JVC 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2 0 0 2

3 7

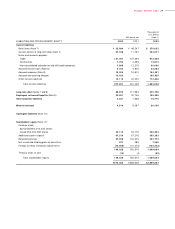

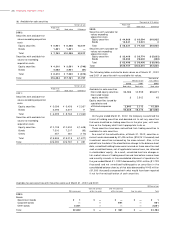

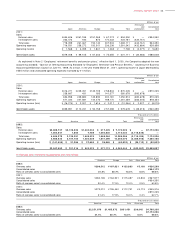

Millions of yen

Over one year but Over five years but

Within one year within five years within ten years Over ten years Total

2001:

Bonds

Government bonds ¥ 304 ¥ 1 ¥ —¥ —¥ 305

Corporate bonds ——996 —996

Other bonds 1,997 5,242 —1,974 9,213

Others ——281 —281

Total ¥2,301 ¥5,243 ¥1,277 ¥1,974 ¥10,795

Thousands of U.S. dollars

Over one year but Over five years but

Within one year within five years within ten years Over ten years Total

2002:

Bonds

Government bonds $ 8 $ — $ —$ —$ 8

Corporate bonds ——7 ,4 5 1 —7 ,4 5 1

Other bonds 2 1 ,0 6 0 — — —21,060

Total $2 1,0 6 8 $ —$ 7 ,4 5 1 $ —$ 2 8 ,5 1 9

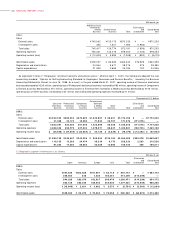

Available-for-sale securities sold in the years ended March 31, 2002

and 2001:

