Logitech 2013 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

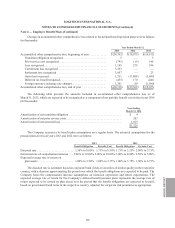

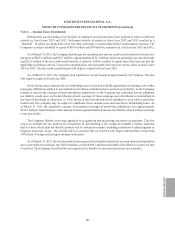

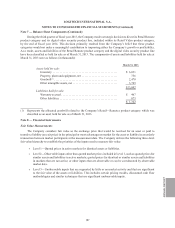

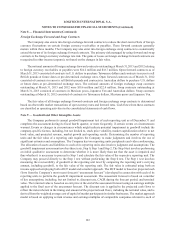

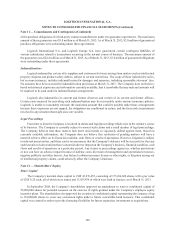

goodwill related to the Company’s video conferencing operating segment, investment in a privately-held company,

and goodwill, other intangibles and property, plant and equipment related to the digital video security product line

were measured at fair value on a non-recurring basis using the type of inputs shown (in thousands):

Fair

Value as of

March 31,

2013

Impairment

Charge

Year Ended

March 31,

2013

Level 3

Goodwill—Video Conferencing segment ....................................

$124,613

$ 214,500

Investment in privately-held company ...................................... 370 3,600

Goodwill, other intangibles and other assets—Digital Video

Security ........................................................... — 2,188

$124,983 $ 220,288

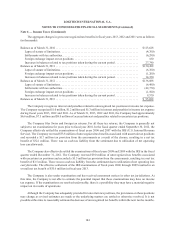

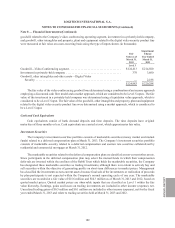

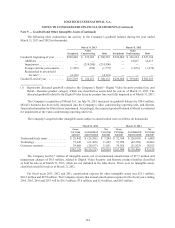

The fair value of the video conferencing goodwill was determined using a combination of an income approach

employing a discounted cash flow model and a market approach, which are considered to be Level 3 inputs. The fair

value of the investment in a privately-held company was determined using a liquidation value approach, which is

considered to be a Level 3 input. The fair value of the goodwill, other intangibles and property, plant and equipment

related to the digital video security product line were determined using a market approach, which is considered to

be a Level 3 input.

Cash and Cash Equivalents

Cash equivalents consist of bank demand deposits and time deposits. The time deposits have original

maturities of three months or less. Cash equivalents are carried at cost, which approximates fair value.

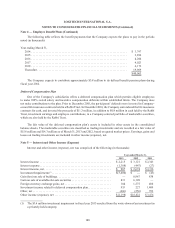

Investment Securities

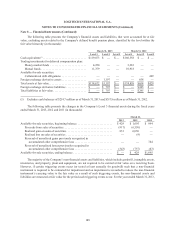

The Company’s investment securities portfolio consists of marketable securities (money market and mutual

funds) related to a deferred compensation plan at March 31, 2013. The Company’s investment securities portfolio

consists of marketable security related to a deferred compensation and auction rate securities collateralized by

residential and commercial mortgages at March 31, 2012.

The marketable securities related to the deferred compensation plan are classified as non-current other assets.

Since participants in the deferred compensation plan may select the mutual funds in which their compensation

deferrals are invested within the confines of the Rabbi Trust which holds the marketable securities, the Company

has designated these marketable securities as trading investments, although there is no intent to actively buy and

sell securities within the objective of generating profits on short-term differences in market prices. Management

has classified the investments as non-current assets because final sale of the investments or realization of proceeds

by plan participants is not expected within the Company’s normal operating cycle of one year. The marketable

securities are recorded at a fair value of $15.6 million and $14.3 million as of March 31, 2013 and 2012, based on

quoted market prices. Quoted market prices are observable inputs that are classified as Level 1 within the fair

value hierarchy. Earnings, gains and losses on trading investments are included in other income (expense), net.

Unrealized trading gains of $0.5 million and $0.1 million are included in other income (expense), net for the fiscal

year ended March 31, 2013 and relate to trading securities held at March 31, 2013 and 2012.

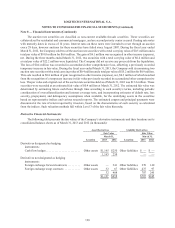

Note 8 — Financial Instruments (Continued)

ANNUAL REPORT

189