Logitech 2013 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Foreign currency exchange gains or losses relate to balances denominated in currencies other than the

functional currency of a particular subsidiary, to the sale of currencies, and to gains or losses recognized on

foreign exchange forward contracts. We do not speculate in currency positions, but we are alert to opportunities to

maximize foreign exchange gains.

Investment income for fiscal years 2013 and 2012 represents earnings, gains, and losses on trading investments

related to a deferred compensation plan offered by one of our subsidiaries. Investment income for fiscal year

2011 represents earnings, gains, and losses on the trading investments and changes in the cash surrender value of

Company-owned life insurance contracts, related to the same deferred compensation plan. In December 2010, we

surrendered the life insurance contracts for cash, and invested the proceeds in a portfolio of mutual funds, which

represent the trading investments.

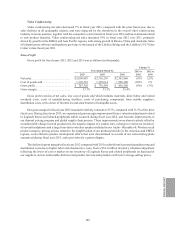

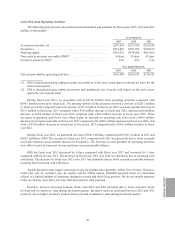

Provision for (benefit from) for Income Taxes

The provision for (benefit from) income taxes and effective income tax rate for fiscal years 2013, 2012 and

2011 were as follows (in thousands):

Year Ended March 31,

2013 2012 2011

Provision for (benefit from) income taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . $(25,588) $19,819 $19,988

Effective income tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10.1% 21.7% 13.5%

The provision for income taxes consists of income and withholding taxes. Logitech operates in multiple

jurisdictions and its profits are taxed pursuant to the tax laws of these jurisdictions. Our effective income tax

rate may be affected by changes in or interpretations of tax laws and tax agreements in any given jurisdiction,

utilization of net operating loss and tax credit carryforwards, changes in geographical mix of income and expense,

and changes in management’s assessment of matters such as the ability to realize deferred tax assets.

The change in the effective income tax rate to 10.1% in fiscal year 2013 compared with 21.7% in fiscal year

2012 is primarily due to the mix of income and losses in the various tax jurisdictions in which we operate, and a

tax benefit of $35.6 million in fiscal year 2013 related to the reversal of uncertain tax positions resulting from the

closure of federal income tax examinations in the U.S.

The change in the effective income tax rate to 21.7% in fiscal year 2012 compared with 13.5% in 2011 is

primarily due to the mix of income and losses in the various tax jurisdictions in which we operate, and a tax benefit

of $7.2 million in fiscal year 2011 from the closure of income tax audits in certain jurisdictions.

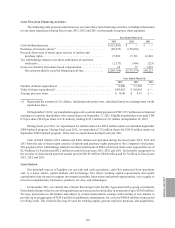

On January 2, 2013, the enactment in the U.S. of the American Taxpayer Relief Act of 2012 extended

retroactively through the end of calendar year 2013 the U.S. federal research and development tax credit which

had expired on December 31, 2011. The income tax benefit for the fiscal year ended March 31, 2013 reflected a

$2.2 million tax benefit from the reinstatement of the U.S. federal research tax credit.

As of March 31, 2013, the total amount of unrecognized tax benefits and related accrued interest and penalties

due to uncertain tax positions was $102.0 million, of which $90.3 million would affect the effective income tax

rate if realized. The decline in unrecognized tax benefits associated with uncertain tax positions in the amount

of $42.0 million in fiscal year 2013 is primarily due to $42.8 million from the effective settlement of income tax

examinations in the U.S. in which a $35.6 million of tax benefit was recognized.

We continue to recognize interest and penalties related to unrecognized tax positions in income tax expense.

We recognized $1.0 million, $1.2 million and $1.3 million in interest and penalties in income tax expense during

fiscal years 2013, 2012 and 2011. As of March 31, 2013, 2012 and 2011, we had approximately $6.6 million,

$7.5 million and $8.0 million of accrued interest and penalties related to uncertain tax positions.

114