Logitech 2013 Annual Report Download - page 179

Download and view the complete annual report

Please find page 179 of the 2013 Logitech annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LOGITECH INTERNATIONAL S.A.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

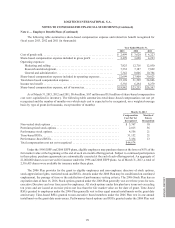

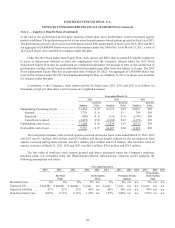

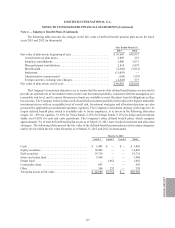

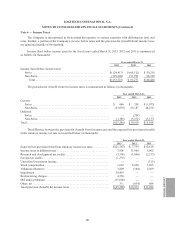

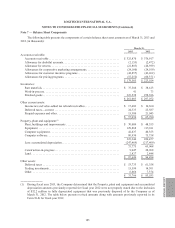

The following table presents the changes in the fair value of defined benefit pension plan assets for fiscal

years 2013 and 2012 (in thousands):

Year Ended March 31,

2013 2012

Fair value of plan assets, beginning of year . . . . . . . . . . . . . . . . . . . . . . . . . . $ 50,669 $45,937

Actual return on plan assets. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,889 219

Employer contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5,800 5,071

Plan participant contributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,814 2,878

Benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,285) (3,812)

Settlement. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (11,093) —

Administrative expenses paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (164) (197)

Foreign currency exchange rate changes. . . . . . . . . . . . . . . . . . . . . . . . . . (2,628) 573

Fair value of plan assets, end of year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 46,002 $50,669

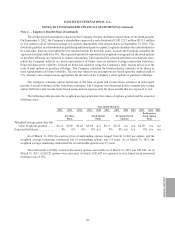

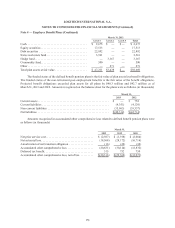

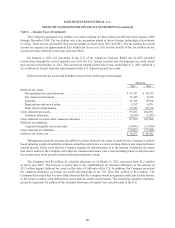

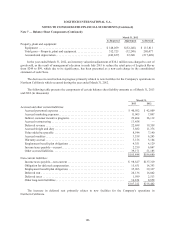

The Company’s investment objectives are to ensure that the assets of its defined benefit plans are invested to

provide an optimal rate of investment return on the total investment portfolio, consistent with the assumption of a

reasonable risk level, and to ensure that pension funds are available to meet the plans’ benefit obligations as they

become due. The Company believes that a well-diversified investment portfolio will result in the highest attainable

investment return with an acceptable level of overall risk. Investment strategies and allocation decisions are also

governed by applicable governmental regulatory agencies. The Company’s investment strategy with respect to its

largest defined benefit plan, which is available only to Swiss employees, is to invest in the following allocation

ranges: 28 - 43% for equities, 33-63% for Swiss bonds, 5-15% for foreign bonds, 5-15% for hedge and investment

funds, and 0-20% for cash and cash equivalents. The Company’s other defined benefit plans, which comprise

approximately 3% of total defined benefit plan assets as of March 31, 2013, have similar investment and allocation

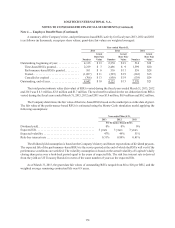

strategies. The following tables present the fair value of the defined benefit pension plan assets by major categories

and by levels within the fair value hierarchy as of March 31, 2013 and 2012 (in thousands):

March 31, 2013

Level 1 Level 2 Level 3 Tota l

Cash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 5,405 $ — $ — $ 5,405

Equity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,802 — — 14,802

Debt securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19,714 — — 19,714

Swiss real estate fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,968 — — 3,968

Hedge fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — 1,062 — 1,062

Commodity fund. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 693 — — 693

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 106 252 — 358

Total plan assets at fair value . . . . . . . . . . . . . . . . . . . . . . $ 44,688 $1,314 $ — $46,002

Note 4 — Employee Benefit Plans (Continued)

ANNUAL REPORT

177