Logitech 2013 Annual Report Download - page 207

Download and view the complete annual report

Please find page 207 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

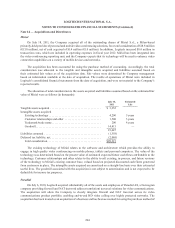

accounting. The total consideration paid of $7.3 million was allocated based on estimated fair values to $7.0 million

of identifiable intangible assets and $0.1 million of assumed liabilities, with the remaining balance allocated to

goodwill. The intangible assets acquired are amortized on a straight-line basis over their estimated useful lives

of five years. The goodwill associated with the acquisition is not subject to amortization and is not expected to be

deductible for income tax purposes.

3Dconnexion

On March 31, 2011, the Company sold its equity interest in certain 3Dconnexion subsidiaries, the provider

of the Company’s 3D controllers, and its intellectual property rights related to the manufacture and sale of certain

3Dconnexion products, to a group of third party individuals and certain 3Dconnexion employees. The sale price

was $9.1 million, not including cash retained. Under the sale agreement, the Company will continue to manufacture

3Dconnexion products and sell to the buyers for a period of three years. The loss resulting from the sale was

not material.

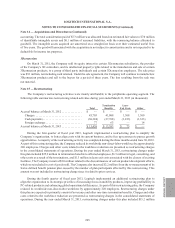

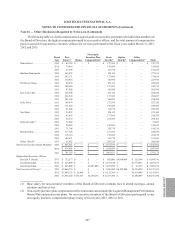

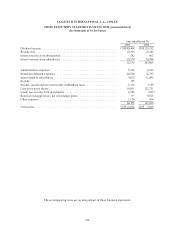

Note 15 — Restructuring

The Company’s restructuring activities were mainly attributable to the peripherals operating segment. The

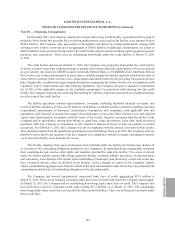

following table summarizes restructuring related activities during year ended March 31, 2013 (in thousands):

Tota l

Termination

Benefits

Lease

Exit Costs Other

Accrual balance at March 31, 2012 .............. $ — $ — $ — $ —

Charges................................. 43,705 41,088 1,308 1,309

Cash payments ........................... (30,324) (27,768) (1,233) (1,323)

Foreign exchange ......................... 77 63 — 14

Accrual balance at March 31, 2013 .............. $ 13,458 $ 13,383 $ 75 $ —

During the first quarter of fiscal year 2013, Logitech implemented a restructuring plan to simplify the

Company’s organization, to better align costs with its current business, and to free up resources to pursue growth

opportunities. A majority of the restructuring activity was completed during the three months ended June 30, 2012.

As part of this restructuring plan, the Company reduced its worldwide non-direct-labor workforce by approximately

340 employees. Charges and other costs related to the workforce reduction are presented as restructuring charges

in the consolidated statements of operations. During the year ended March 31, 2013, restructuring charges under

this plan included $25.9 million in termination benefits to affected employees, $1.3 million in legal, consulting, and

other costs as a result of the terminations, and $1.3 million in lease exit costs associated with the closure of existing

facilities. The Company incurred $3.0 million related to the discontinuance of certain product development efforts,

which were included in cost of goods sold. The Company also incurred $2.2 million from the re-measurement of its

Swiss defined benefit pension plan caused by the number of plan participants affected by this restructuring. This

amount was not included in restructuring charge since it related to prior services.

During the fourth quarter of fiscal year 2013, Logitech implemented an additional restructuring plan to

align the organization to its strategic priorities of increasing focus on mobility products, improving profitability in

PC-related products and enhancing global operational efficiencies. As part of this restructuring plan, the Company

reduced its worldwide non-direct-labor workforce by approximately 220 employees. Restructuring charges under

this plan are expected to primarily consist of severance and other one-time termination benefits. Charges and other

costs related to the workforce reduction are presented as restructuring charges in the consolidated statements of

operations. During the year ended March 31, 2013, restructuring charges under this plan included $15.2 million

Note 14 — Acquisitions and Divestitures (Continued)

ANNUAL REPORT

205