Logitech 2013 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

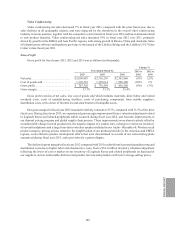

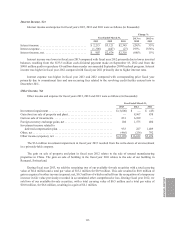

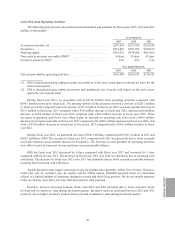

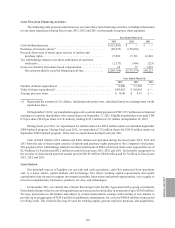

Interest Income, Net

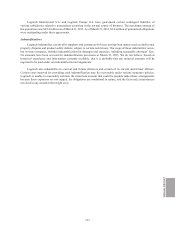

Interest income and expense for fiscal years 2013, 2012 and 2011 were as follows (in thousands):

Year Ended March 31,

Change %

2013 vs

2012

2012 vs

20112013 2012 2011

Interest income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 2,215 $3,121 $2,343 (29)% 33%

Interest expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (1,308) (447) (27) 193% 1556%

Interest income, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 907 $2,674 $2,316 (66)% 15%

Interest income was lower in fiscal year 2013 compared with fiscal year 2012 primarily due to lower invested

balances resulting from the $133.5 million cash dividend payment made on September 18, 2012 and from the

$90.0 million paid to repurchase 8.6 million shares under our amended September 2008 buyback program. Interest

income was higher in fiscal year 2012 compared with fiscal year 2011 primarily due to higher interest rates.

Interest expense was higher in fiscal year 2013 and 2012 compared with corresponding prior fiscal year

primarily due to commitment fees and non-recurring fees related to the revolving credit facility entered into in

December 2011.

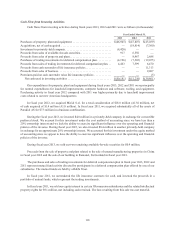

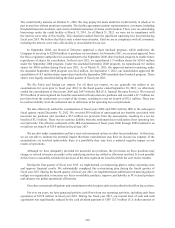

Other Income, Net

Other income and expense for fiscal years 2013, 2012 and 2011 were as follows (in thousands):

Year Ended March 31,

2013 2012 2011

Investment impairment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (3,600) $ — $ (43)

Gain (loss) on sale of property and plant. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 8,967 838

Gain on sale of investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 831 6,109 —

Foreign currency exchange gains, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 104 1,575 480

Investment income related to

deferred compensation plan. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 933 227 1,409

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (466) (256) 792

Other income (expense), net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ (2,198) $16,622 $3,476

The $3.6 million investment impairment in fiscal year 2013 resulted from the write-down of an investment

in a privately-held company.

The gain on sale of property and plant in fiscal year 2012 relates to the sale of unused manufacturing

properties in China. The gain on sale of building in the fiscal year 2011 relates to the sale of our building in

Romanel, Switzerland.

During fiscal year 2013, we sold the remaining two of our available-for-sale securities with a total carrying

value of $0.4 million and a total par value of $15.2 million for $0.9 million. This sale resulted in $0.8 million of

gain recognized in other income (expense), net, $0.3 million of which resulted from the recognition of a temporary

increase in fair value previously recorded in accumulated other comprehensive loss. During fiscal year 2012, we

sold two of our available-for-sale securities, with a total carrying value of $0.5 million and a total par value of

$10.0 million, for $6.6 million, resulting in a gain of $6.1 million.

ANNUAL REPORT

113