JVC 2011 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2011 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JVC KENWOOD Corporation

16

The Car Electronics business handles products such as car audio

systems, car AV systems, car navigation systems as well as

optical disk drive mechanisms and optical pickups for car-

mounted equipment for the after-market and OEM segments.

Car electronics must be of a high quality and reliable to

cope with the special temperature and vibration conditions

inside vehicles. They are therefore one of the business domains

in which Japanese corporations can exercise their strengths. We

at JVC KENWOOD have positioned the Car Electronics business,

in which both JVC and Kenwood participated, as the largest

business of the JVC KENWOOD Group. We expect the effects of

integration will be greatest in this business. In this business, we

have also pushed forward with efforts to integrate the

technological development, production, procurement, product

planning, and marketing functions since October 2007. The two

companies had fostered over many years acoustic, video and

car-mounting technologies, and product planning capabilities.

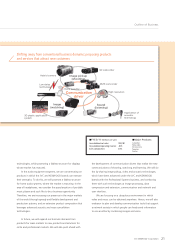

We will leverage the strength of the after-market segment in the OEM segment and expand

our business domains from excitement to peace of mind. We will do this by focusing on

developing products that address concerns about safety, security and ecology and that merge

cutting-edge technologies.

We have focused on developing new products by combining

these with cutting-edge data compression and extension

technologies and user interface technologies. In addition, we

have developed marketing and sales strategies by making the

most of the KENWOOD and JVC brands, which have different

features, respectively. At the same time, we have further

enhanced our cost competitiveness by integrating production

and procurement.

As a result, in the after-market segment, which has a large

sales composition ratio, car audio and car navigation systems

realized the largest share in the European and U.S. consumer

markets. In Japan, a market shift from audio systems to car

navigation systems is advancing. And in that market, we are

rapidly increasing our market share by commercializing Saisoku-

Navi, a memory car navigation system with the industryʼs

highest level response as well as clear images, by integrating the

technologies of the two companies.

With our eye on the shift from the after-market market to

Car Electronics Business

Car

Electronics

Business

Chief Operating Officer, Car Electronics Business Group

Shoichiro Eguchi

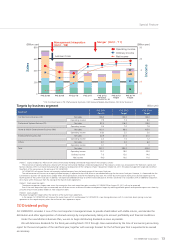

FYE 3/ ’14

Target

FYE 3/’11

Results

FYE 3/’12

Forecast (announced on Oct. 28)

FYE 3/’13

Target

Net sales

108.4 billion yen

Net sales

150.0 billion yen

0

Consumer

sector

OEM

sector

Net sales

(Consumer sector) (Billion yen) Net sales

(OEM sector)(Billion yen) Operating income

(Billion yen)

a p Dipa

rontVi

Cara art on

ar Vi

Caraar onitor(at)

DC

a

oi C

at Di

art on

()

a p Dipa

rontVi

Cara art on ar Vi

Cara

ar onitor

(at)

DC a

oi C

at Di

art on

(a)

Targets

for FYE3/’14:

Net sales of OEM sector

FYE3/’11 -> FYE3/’14: up 80%

Domestic sales of consumer navigation systems

40,000 units in FYE3/’11 -> 200,000 units in FYE3/’14

Net sales in emerging markets

JPY22B in FYE3/’11 -> JPY30B or more in FYE3/’14 (up 40%)

Net sales: JPY150B; Operating income: JPY8B