JVC 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2 0 0 2

3 9

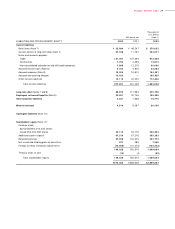

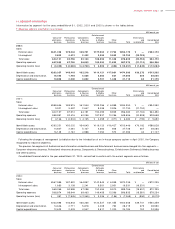

1 0 . CONTINGENT LIABILITIES

The contingent liabilities of the Company and its consolidated

subsidiaries at March 31, 2002 were as follows:

Thousands of

Millions of yen U.S. dollars

As endorser of export bills

discounted with banks ¥19,626 $147,564

As guarantor for loans to employees 2,426 18,241

As guarantor for loan to affiliated

company and lease obligations of

affiliated company and others 2,150 16,165

¥24,202 $181,970

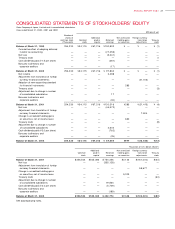

1 1 . STOCKH OLDERS’ EQUITY

Under the Commercial Code of Japan (the “Code”), at least 50% of

the issue price of new shares is required to be designated as stated

capital. The portion which is to be designated as stated capital is

determined by resolution of the Board of Directors. Proceeds in excess

of the amounts designated as stated capital are credited to additional

paid-in capital.

Effective October 1, 2001, the Code provides that an amount equal

to at least 10% of cash dividends and other cash appropriations shall be

appropriated and set aside as a legal reserve until the total amount of

legal reserve and additional paid-in capital equals 25% of common stock.

The legal reserve and additional paid-in capital may be used to elimi-

nate or reduce a deficit by resolution of the stockholders’ meeting or

may be capitalized by resolution of the Board of Directors. On condition

that the total amount of legal reserve and additional paid-in capital

remains being equal to or exceeding 25% of common stock, they are

available for distributions or certain other purposes by the resolution of

stockholders’ meeting. Legal reserve is included in retained earnings in

the accompanying consolidated financial statements.

The maximum amount that the Company can distribute as dividends

is calculated based on the non-consolidated financial statements of

the Company and in accordance with the Code.

1 2 . DERIVATIVE FINANCIAL INSTRUMENTS

The Company and its consolidated subsidiaries use derivative financial

instruments in the normal course of their business to manage the

exposure to fluctuations in foreign exchange rates and interest rates.

The primary classes of derivatives used by the Company and its consoli-

dated subsidiaries are forward exchange contracts, option contracts

and interest rate swap contracts.

These derivative financial transactions are executed and managed

by the Company’s accounting department and are authorized by the

Director responsible for accounting matters under the supervision by

the Board of Directors.

The following summarizes hedging derivative financial instruments

used by the Companies and items hedged:

Hedging instruments: Hedged items:

Forward exchange contracts Foreign currency trade receivables

and option contracts and trade payables, future transactions

denominated in a foreign currency

Interest rate swap contracts Interest on bonds

The Companies evaluate hedge effectiveness by comparing the

cumulative changes in cash flows from or the changes in fair value

of hedged items and the corresponding changes in the hedging

derivative instruments.

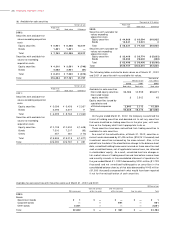

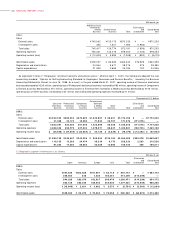

The following tables summarize market value information as of March

31, 2001 of derivative transactions for which hedge accounting has not

been applied:

Millions of yen

Contract Market Recognized

March 31, 200 1 amount value gain (loss)

Swap contracts:

Receive fixed/pay floating ¥5,000 ¥(1) ¥(1)

Pay fixed/receive floating 5,000 ¥ 1 ¥ 1

The fair value of interest rate swap contracts are estimated based on

the quotes obtained from financial institutions.

As the companies applied hedge accounting to all derivatives in

2002, market value information for 2002 is not disclosed.

1 3 . LEASE INFORMATI ON

The Companies lease certain buildings and structures, vehicles,

machinery and equipment and other assets under non-capitalized

finance and operating leases. Finance leases which do not transfer

ownership to lessees are not capitalized and are accounted for in

the same manner as operating leases. Certain information for such

non-capitalized finance and operating leases is as follows.

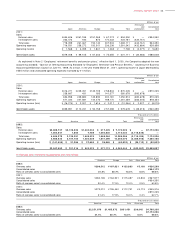

Lessee:

(1) A summary of assumed amounts of acquisition cost, accumulated

depreciation and net book value at March 31, 2002 and 2001 is

as follows:

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

2 0 0 2 :

Buildings and structures ¥ 1,2 2 3 ¥ 4 4 6 ¥ 7 7 7

Vehicles, machinery and

equipment 7 ,8 8 2 3 ,6 8 8 4 ,1 9 4

Tools, furniture and fixtures 1 2 ,5 7 5 6 , 2 2 1 6 ,3 5 4

Leasehold rights 1 8 3 7 9 1 0 4

Software 5 6 2 7 2 9

¥2 1 ,9 1 9 ¥1 0 ,4 6 1 ¥1 1 ,4 5 8

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

2001:

Buildings and structures ¥ 1,975 ¥1,023 ¥ 952

Vehicles, machinery and

equipment 9,119 3,341 5,778

Tools, furniture and fixtures 11,361 5,446 5,915

Leasehold rights 122 56 66

Software 115 83 32

¥22,692 ¥9,949 ¥12,743

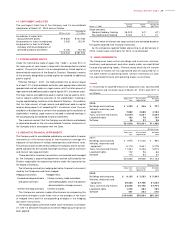

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

2 0 0 2 :

Buildings and structures $ 9 ,1 9 5 $ 3 ,3 53 $ 5,84 2

Vehicles, machinery and

equipment 59,263 27,729 31,534

Tools, furniture and fixtures 94,549 46,775 47,774

Leasehold rights 1,376 594 782

Software 421 203 218

$164,804 $78,954 $86,150