Logitech 2013 Annual Report Download - page 60

Download and view the complete annual report

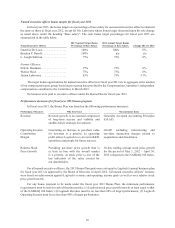

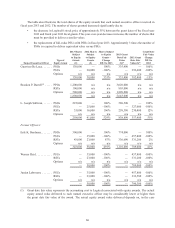

Please find page 60 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The PSOs granted to our executive officers have an exercise price of $7.83, Logitech’s trading price on the

date of grant. The PSOs vest when Logitech’s average closing price per share over a consecutive 90-day trading

period meets or exceeds multiples of Logitech’s trading price on the date of grant as noted below.

• 25% of the shares vest once Logitech’s average stock price over a 90-day consecutive period is $11.75, a

150%multipleofLogitech’stradingpriceonthedateofgrant;

• 25% of the shares vest once Logitech’s average stock price over a 90-day consecutive period is $13.70, a

175%multipleofLogitech’stradingpriceonthedateofgrant;

• 50% of the shares vest once Logitech’s average stock price over a 90-day consecutive period is $15.66,

a 200% multiple of Logitech’s trading price on the date of grant.

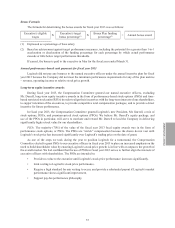

For any shares to vest, the associated stock price performance criteria must be met within 4 years of the date

of grant, or the associated shares will be cancelled. No shares are exercisable before the 2nd anniversary of grant,

unless the executive is involuntarily terminated or, after a change of control, resigns for good reason. In that case,

shares will become vested only to the extent that the performance criteria have been met.

Because the value at grant of a PSO is lower than that of PSUs, RSUs or standard stock options, we needed

to grant a larger number of PSOs to deliver similar grant-date award value. As a result, PSOs have a more dilutive

impact on our stock pool, but in the Compensation Committee’s view, this will be offset by the increased potential

incentive value to our executives and the potential return on equity value to our shareholders.

RSUs. Thirty percent of the value of the fiscal year 2013 focal equity awards were granted in the form of

restricted stock units. Time-based restricted stock units, or RSUs, provide for the issuance of shares at a future

date upon vesting of the RSUs. Due to the delay in the fiscal year 2013 grants, which were granted nine months

into fiscal year 2013, the RSUs have a three-year vesting period, with the RSUs vesting in three equal annual

increments. RSUs granted to our executive officers in fiscal year 2014 have our typical four-year vesting period.

The Compensation Committee believes RSUs create incentives for performance and further align the interests

of executives with those of shareholders because an RSU’s value increases or decreases in conjunction with the

Company’s stock price. Because the value at grant of RSUs is generally greater than that of stock options, we are

able to grant a smaller number of RSUs while delivering similar grant-date award value. As a result, granting RSUs

helps minimize the dilutive effects of our equity awards on our shareholders and, in the Committee’s view, provides

a more cost effective balance of incentive and risk than standard stock options.

PPOs. In April 2012, the Compensation Committee made a grant of premium-priced options, or PPOs, to

our new President, Mr. Darrell as part of his new hire package. PPOs are stock options that have an exercise

price that is set higher than Logitech’s trading price on the date of grant. The Committee believes PPOs create

exceptional incentives for performance and further align the interests of executives with those of shareholders

because a PPO has no value until Logitech’s stock price performance has been considerably increased. Because the

value at grant of PPOs is significantly lower than that of RSUs, PSUs, PSOs, or standard stock options, we needed

to grant a significantly larger number of PPOs to deliver similar grant-date award value. As a result, PPOs have a

more dilutive impact on our stock pool, but in the Committee’s view, this will be offset by the increased incentive

value and potential upside to our shareholders and to our new President and Chief Executive Officer. Mr. Darrell’s

PPO grants have exercise prices of approximately $14, $16, and $20, which represent $175%, 200% and 250% of

Logitech’s trading price on the grant date.

58