products to Microsoft.

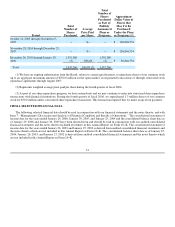

Gross Margin Improvement

We continue to remain intensely focused on improving our gross margin. Beginning in fiscal 2005, we implemented profit

improvement initiatives across our company which were designed to improve business and operational processes. During the fourth

quarter of fiscal 2006, our gross margin was 40.2%, which represents an increase of 600 basis points from our gross margin of 34.2%

for the fourth quarter of fiscal 2005. Our gross margin was 38.3% for fiscal 2006, which represents an increase of 600 basis points

from our gross margin of 32.3% for fiscal 2005. We believe that we can continue to improve our gross margin during fiscal 2007.

35