JVC 2002 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2002 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2 0 0 2

3 5

As a result of adopting tax-effect accounting, deferred tax assets

and long-term deferred tax assets at March 31, 2000 were decreased

by ¥6,170 million and ¥14,729 million, respectively, deferred tax

liabilities and long-term deferred tax liabilities at that date were

increased by ¥460 million and ¥44 million, respectively, net loss

for the year ended March 31, 2000 was decreased by ¥1,959 million,

and the retained earnings at April 1, 1999 was decreased by

¥27,259 million.

Employees’ severance and retirement benefits

The Company has funded pension plans and unfunded benefit plans

to provide retirement benefits for substantially all employees. Approxi-

mately 85% of total retirement benefits for employees is covered by

funded pension plans.

Upon retirement or termination of employment for reasons other

than dismissal for cause, eligible employees are entitled to lump-sum

and/or annuity payments based on the current rates of their pay and

length of service.

At March 31, 2000, employees’ retirement benefits were prin-

cipally stated at 40% (100% for certain employees whose age

reached 55) of the amount which would be required to be paid (less

the amount which is expected to be covered by the pension plans)

if all eligible employees voluntarily terminated their employment at

the balance sheet date, plus the unamortized balance of certain

previously accumulated amounts.

Effective April 1, 2000, the Companies adopted the new accounting

standard, “Opinion on Setting Accounting Standard for Employees’

Severance and Pension Benefits,” issued by the Business Accounting

Deliberation Council on June 16, 1998 (the “New Accounting Standard”).

Under the New Accounting Standard, the liabilities and expenses

for severance and retirement benefits are determined based on the

amounts actuarially calculated using certain assumptions.

The Companies provided allowance for employees’ severance and

retirement benefits at March 31, 2001 based on the estimated

amounts of projected benefit obligation and the fair value of the plan

assets at that date.

The excess of the projected benefit obligation over the total of the

fair value of pension assets as of April 1, 2000 and the liabilities for

severance and retirement benefits recorded as of April 1, 2000 (the

“net transition obligation”) amounted to ¥41,686 million. The net

transition obligation will be recognized in expenses in equal amounts

primarily over 15 years commencing with the year ended March 31,

2001. Prior service costs are recognized in income or expenses using

the straight-line method over 10 years, and actuarial gains and losses

are recognized in expenses using the straight-line method over 10 years

commencing with the succeeding period.

As a result of the adoption of the new accounting standard, in

the year ended March 31, 2001, severance and retirement benefit

expenses increased by ¥595 million, and income before income taxes

decreased by ¥557 million compared with what would have been

recorded under the previous accounting standard.

Effect on segment information is described in Note 14.

Amounts per share of common stock

The computation of net income per share is based on the weighted-

average number of shares of common stock outstanding during each year.

Diluted net income per share assumes dilution that could occur if

convertible bonds or similar securities were converted into common

stock exercised to result in the issuance of common stock. As the

result of computation for the year ended March 31, 2001, and as the

Company reported net losses for the years ended March 31, 2002 and

2000, inclusion of potential common shares would have an antidilutive

effect on per share amounts. Accordingly, the Company’s basic and

diluted earnings per share computations are the same for the periods

presented.

Cash dividends per share represent the actual amount declared as

applicable to the respective years.

Reclassifications

Certain prior year amounts have been reclassified to conform to the

2002 presentation. These changes had no impact on previously

reported results of operations or stockholders’ equity.

3 . TRANSACTIONS WITH MATSUSHITA ELECTRIC I NDUSTRIAL

CO., LTD.

The Company is a subsidiary of Matsushita Electric Industrial Co.,

Ltd. (“Matsushita”). At March 31, 2002, Matsushita held 133,227

thousand shares of common stock of the Company, or 52.40% of the

total outstanding shares.

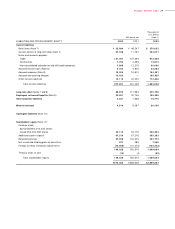

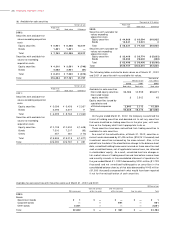

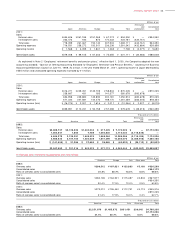

Major account balances with Matsushita at March 31, 2002 and

2001 were as follows:

Thousands of

Millions of yen U.S. dollars

2 0 0 2 20 01 2 0 0 2

Due from Matsushita ¥ 3 4 3 ¥ 239 $ 2 ,5 7 9

Due to Matsushita 2 ,3 6 1 2,781 17,752

Sales to and purchases from Matsushita for the years ended March

31, 2002, 2001 and 2000 were as follows:

Thousands of

Millions of yen U.S. dollars

2 0 0 2 2001 2000 2 0 0 2

Net sales ¥ 1,25 6 ¥ 1,148 ¥ 900 $ 9 ,4 4 4

Net purchases 2 0 ,6 8 3 36,898 35,879 1 5 5 , 5 1 1

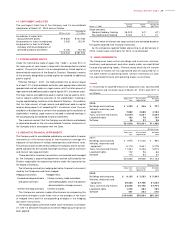

4 . IN VENTORI ES

Inventories at March 31, 2002 and 2001 were as follows:

Thousands of

Millions of yen U.S. dollars

2 0 0 2 2001 2 0 0 2

Finished goods ¥ 8 5,8 1 5 ¥108,660 $ 6 4 5 ,2 2 6

Work in process 13,166 17,039 98,992

Raw materials and

supplies 27,082 29,645 2 0 3 , 6 2 4

¥126,063 ¥155,344 $ 9 4 7 , 8 4 2

5 . SECU RI TIES

The following tables summarize acquisition costs, book values and

fair value of securities with available fair values as of March 31,

2002 and 2001:

(a) Trading securities

Thousands of

Millions of yen U.S. dollars

2 0 0 2 20 01 2 0 0 2

Book value ¥ —¥2,464 $ —

Amount of net unrealized gains

or losses included in the

income statement (280) 114 (2 ,1 0 5 )