JVC 2002 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2002 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2 0 0 23 4

securities that are not classified in any of the above categories

(hereafter, “available-for-sale securities”).

Trading securities are stated at fair market value. Gains and losses

realized on disposal and unrealized gains and losses from market value

fluctuations are recognized as gains or losses in the period of the change.

The Companies had no held-to-maturity debt securities. Equity

securities issued by subsidiaries and affiliated companies, which are

not consolidated or accounted for using the equity method, are stated

at moving-average cost. Available-for-sale securities with available fair

market values are stated at fair market value. Unrealized gains and

unrealized losses on these securities are reported, net of applicable

income taxes, as a separate component of stockholders’ equity.

Realized gains and losses on sale of such securities are computed

using moving-average cost. Other securities with no available fair

market value are stated at moving-average cost.

If the market value of equity securities issued by non-consolidated

subsidiaries and affiliated companies, and available-for-sale securities,

declines significantly, such securities are stated at fair market value

and the difference between fair market value and the carrying amount

is recognized as a loss in the period of the decline. If the fair market

value of equity securities issued by non-consolidated subsidiaries and

affiliated companies not accounted for by the equity method is not

readily available, such securities should be written down to net asset

value with a corresponding charge in the income statement in the

event net asset value declines significantly.

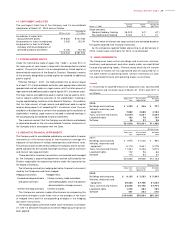

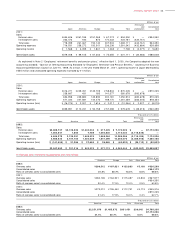

As a result of adopting the new accounting standard for financial

instruments, in the year ended March 31, 2001, income before

income taxes increased by ¥1,484 million. Also, based on the

examination of the intent of holding each security upon application

of the new accounting standard on April 1, 2000, trading securities

as well as available-for-sale securities maturing within one year from

the balance sheet date are included in current assets, and other

securities are included in investments and advances. As a result, at

April 1, 2000, securities in current assets decreased by ¥6,013

million and investment securities increased by the same amount

compared with what would have been reported under the previous

accounting policy.

Derivatives and hedge accounting

The new accounting standard for financial instruments, effective from

the year ended March 31, 2001, requires companies to state derivative

financial instruments at fair value and to recognize changes in the fair

value as gains or losses unless derivative financial instruments are used

for hedging purposes.

If derivative financial instruments are used as hedges and meet

certain hedging criteria, the Companies defer recognition of gains or losses

resulting from changes in fair value of derivative financial instruments

until the related losses or gains on the hedged items are recognized.

However, in cases where forward foreign exchange contracts are used

as hedges and meet certain hedging criteria, forward foreign exchange

contracts and hedged items are accounted for in the following manner:

1. If a forward foreign exchange contract is executed to hedge an

existing foreign currency receivable or payable,

(a) the difference, if any, between the Japanese yen amount of the

hedged foreign currency receivable or payable translated using the

spot rate at the inception date of the contract and the book value of

the receivable or payable is recognized in the income statement in the

period which includes the inception date, and

(b) the discount or premium on the contract (that is, the difference

between the Japanese yen amount of the contract translated using the

contracted forward rate and that translated using the spot rate at the

inception date of the contract) is recognized in the period which

includes the inception date.

2. If a forward foreign exchange contract is executed to hedge a future

transaction denominated in a foreign currency, the future transaction

will be recorded using the contracted forward rate, and no gains or

losses on the forward foreign exchange contract are recognized.

Also, if interest rate swap contracts are used as hedges and meet

certain hedging criteria, the net amount to be paid or received under

the interest rate swap contract is added to or deducted from the

interest on the assets or liabilities for which the swap contract

was executed.

Property, plant and equipment

Property, plant and equipment is stated at cost. Depreciation is

computed primarily by the declining-balance method at rates based

on the estimated useful lives of the assets. Certain consolidated

overseas subsidiaries use the straight-line method.

The ranges of useful lives for computing depreciation are generally

as follows:

Buildings 20 to 50 years

Machinery and equipment 03to 07 years

Expenditures for maintenance and repairs are charged to income

as incurred.

Software costs

In accordance with the provisional rule of the JICPA’s Accounting

Committee Report No.12 “Practical Guidance for Accounting for

Research and Development Costs, etc.” (the “Report”), the Company

accounts for software which was included in long-term prepaid

expenses in investments and other in the same manner in 2000 as in

1999. Pursuant to the Report, however, the Company included

software in other assets in 2002 and 2001. Software costs are

amortized using the straight-line method over the estimated useful

lives (three to five years).

Finance leases

Finance leases, except those leases for which the ownership of the leased

assets is considered to be transferred to the lessee, are accounted for in

the same manner as operating leases.

Research and development

Research and development expenditures for new products or improve-

ment of existing products are charged to income as incurred.

Income taxes

The Companies provided income taxes at the amounts currently pay-

able for the year ended March 31, 1999. Effective April 1, 1999,

the Companies adopted a New Accounting Standard, which recog-

nizes tax effects of temporary differences between the financial

statement basis and the tax basis of assets and liabilities. Under

the new accounting standard, the provision for income taxes is com-

puted based on the pretax income included in the consolidated

statement of operations. The asset and liability approach is used to

recognize deferred tax assets and liabilities for the expected future

tax consequences of temporary differences.

The amount of deferred income taxes attributable to the net tax

effects of the temporary differences at April 1, 1999, is reflected

as a cumulative adjustment of ¥27,259 million to the retained

earnings brought forward from the previous year. Prior years’ financial

statements have not been restated.