JVC 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2 0 0 24 0

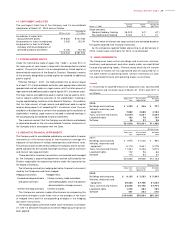

The assumed amounts of acquisition cost and depreciation under non-

capitalized finance leases for the year ended March 31, 2002 are

calculated excluding the assumed interest charges due to the increase

in 2002 in the ratio of future minimum lease payments under non-

capitalized finance leases over the total amount of the future minimum

lease payments and property, plant and equipment as of March 31,

2002, whereas the assumed amounts of acquisition cost and

depreciation for the previous years are calculated including the

assumed interest charges.

Based on the calculation including the assumed interest charges

as of March 31, 2002, the assumed amounts of acquisition cost and

depreciation under non-capitalized finance leases are as follows:

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

2002:

Buildings and structures ¥ 2 ,0 09 ¥ 1,18 8 ¥ 8 2 1

Vehicles, machinery and

equipment 8 ,7 9 6 4 ,1 33 4 ,6 6 3

Tools, furniture and fixtures 1 4 ,2 3 4 6 ,75 8 7 ,4 76

Leasehold rights 1 9 4 8 2 1 1 2

Software 6 0 30 3 0

¥25,293 ¥12,191 ¥13,102

Thousands of U.S. dollars

Acquisition Accumulated Net book

cost depreciation value

2002:

Buildings and structures $ 15 ,1 0 5 $ 8,93 2 $ 6 ,1 7 3

Vehicles, machinery and

equipment 6 6 ,1 3 5 3 1 ,0 7 5 3 5 ,0 6 0

Tools, furniture and fixtures 1 0 7 ,0 2 3 5 0 ,8 1 2 5 6 ,2 1 1

Leasehold rights 1 ,4 5 9 6 1 7 8 4 2

Software 451 226 225

$ 1 9 0 ,1 7 3 $ 9 1 ,6 6 2 $ 9 8 ,5 1 1

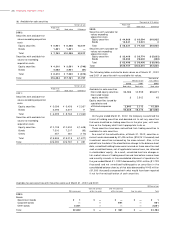

(2) Future minimum lease payments under the non-capitalized finance

and operating leases at March 31, 2002 and 2001 are as follows:

Thousands of

Millions of yen U.S. dollars

Non-capitalized finance leases 2002 20 01 2 0 0 2

Due within one year ¥ 4 ,3 4 6 ¥ 4,377 $32,677

Due after one year 7,561 8,365 5 6 ,8 4 9

¥11,907 ¥12,742 $89,526

Thousands of

Millions of yen U.S. dollars

Operating leases 2002 20 01 2 0 0 2

Due within one year ¥1,053 ¥ 911 $ 7,91 7

Due after one year 1,941 1,355 1 4 ,5 9 4

¥2,994 ¥2,266 $22,511

The assumed amount of future minimum lease payments under non-

capitalized finance leases for the year ended March 31, 2002 is

calculated excluding assumed interest charges due to the increase in

2002 in the ratio of future minimum lease payments under non-

capitalized finance leases over the total amount of the future minimum

lease payments and property, plant and equipment as of March 31,

2002, whereas the assumed amount of future minimum lease

payments for the previous years are calculated including the assumed

interest charges.

Based on the calculation including the assumed interest charges as of

March 31, 2002, the assumed amount of future minimum lease

payments under non-capitalized finance leases is as follows:

Thousands of

Millions of yen U.S. dollars

Non-capitalized finance leases 2 0 0 2 2 0 0 2

Due within one year ¥ 4 ,9 95 $ 3 7 ,55 6

Due after one year 8 ,1 0 7 6 0 ,9 5 5

¥1 3 ,1 0 2 $ 9 8 ,5 1 1

(3) Lease payments, assumed depreciation charges and assumed

interest charges for the year ended March 31, 2002 and 2001 are

as follows:

Thousands of

Millions of yen U.S. dollars

2 0 0 2 2001 2000 2 0 0 2

Lease payments ¥4 ,2 5 3 ¥3,018 ¥3,119 $ 3 1 ,9 7 7

Assumed depreciation

charges 3 ,7 8 0 3,018 3,119 28,421

Assumed interest

charges 466 ——3 ,5 0 4

(4) Assumed depreciation charges are computed using the straight-line

method over lease terms assuming no residual value.

(5) The excess amount of total lease payments over acquisition cost of

leased property is deemed as accumulated interest expenses and allocated

for each period on the basis of the interest method.

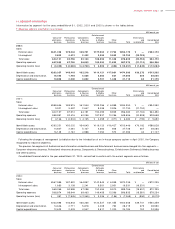

Lessor:

The Company and its subsidiary lease certain equipment under

non-capitalized finance leases, as lessees and lease that equipment

under non-capitalized finance leases, as lessors. Future minimum lease

receipts under these non-capitalized finance and operating leases at

March 31, 2002 and 2001 are as follows:

Thousands of

Millions of yen U.S. dollars

Non-capitalized finance leases 2 0 0 2 2001 2 0 0 2

Due within one year ¥1,031 ¥1,425 $ 7,75 2

Due after one year 1 ,0 9 3 1,958 8 , 2 1 8

¥2,124 ¥3,383 $ 1 5 , 9 7 0

Thousands of

Millions of yen U.S. dollars

Operating leases 2 0 0 2 2001 2 0 0 2

Due within one year ¥3 8 ¥270 $ 2 8 6

Due after one year 1 7 281 128

¥5 5 ¥551 $ 4 1 4