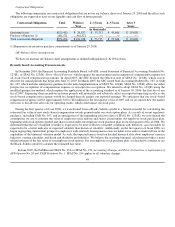

NVIDIA 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 NVIDIA annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

in accounting principle, and changes the requirements for accounting for and reporting of a change in accounting principle. We will

adopt SFAS 154 during the first quarter of fiscal 2007. We do not expect the adoption of SFAS No. 154 to have a material impact on

our consolidated financial position, results of operations or cash flows.

In June 2005, the FASB ratified the Emerging Issues Task Force's, or EITF's, Issue No. 05−06, or EITF No. 05−06,

Determining the Amortization Period for Leasehold Improvements. EITF No. 05−06 provides that the amortization period used for

leasehold improvements acquired in a business combination or purchased after the inception of a lease be the shorter of (a) the useful

life of the assets or (b) a term that includes required lease periods and renewals that are reasonably assured upon the acquisition or the

purchase. The provisions of EITF No. 05−06 are effective on a prospective basis for leasehold improvements purchased or acquired.

We adopted EITF No. 05−06 during the second quarter of fiscal 2006 and it did not have a material impact on our consolidated

financial position, results of operations or cash flows.

In November 2005, the FASB issued Staff Position, or FSP, FAS115−1/124−1, The Meaning of Other−Than−Temporary

Impairment and Its Application to Certain Investments, which addresses the determination as to when an investment is considered

impaired, whether that impairment is other than temporary, and the measurement of an impairment loss. This FSP also includes

accounting considerations subsequent to the recognition of an other−than−temporary impairment and requires certain disclosures

about unrealized losses that have not been recognized as other−than−temporary impairments. The guidance in this FSP amends SFAS

No. 115, Accounting for Certain Investments in Debt and Equity Securities, and SFAS No. 124, Accounting for Certain Investments

Held by Not−for−Profit Organizations, and APB Opinion No. 18, The Equity Method of Accounting for Investments in Common

Stock. We will adopt this FSP during the first quarter of fiscal 2007. We do not believe the adoption of this FSP will have a material

impact on our consolidated financial position, results of operations or cash flows.

In November 2005, the FASB issued FSP FAS123(R)−3, Transition Election to Accounting for the Tax Effects of Share−Based

Payment Awards. This FSP requires an entity to follow either the transition guidance for the additional−paid−in−capital pool as

prescribed in SFAS No. 123(R), Share−Based Payment, or the alternative transition method as described in the FSP. An entity that

adopts SFAS No. 123(R) using the modified prospective application may make a one−time election to adopt the transition method

described in this FSP. An entity may take up to one year from the later of its initial adoption of SFAS No. 123(R) or the effective date

of this FSP to evaluate its available transition alternatives and make its one−time election. This FSP became effective in November

2005. We are currently evaluating the impact that the adoption of this FSP could have on our consolidated financial position, results of

operations or cash flows.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

Interest Rate Risk

We invest in a variety of financial instruments, consisting principally of investments in commercial paper, money market funds

and highly liquid debt securities of corporations, municipalities and the United States government and its agencies. These investments

are denominated in United States dollars.

We account for our investment instruments in accordance with Statement of Financial Accounting Standards No. 115, or SFAS

No. 115, Accounting for Certain Investments in Debt and Equity Securities. All of the cash equivalents and marketable securities are

treated as “available−for−sale” under SFAS No. 115. Investments in both fixed rate and floating rate interest earning instruments carry

a degree of interest rate risk. Fixed rate securities may have their market value adversely impacted due to a rise in interest rates, while

floating rate securities may produce less income than expected if interest rates fall. Due in part to these factors, our future investment

income may fall short of expectations due to changes in interest rates or we may suffer losses in principal if we are forced to sell

securities that decline in market value due to changes in interest rates. However, because we classify our debt securities as

“available−for−sale”, no gains or losses are recognized due to changes in interest rates unless such securities are sold prior to maturity

or declines in fair value are determined to be other than temporary. These securities are reported at fair value with the related

unrealized gains and losses included in accumulated other comprehensive income, a component of stockholders' equity, net of tax.

50