Thousands of

Millions of yen U.S. dollars

2002 20 01 2 0 0 2

Sales ¥19,640 ¥16,160 $ 1 4 7 ,6 6 9

Gains 7 6 3 1,450 5 , 7 3 7

Losses 3 5 8 640 2 ,6 9 2

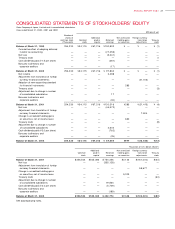

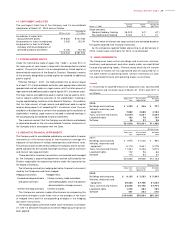

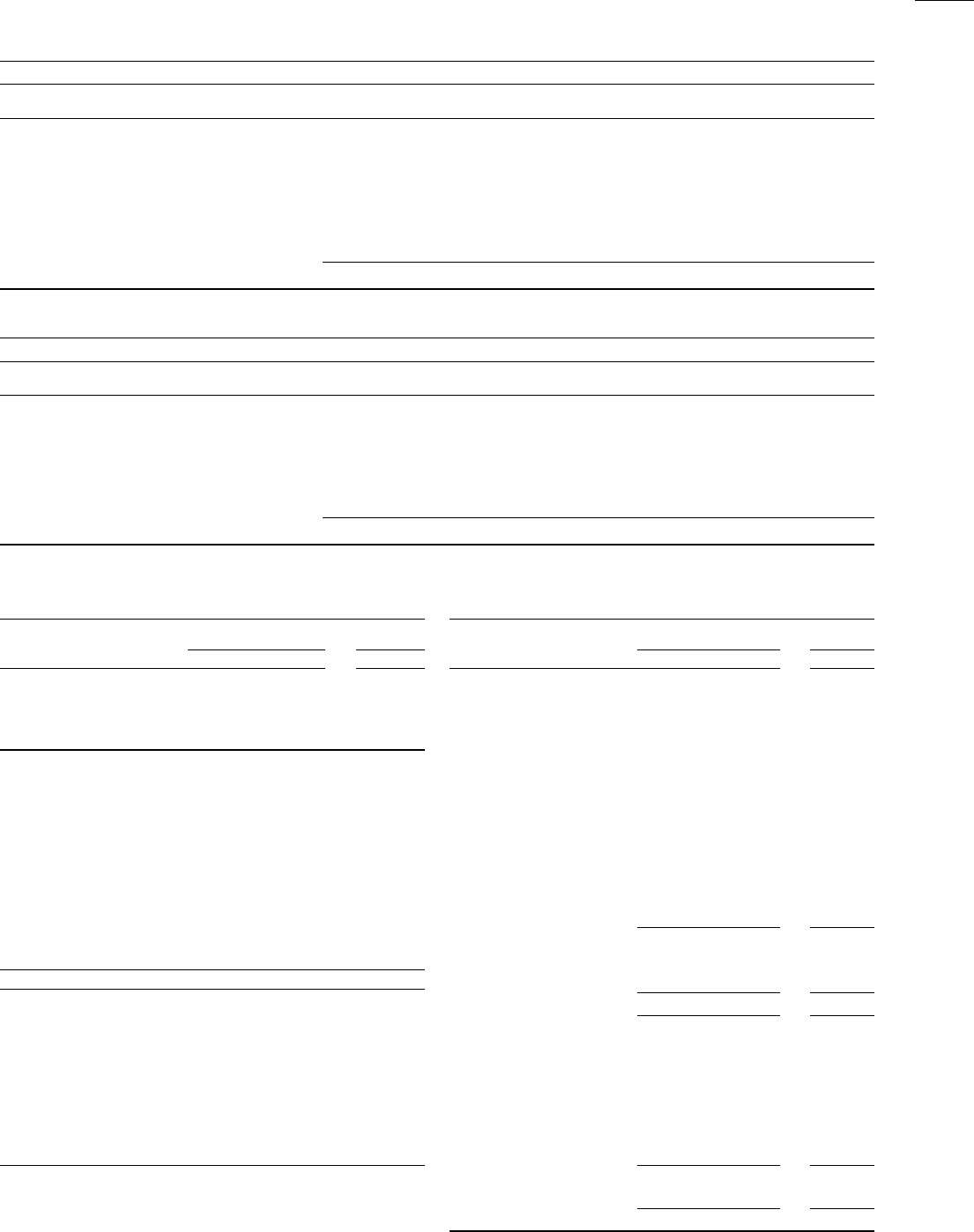

6 . INCOME TAXES

Income taxes in Japan consist of corporation, enterprise and inhabit-

ants’ taxes. The Company and its domestic consolidated subsidiar-

ies are subject to the income taxes referred to above which, in the

aggregate, resulted in statutory tax rates of approximately 42.0%.

Foreign subsidiaries are subject to income taxes of the countries

in which they domicile.

The following table summarizes the significant differences between

the statutory tax rate and the Company’s effective tax rate for financial

statement purposes for the year ended March 31, 2001.

20 01

Statutory tax rate 42.0 %

Lower tax rates of overseas subsidiaries (7.4)%

Expenses not deductible for tax purposes 20.0 %

Effect of changes in valuation allowance

for deferred tax assets (13.7)%

Other 35.8 %

Effective tax rate 76.7 %

Information for 2002 is not prepared as the Company incurred a net

loss in the year ended March 31, 2002.

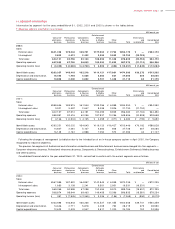

Significant components of the Company’s deferred tax assets and

liabilities at March 31, 2002 and 2001 were as follows:

Thousands of

Millions of yen U.S. dollars

2 0 0 2 2001 2 0 0 2

Deferred tax assets:

Loss on devaluation

of inventory ¥ 5 ,4 6 5 ¥ 4,939 $ 4 1,09 0

Accrued expenses not

deductible for tax purposes 5 ,9 5 6 6,479 44,782

Accrued restructuring charges

not currently deductible 5 ,5 9 7 —42,083

Depreciation 8 ,0 2 8 7,938 60,361

Retirement and severance

benefits 5 ,1 0 1 3,474 38,353

Tax loss carryforwards 21,767 11,009 1 6 3 ,6 6 2

Other 13,640 9,657 1 0 2 ,5 5 6

Total gross deferred

tax assets 65,554 43,496 4 9 2 , 8 8 7

Less valuation allowance (4 4 ,6 2 8 ) 24,912 (335,549)

Net deferred tax assets ¥2 0 ,9 2 6 ¥18,584 $ 1 5 7 , 3 3 8

Deferred tax liabilities:

Unrealized gain from

appreciation of trading

securities ¥ (94 4 ) ¥ (787) $ (7 ,0 98 )

Net unrealized holding

gains on securities (670) (—)(5 ,0 3 7 )

Other (823) (670) (6 ,1 8 8 )

Total gross deferred

tax liabilities ¥ (2 ,4 3 7 ) ¥ (1,457) $ (1 8,32 3 )

Net deferred tax assets ¥1 8 ,4 8 9 ¥17,127 $ 1 3 9 , 0 1 5