JVC 2001 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2001 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.< 2 VICTOR COMPANY OF JAPAN, LIMITED 3 >

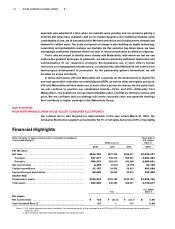

TOP- AND BOTTOM-LINE GROWTH, BUT REALITIES TO FACE

• Consolidated net sales rose 7.4% to ¥934.3 billion (US$7,535 million) over the previous fiscal year.

• Higher sales were achieved in digital and networking products—a key area of focus for JVC

in our drive to transform into a “Digital & Network Company.”

• Operating income moved into the black and net income increased to ¥2.5 billion (US$20

million), reversing a year-ago loss of ¥5.3 billion.

On June 28, 2001, I was elected as a director of Victor Company of Japan, Limited (JVC) at the

annual meeting of stockholders and appointed president at a subsequent Board of Directors’

meeting. I have taken the helm at a transitional time in the history of JVC. While our financial

results improved strongly in the past fiscal year, we still have a number of fundamental issues

to resolve, such as ensuring sustainable growth over the long term and reinventing JVC to

strengthen our balance sheet.

“Value Creation 21,” a three-year plan (fiscal 2002 to fiscal 2004) launched this fiscal year,

points us in this direction and shifts our focus back to what we do best. The plan bears the

same name as the initiative presently being implemented by Matsushita Electric Industrial

Co., Ltd., which holds 52.4% of JVC’s outstanding shares. Parallel is the operative word. That’s

because while running JVC in harmony with Matsushita Group strategy, we will implement

reforms at JVC toward independently established goals. This parallel approach signifies our

commitment to remaining a company with the authority to make the independent decisions

required to run our business, while at the same time being a key member of the Matsushita

Group. Our ultimate goal is to raise our corporate value in both contexts.

“VALUE CREATION 21” BASIC STRATEGY—FROM DECONSTRUCTION TO CREATION

PRACTICING THOROUGH CAPITAL COST MANAGEMENT

JVC has in the past had a strong balance sheet. In recent times, however, that strength has

been gradually undermined by insufficient recognition of the importance of capital cost

management (CCM) and cash flows. At present, our profits aren’t covering the cost of capital.

Correcting our inventory overhang is the most immediate challenge we face in redressing the

balance. This will be achieved by shortening lead-times and practicing thoroughgoing

management. Shrinking investment assets will also be instrumental in managing our capital

cost more effectively. Here, we will reorganize factories, overhaul business structures and

unwind cross-shareholdings. The freed up resources will be channeled into growth businesses,

particularly Digital and Networking (D&N) business.

Tightening our focus on product lines that generate earnings and trimming fixed costs will

contribute positively to CCM, too. To this end, we plan to rightsize or withdraw from

unprofitable businesses and undertake strict profit management on an individual product

model basis. Thus we are tackling CCM from multiple angles, eliminating management, quality

control and production losses, and trimming our headcount to reduce personnel expenses.

These actions demonstrate our resolve to meeting stakeholders’ expectations by delivering

positive CCM in fiscal 2004.

ACCELERATING CREATION THROUGH COOPERATION—A GROWTH DRIVER WITHIN THE MATSUSHITA GROUP

Another reality we must face is our insufficient resources in certain areas. Striking up alliances

and deepening ties with strategic partners are answers to this problem. Heretofore, we have

promoted a strategy with a high degree of independence within the Matsushita Group. That

strategy has been rooted in our sophisticated technology and wealth of entertainment content.

We have pursued a relationship founded on “mutual development through competition.” This