Logitech 2013 Annual Report Download - page 192

Download and view the complete annual report

Please find page 192 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

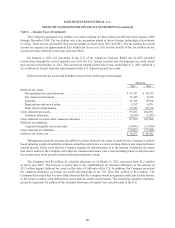

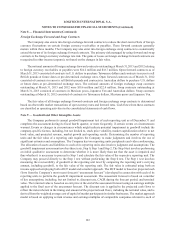

The auction rate securities are classified as non-current available-for-sale securities. These securities are

collateralized by residential and commercial mortgages, and are second-priority senior secured floating rate notes

with maturity dates in excess of 10 years. Interest rates on these notes were intended to reset through an auction

every 28 days, however auctions for these securities have failed since August 2007. During the fiscal year ended

March 31, 2012, the Company sold two of the auction rate securities with a total carrying value of $0.5 million and a

total par value of $10.0 million for $6.6 million. The gain of $6.1 million was recognized in other income (expense),

net. During the three months ended March 31, 2012, two securities with a total carrying value of $0.4 million and

a total par value of $22.2 million were liquidated. The Company did not receive any proceeds from the liquidation.

The loss of $0.4 million was recorded in accumulated other comprehensive loss, offsetting a previously recorded

temporary increase in fair value. During the fiscal year ended March 31, 2013, the Company sold its remaining two

auction rate securities with a total carrying value of $0.4 million and a total par value of $15.2 million for $0.9 million.

This sale resulted in $0.8 million of gain recognized in other income (expense), net, $0.3 million of which resulted

from the recognition of a temporary increase in fair value previously recorded in accumulated other comprehensive

loss. The par value and original cost of the auction rate securities held as of March 31, 2012 was $15.2 million. These

securities were recorded at an estimated fair value of $0.4 million at March 31, 2012. The estimated fair value was

determined by estimating future cash flows through time according to each security’s terms, including periodic

consideration of overcollateralization and interest coverage tests, and incorporating estimates of default rate, loss

severity, prepayment, and delinquency assumptions when available, for the underlying assets in the securities

based on representative indices and various research reports. The estimated coupon and principal payments were

discounted at the rate of return required by investors, based on the characteristics of each security as calculated

from the indices. Such valuation methods fall within Level 3 of the fair value hierarchy.

Derivative Financial Instruments

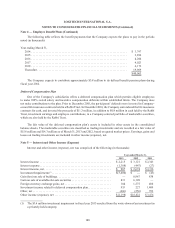

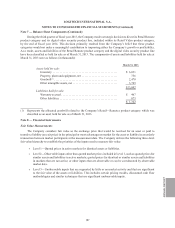

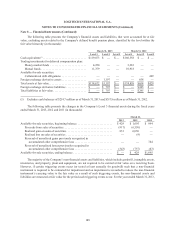

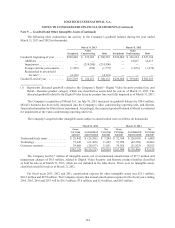

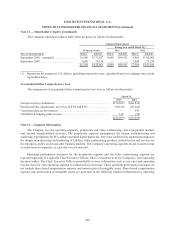

The following table presents the fair values of the Company’s derivative instruments and their locations on its

consolidated balance sheets as of March 31, 2013 and 2012 (in thousands):

Asset Derivatives Liability Derivatives

Fair Value Fair Value

March 31, March 31,

Location 2013 2012 Location 2013 2012

Derivatives designated as hedging

instruments:

Cash flow hedges ........................ Other assets $1,165 $250 Other liabilities $ — $ —

1,165 250 — —

Derivatives not designated as hedging

instruments:

Foreign exchange forward contracts ......... Other assets — 341 Other liabilities 270 148

Foreign exchange swap contracts ........... Other assets 32 67 Other liabilities 437 97

32 408 707 245

$1,197 $658 $707 $245

Note 8 — Financial Instruments (Continued)

190