JVC 2011 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2011 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

JVC KENWOOD Corporation 13

(Note 1)Capital and Business Alliance with Shinwa International Holdings Limited and Acquisition of the Companyʼs Shares

The conversion of capital and Business Alliance with Shinwa International Holdings Limited and acquisition of the companyʼs shares was announced in the “Notice on Capital and

Business Alliance with In-Car Device Manufacturing Company and Acquisition of the Companyʼs Shares” released on October 28, 2011. The above management targets do not reflect

the effects of this conversion on the earnings of JVC KENWOOD.

JVC KENWOOD will convert Shinwa into an equity-method company from the fourth quarter of the current fiscal year.

The said conversion of Shinwa into an equity-method company is expected to have little effect on consolidated earnings for the current fiscal year. However, it is forecasted that the

Car Electronics business will expand and a synergy effect will be generated in and after the following fiscal year. This will be due to the capital and business alliance beginning in the

fourth quarter of the current fiscal year. In addition, we expect consolidated earnings to further increase because of Shinwaʼs conversion into a subsidiary with an additional acquisition

of its shares within three years from the closing of the Share Transfer Agreements.

(Note 2)Stock acquisition rights

The above management targets were set on the assumption that stock acquisition rights issued by JVC KENWOOD on August 25, 2011 will not be exercised.

Even if the stock acquisition rights are exercised, we will do our utmost to achieve the above management targets by realizing profitable growth and repurchasing our own shares by

using the amount to be paid by holders of stock acquisition rights.

(Note 3)Loans payable

The above management targets reflect the contents of the current loan agreements.

In the merger, JVC KENWOOD will take over the current loans of JVC and Kenwood. JVC KENWOOD is now having discussions with its main bank about signing a new loan

agreement as an integral company when the said current loan agreements expire.

JVC KENWOOD considers it one of the most important managerial issues to provide shareholders with stable returns, and decides the

distribution and other appropriation of retained earnings by comprehensively taking into account profitability and financial conditions.

Under the new Mid-term Business Plan, we aim to begin distributing dividends as soon as possible.

We will determine dividends for the fiscal year ending March 2012 through close examination by the time of announcing accounting

report for the second quarter of the said fiscal year, together with earnings forecast for the full fiscal year that is expected to be revised

as necessary.

(5)

Dividend policy

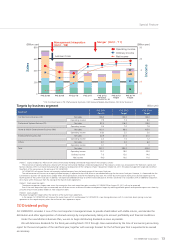

Special Feature

0

200

400

600

800

-50

-25

0

25

50

iion n

Sales

iion n

Income

Nt ino

Opratin ino

Orinar ino

FYE 3/11 FYE 3/12

Forecast

(announced on Oct. 28)

FYE 3/13

Target

FYE 3/14

Target

FYE 3/10FYE 3/09FYE 3/08

HM

PS

CE

SE

Management Integration

(Oct.1, 08)

Merger (Oct.1, 11)

an Crii

CE Car Etroni roiona t o oi Etroni E Entrtainnt

Targets by business segment (Billion yen)

Segment FYE 3/11

Results

FYE 3/13

Target

FYE 3/14

Target

Car Electronics Business (CE) Net sales 108.4 132.0 150.0

Operating income 7.9 7.5 8.0

Professional Systems Business (PS) Net sales 92.5 116.0 128.0

Operating income 3.6 7.0 7.8

Home & Mobile Entertainment Business (HM) Net sales 100.1 96.0 105.0

Operating income (0.8) 2.5 3.0

Entertainment Business (SE) Net sales 42.9 41.0 41.0

Operating income 2.2 1.0 1.2

Others Net sales 8.7 5.0 6.0

Operating income 0.1 0 0

Total Net sales 352.7 390.0 430.0

Operating income 13.0 18.0 20.0

Ordinary income 7.6 13.0 14.0

Net income (4.0) 10.0 11.0