JVC 2002 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2002 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2 0 0 2

2 3

0

1 0

2 0

3 0

4 0

5 0

9 8 0 29 9 0 0 0 1

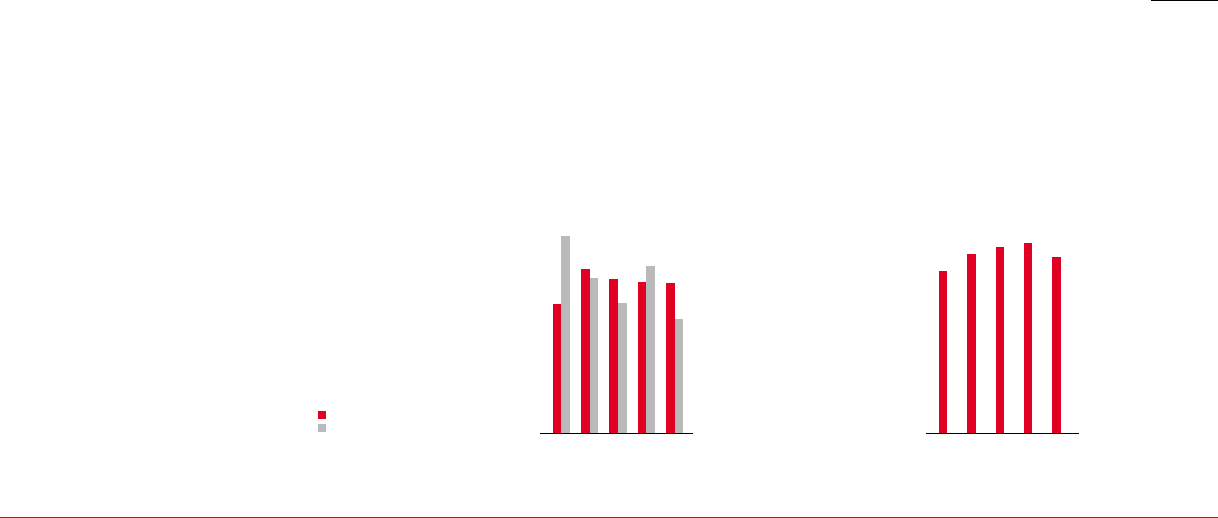

R&D EXPENDITURES

(Billions of yen)

DEPRECIATION AND

AMORTIZATION/

CAPITAL EXPENDITURES

(Billions of yen)

0

1 0

2 0

3 0

4 0

9 8 0 29 9 0 0 0 1

Depreciation & amortization

Capital expenditures

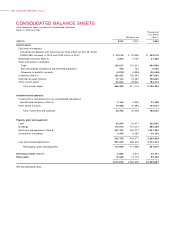

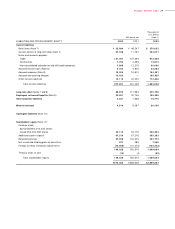

inventories, selling cross-shareholdings and reducing

debt by more effectively utilizing Group funds. Total

current assets fell 10.8%, or ¥44.5 billion, to ¥366.6

billion (US$2,756 million). This was primarily due to

an 18.8%, or ¥29.3 billion decline in inventories to

¥126.1 billion (US$948 million).

Investments and advances declined 50.9%, or

¥21.5 billion, to ¥20.8 billion (US$156 million). This

was mainly attributable to sales of cross-shareholdings.

Property, plant and equipment (less accumulated

depreciation) fell 5.9%, or ¥6.9 billion, to ¥110.6

billion (US$832 million), chiefly reflecting lower

capital expenditures.

Total current liabilities fell 5.1%, or ¥13.4 billion,

to ¥247.7 billion (US$1,862 million), as notes and

accounts payable-trade decreased 11.7%, or ¥16.1

billion, to ¥121.3 billion (US$912 million), and bank

loans were also lower, declining 25.4%, or ¥12.3

billion, to ¥36.0 billion (US$271 million). The current

portion of long-term debt increased ¥15.4 billion

(US$116 million) and accrued restructuring charges

were ¥13.4 billion (US$101 million).

Long-term debt was ¥89.9 billion (US$676

million), 23.6%, or ¥27.7 billion lower than one

year earlier. This mainly reflected the transfer

to current liabilities of convertible bonds due for

redemption within one year.

Stockholders’ equity decreased 19.0%, or ¥34.3

billion, to ¥146.2 billion (US$1,100 million), mainly

due to the net loss of ¥44.6 billion (US$335 million).

As a result of this and other factors, stockholders’

equity as a percentage of total assets fell from 30.8%

to 28.5%.

CASH FLOWS

Operating activities provided net cash of ¥28.1 billion

(US$211 million), compared with net cash used of

¥26.4 billion last year. This was mainly due to efforts

to reduce inventories, which largely offset the loss

before income taxes and minority interests.

Investing activities used net cash of ¥5.6 billion

(US$42 million), less than the ¥7.9 billion used

last year, mainly due to efforts to reduce capital

expenditures. Purchases of property, plant and

equipment during the year amounted to ¥22.9 billion

(US$172 million).

Financing activities used net cash of ¥34.7 billion

(US$261 million), compared with cash provided of

¥35.2 billion last year. This mainly reflects cash

used to reduce short-term bank loans by effectively

using JVC Group funds, the redemption of bonds and

net decrease in commercial paper. Consequently,

interest-bearing debt was reduced by ¥30.0 billion

(US$226 million).

As a result of the foregoing, cash and cash

equivalents at the end of the year were ¥69.3 billion

(US$521 million), 12.6%, or ¥10.0 billion lower

than a year ago.