Logitech 2013 Annual Report Download - page 122

Download and view the complete annual report

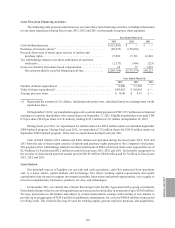

Please find page 122 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The credit facility matures on October 31, 2016. We may prepay the loans under the credit facility in whole or in

part at any time without premium or penalty. The facility agreement contains representations, covenants, including

threshold financial covenants, and events of default customary in Swiss credit markets. There were no outstanding

borrowings under the credit facility at March 31, 2013. As of March 31, 2013, we were not in compliance with

the interest cover ratio of this facility. This situation resulted from the significant operating loss incurred during

fiscal year 2013. We believe that this is only a short-term situation. Until we are in compliance with all covenants,

including the interest cover ratio, this facility is not available for our use.

In September 2008, our Board of Directors approved a share buyback program, which authorizes the

Company to invest up to $250.0 million to purchase its own shares. In November 2011, we received approval from

the Swiss regulatory authorities for an amendment to the September 2008 share buyback program to enable future

repurchases of shares for cancellation. In fiscal year 2012, we repurchased 17.5 million shares for $156.0 million

under the September 2008 program. Under the amended September 2008 program, we repurchased 8.6 million

shares for $90.0 million during fiscal year 2013. As of March 31, 2013, the approved amount remaining under

the amended September 2008 program was $4.4 million. On September 5, 2012, our shareholders approved the

cancellation of 18.5 million shares repurchased under the September 2008 amended share buyback program. These

shares were legally cancelled during the third quarter of fiscal year 2013.

We file Swiss and foreign tax returns. For all these tax returns, we are generally not subject to tax

examinations for years prior to fiscal year 2001. In the fiscal quarter ended September 30, 2012, we effectively

settled the examinations of fiscal years 2006 and 2007 with the IRS (U.S. Internal Revenue Service). We reversed

$33.8 million of unrecognized tax benefits associated with uncertain tax positions and recorded a $1.7 million tax

provision from the assessments as a result of the closure, resulting in a net tax benefit of $32.1 million. There was

no cash tax liability from the settlement due to utilization of net operating loss carryforwards.

We also effectively settled the examinations of fiscal years 2008 and 2009 with the IRS in the subsequent

fiscal quarter ended December 31, 2012. We reversed $9.0 million of unrecognized tax benefits associated with

uncertain tax positions and recorded a $5.5 million tax provision from the assessments, resulting in a net tax

benefit of $3.5 million. There was no cash tax liability from the settlement due to utilization of net operating loss

carryforwards. The effective settlement of the IRS examinations of fiscal years 2006 through 2009 resulted in an

overall net tax benefit of $35.6 million in fiscal year 2013.

We are also under examination and have received assessment notices in other tax jurisdictions. At this time,

we are not able to estimate the potential impact that these examinations may have on income tax expense. If the

examinations are resolved unfavorably, there is a possibility they may have a material negative impact on our

results of operations.

Although we have adequately provided for uncertain tax positions, the provisions on these positions may

change as revised estimates are made or the underlying matters are settled or otherwise resolved. It is not possible

at this time to reasonably estimate the decrease of the unrecognized tax benefits within the next twelve months.

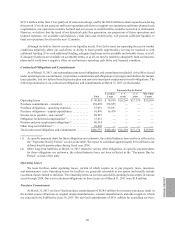

During the first quarter of fiscal year 2013, we implemented a restructuring plan to reduce operating costs

and improve financial results. We substantially completed this restructuring plan during the fourth quarter of

fiscal year 2013. During the fourth quarter of fiscal year 2013, we implemented an additional restructuring plan to

realign our organization to increase our focus on mobility products, improve profitability in PC-related products

and enhance our global operational efficiencies.

Our other contractual obligations and commitments which require cash are described in the following sections.

For over ten years, we have generated positive cash flows from our operating activities, including cash from

operations of $117.0 million in fiscal year 2013. During the fiscal year 2013, our normal level of cash and cash

equivalents was significantly reduced by the cash dividend payment of CHF 125.7 million (U.S. dollar amount of

120