Logitech 2013 Annual Report Download - page 200

Download and view the complete annual report

Please find page 200 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

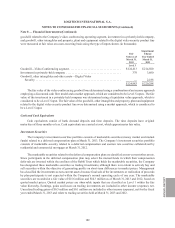

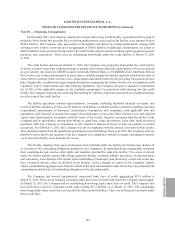

of the purchase obligations of a third-party contract manufacturer under two guarantee agreements. The maximum

amount of these guarantees was $3.8 million as of March 31, 2013. As of March 31, 2013, $2.0 million of guaranteed

purchase obligations were outstanding under these agreements.

Logitech International S.A. and Logitech Europe S.A. have guaranteed certain contingent liabilities of

various subsidiaries related to transactions occurring in the normal course of business. The maximum amount of

the guarantees was $22.4 million as of March 31, 2013. As of March 31, 2013, $3.0 million of guaranteed obligations

were outstanding under these agreements.

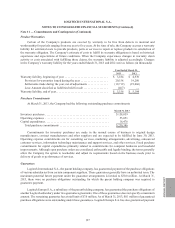

Indemnifications

Logitech indemnifies certain of its suppliers and customers for losses arising from matters such as intellectual

property disputes and product safety defects, subject to certain restrictions. The scope of these indemnities varies,

but in some instances, includes indemnification for damages and expenses, including reasonable attorneys’ fees.

No amounts have been accrued for indemnification provisions at March 31, 2013. The Company does not believe,

based on historical experience and information currently available, that it is probable that any material amounts will

be required to be paid under its indemnification arrangements.

Logitech also indemnifies its current and former directors and certain of its current and former officers.

Certain costs incurred for providing such indemnification may be recoverable under various insurance policies.

Logitech is unable to reasonably estimate the maximum amount that could be payable under these arrangements

because these exposures are not capped, the obligations are conditional in nature, and the facts and circumstances

involved in any situation that might arise are variable.

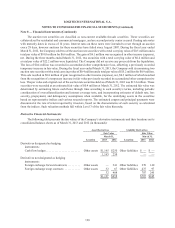

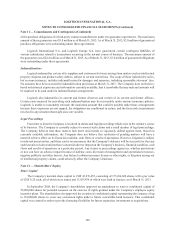

Legal Proceedings

From time to time the Company is involved in claims and legal proceedings which arise in the ordinary course

of its business. The Company is currently subject to several such claims and a small number of legal proceedings.

The Company believes that these matters lack merit and intends to vigorously defend against them. Based on

currently available information, the Company does not believe that resolution of pending matters will have a

material adverse effect on its financial condition, cash flows or results of operations. However, litigation is subject

to inherent uncertainties, and there can be no assurances that the Company’s defenses will be successful or that any

such lawsuit or claim would not have a material adverse impact on the Company’s business, financial condition, cash

flows and results of operations in a particular period. Any claims or proceedings against us, whether meritorious

or not, can have an adverse impact because of defense costs, diversion of management and operational resources,

negative publicity and other factors. Any failure to obtain necessary license or other rights, or litigation arising out

of intellectual property claims, could adversely affect the Company’s business.

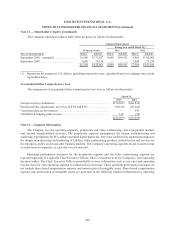

Note 12 — Shareholders’ Equity

Share Capital

The Company’s nominal share capital is CHF 43,276,655, consisting of 173,106,620 shares with a par value

of CHF 0.25 each, all of which were issued and 13,855,436 of which were held in treasury as of March 31, 2013.

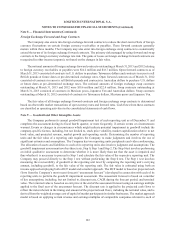

In September 2008, the Company’s shareholders approved an amendment to reserve conditional capital of

25,000,000 shares for potential issuance on the exercise of rights granted under the Company’s employee equity

incentive plans. The shareholders also approved the creation of conditional capital representing the issuance of up

to 25,000,000 shares to cover any conversion rights under a future convertible bond issuance. This conditional

capital was created in order to provide financing flexibility for future expansion, investments or acquisitions.

Note 11 — Commitments and Contingencies (Continued)

198