Logitech 2013 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of the CNY, we maintain a portion of our cash investments in CNY-denominated accounts. At March 31, 2013, net

liabilities held in CNY totaled $95.4 million. We continue to evaluate the level of net assets held in CNY relative to

component and raw material purchases and interest rates on cash equivalents.

Derivatives

We enters into foreign exchange forward contracts to hedge against exposure to changes in foreign currency

exchange rates related to our subsidiaries’ forecasted inventory purchases. The primary risk managed by using

derivative instruments is the foreign currency exchange rate risk. We have designated these derivatives as cash flow

hedges. Logitech does not use derivative financial instruments for trading or speculative purposes. These hedging

contracts generally mature within four months, and are denominated in the same currency as the underlying

transactions. Gains and losses in the fair value of the effective portion of the hedges are deferred as a component

of accumulated other comprehensive loss until the hedged inventory purchases are sold, at which time the gains

or losses are reclassified to cost of goods sold. We assess the effectiveness of the hedges by comparing changes in

the spot rate of the currency underlying the forward contract with changes in the spot rate of the currency in which

the forecasted transaction will be consummated. If the underlying transaction being hedged fails to occur or if a

portion of the hedge does not generate offsetting changes in the foreign currency exposure of forecasted inventory

purchases, we immediately recognize the gain or loss on the associated financial instrument in other income

(expense). As of March 31, 2013, the notional amounts of foreign exchange forward contracts outstanding related

to forecasted inventory purchases were $38.5 million (A30.1 million). Deferred realized losses of $0.6 million are

recorded in accumulated other comprehensive loss at March 31, 2013, and are expected to be reclassified to cost of

goods sold when the related inventory is sold. Deferred unrealized gains of $1.1 million related to open cash flow

hedges are also recorded in accumulated other comprehensive loss as of March 31, 2013 and these forward contracts

will be revalued in future periods until the related inventory is sold, at which time the resulting gains or losses will

be reclassified to cost of goods sold.

We also enter into foreign exchange forward contracts to reduce the short-term effects of foreign currency

fluctuations on certain foreign currency receivables or payables. These forward contracts generally mature within

three months. We may also enter into foreign exchange swap contracts to economically extend the terms of its

foreign exchange forward contracts. The primary risk managed by using forward and swap contracts is the foreign

currency exchange rate risk. The gains or losses on foreign exchange forward contracts are recognized in earnings

based on the changes in fair value. Cash flows from these contracts are classified as operating activities in the

consolidated statements of cash flows.

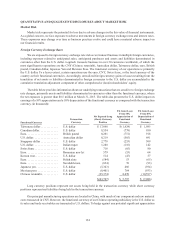

The notional amounts of foreign exchange forward contracts outstanding at March 31, 2013 relating to foreign

currency receivables or payables were $14.2 million. Open forward contracts as of March 31, 2013 consisted of

contracts in U.S. dollars to purchase Taiwanese dollars and contract in euros to sell British pounds. The notional

amounts of foreign exchange swap contracts outstanding at March 31, 2013 were $19.6 million. Swap contracts

outstanding at March 31, 2013 consisted of contracts in Mexican pesos, Japanese Yen and Australian dollars.

Unrealized net losses on the contracts outstanding at March 31, 2013 were $0.7 million.

If the U.S. dollar had appreciated by 10% at March 31, 2013 compared with the foreign currencies in which

we have forward or swap contracts, an unrealized gain of $5.6 million in our forward foreign exchange contract

portfolio would have occurred. If the U.S. dollar had depreciated by 10% compared with the foreign currencies in

which we have forward or swap contracts, a $4.3 million unrealized loss in our forward foreign exchange contract

portfolio would have occurred.

Interest Rates

Changes in interest rates could impact our future interest income on our cash equivalents and investment

securities. We prepared sensitivity analyses of our interest rate exposures to assess the impact of hypothetical

changes in interest rates. Based on the results of these analyses, a 100 basis point decrease or increase in interest

rates from the March 31, 2013 and March 31, 2012 period end rates would not have a material effect on our results

of operations or cash flows.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND

FINANCIAL DISCLOSURE

None.

ANNUAL REPORT

135