JVC 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2 0 0 22 2

0

175

350

525

700

9 8 0 29 9 0 0 0 1

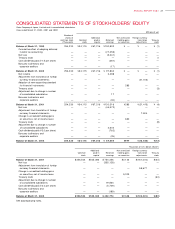

STOCKHOLDERS’ EQUITY/

TOTAL ASSETS

(Billions of yen)

Stockholders’ equity

Total assets

NET INCOME (LOSS)

(Billions of yen)

-5 0

-2 5

0

2 5

5 0

9 8 0 29 9 0 0 0 1

encoders and format converters from television

broadcasters. In contrast, JVC struggled with

weakening demand in the markets for professional

audio systems, karaoke systems and Direct-Drive

Image Light Amplifier (D-ILA) projectors. Overseas,

the Professional electronics segment was affected

by the deteriorating U.S. market, just as consumer

electronics were, with professional camcorders and

D-ILA projectors facing an uphill battle.

COMPONENTS & DEVICES

Components & Devices recorded a 19.2%, or ¥11.8

billion, decline in sales year on year, to ¥49.7 billion

(US$374 million), while operating income fell ¥8.9

billion to a loss of ¥4.7 billion (US$36 million). High-

density build-up multilayer printed wiring boards

(“VIL” PWBs), deflection yokes and other products

could not escape the impact of depressed mobile

phone and PC markets and falling prices. However,

there were a few bright spots—motors for hard disk

drives (HDDs) and optical disc products, and optical

pickups for car CD players.

ENTERTAINMENT SOFTWARES & MEDI AS

Sales in this segment fell 3.4%, or ¥6.3 billion, to

¥177.0 billion (US$1,331 million). Despite hit

records from artists such as Keisuke Kuwata and

Dragon Ash, sales fell due to the industry-wide

slump in softwares and medias. The segment posted

operating income of ¥3.2 billion (US$24 million),

¥1.2 billion less than in the previous fiscal year.

OTHER

Sales increased 11.4%, or ¥0.8 billion, to ¥7.9 billion

(US$59 million), while the operating loss increased

¥0.1 billion to ¥0.5 billion (US$3.6 million).

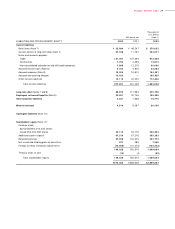

INCOM E (LOSS) BEFORE INCOME

TAXES AND M INORITY INTERESTS

Income before income taxes and minority interests

fell ¥47.9 billion year on year to a loss of ¥38.4

billion (US$289 million). This decline was primarily

due to restructuring charges and loss from write-down

of investment in securities.

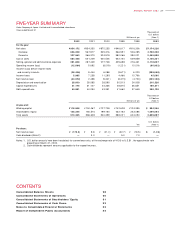

NET INCOME (LOSS)

Net income fell ¥47.1 billion to a net loss of ¥44.6

billion (US$335 million). As a result, net income per

share of ¥9.8 in the previous fiscal year became a net

loss of ¥175.3. ROE was negative 27.3%, a deterio-

ration of 28.6 percentage points.

Consequently, the company made the difficult

decision not to pay a dividend for the year.

LIQUIDITY AND SOURCES OF FUNDS

ASSETS, LIABILITIES AND CAPITAL

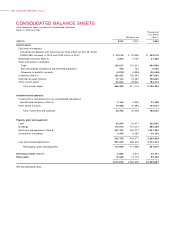

Total assets as of March 31, 2002 stood at ¥513.4

billion (US$3,860 million), a 12.5%, or ¥73.3

billion decline from one year earlier. This was the

result of efforts to reduce assets by cutting back