JVC 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT 2 0 0 2

3 3

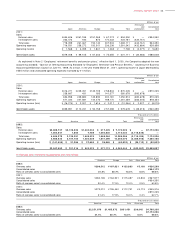

NOTES TO CONSOLIDATED FINANCIAL STATEM ENTS

Victor Company of Japan, Limited and its consolidated subsidiaries

Years ended March 3 1, 2002, 2001 and 20 00

1 . BASIS OF PRESENTING CONSOLIDATED FINANCI AL

STATEMENTS

Victor Company of Japan (the “Company”) and its consolidated domestic

subsidiaries maintain their official accounting records in Japanese yen and

in accordance with the provisions set forth in the Japanese Commercial

Code and accounting principles and practices generally accepted in

Japan (“Japanese GAAP”). The accounts of overseas subsidiaries are

based on their accounting records maintained in conformity with

generally accepted accounting principles and practices prevailing

in the respective countries of domicile. Certain accounting principles

and practices generally accepted in Japan are different from International

Accounting Standards and standards in other countries in certain

respects as to application and disclosure requirements. Accordingly,

the accompanying consolidated financial statements are intended

for use by those who are informed about Japanese accounting principles

and practices.

The accompanying consolidated financial statements have been

restructured and translated into English (with some expanded descriptions

and the inclusion of consolidated statements of stockholders’ equity) from

the consolidated financial statements of the Company prepared in

accordance with Japanese GAAP and filed with the appropriate Local

Finance Bureau of the Ministry of Finance as required by the Securities

and Exchange Law. Some supplementary information included in the

statutory Japanese-language consolidated financial statements, but not

required for fair presentation is not presented in the accompanying

consolidated financial statements.

The translation of the Japanese yen amounts into U.S. dollars are

included solely for the convenience of readers, using the prevailing

exchange rate at March 31, 2002, which was ¥133 to U.S.$1.00.

The convenience translations should not be construed as representations

that the Japanese yen amounts have been, could have been, or could

in the future be, converted into U.S. dollars at this or any other rate

of exchange.

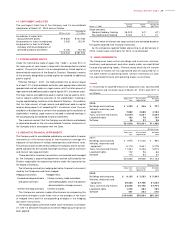

2 . SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Principles of consolidation

The consolidated financial statements include the accounts of the

Company and its significant subsidiaries. All significant intercompany

transactions and accounts have been eliminated.

Effective for the year ended March 31, 2000, all companies are

required to consolidate all significant investees, which are controlled

through substantial ownership of majority voting rights or existence of

certain conditions. Previously, only majority-owned companies were

consolidated. The prior years’ consolidated financial statements have

not been restated.

The effect of applying this rule to the Company’s consolidated

financial statements was immaterial.

Investments in certain unconsolidated subsidiaries and affiliated

companies (20% to 50% owned and certain others 15% to 20% owned)

are, with minor exceptions, stated at their underlying net equity value

after elimination of unrealized intercompany profits and losses. The

Company’s investments in its remaining subsidiaries and affiliated com-

panies are immaterial in the aggregate, and are stated at cost or less.

The differences between acquisition cost and underlying net equity

at the time of acquisition are generally being amortized on the straight-

line method over five years.

Foreign currency translation

Current assets and liabilities denominated in foreign currencies are

translated into Japanese yen at exchange rates prevailing at the balance

sheet dates except for those hedged by foreign currency forward

contracts, which are recorded at contract rates. Prior to April 1, 2000,

non-current assets and liabilities denominated in foreign currencies

were translated at historical exchange rates.

Effective April 1, 2000, the Company and its consolidated subsidiaries

(the “Companies”) adopted the revised accounting standard for foreign

currency translation (the “Revised Accounting Standard”). Under the

Revised Accounting Standard, long-term receivables and payables

denominated in foreign currencies are also translated into Japanese

yen at the year-end rate.

The effect on the consolidated statement of operations of adopting

the Revised Accounting Standard was immaterial.

Balance sheets of consolidated overseas subsidiaries are translated

into Japanese yen at the year-end rate except for stockholders’ equity

accounts, which are translated at the historical rates.

Statements of operations of consolidated overseas subsidiaries are

translated at average rates except for transactions with the Company,

which are translated at the rates used by the Company.

Due to the adoption of the Revised Accounting Standard, the Company

reports foreign currency translation adjustments in stockholders’ equity

and minority interests. The prior year’s amount, which is included in

assets, has not been reclassified.

Cash and cash equivalents

In preparing the consolidated statement of cash flows for the years

ended March 31, 2002, 2001 and 2000, cash on hand, readily

available deposits and short-term highly liquid investments with

maturities not exceeding three months at the time of purchase are

considered to be cash and cash equivalents.

Inventories

Inventories are stated at cost, which is determined primarily by the

average-cost method.

Securities

Prior to April 1, 2000, publicly-traded securities were stated at the

lower of cost or market, and the other securities were stated at cost.

Cost was determined using the moving-average method. Securities of

consolidated subsidiaries in the United States were accounted for in

accordance with the Statement of Financial Accounting Standards

No.115 by the Financial Accounting Standards Board.

Effective April 1, 2000, the Companies adopted the new Japanese

accounting standard for financial instruments (“Opinion Concerning

Establishment of Accounting Standard for Financial Instruments”

issued by the Business Accounting Deliberation Council on January

22, 1999).

Upon applying the new accounting standard, all companies are

required to examine the intent of holding each security and classify

those securities as (a) securities held for trading purposes (hereafter,

“trading securities”), (b) debt securities intended to be held to maturity

(hereafter, “held-to-maturity debt securities”), (c) equity securities

issued by subsidiaries and affiliated companies, or (d) for all other