JVC 2001 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2001 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The 1.5% unsecured convertible bonds are redeemable prior to

their stated maturity, in whole or in part, at the option of the Com-

pany at prices ranging from 107% to 100% of the principal amount,

respectively. The price at which shares of common stock shall be

issued upon conversion is ¥2,867 ($23.12) per share, subject to

adjustment under certain circumstances. The 0.35% and 0.55%

unsecured convertible bonds are redeemable prior to their stated

maturity, in whole or in part, at the option of the Company at prices

ranging from 102% to 100% and 103% to 100% of the principal

amount, respectively. For both issues, the price at which shares of

common stock shall be issued upon conversion is ¥1,487 ($11.99)

per share, subject to adjustment under certain circumstances.

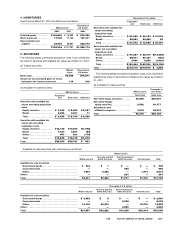

The aggregate annual maturities of long-term debt at March 31,

2001 were as follows:

Thousands of

Year ending March 31 Millions of yen U.S. dollars

2002 . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥11,732 $ 94,613

2003 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27,050 218,145

2004 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,334 59,145

2005 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13,052 105,258

2006 . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39,863 321,476

Thereafter . . . . . . . . . . . . . . . . . . . . . . . 30,294 244,307

¥129,325 $1,042,944

8. PLEDGED ASSETS

The following assets were pledged as collateral for current portion of

long-term debt and accrued expenses at March 31, 2001:

Thousands of

Millions of yen U.S. dollars

Investments . . . . . . . . . . . . . . . . . . . . . . ¥ 1$8

Machinery and equipment . . . . . . . . . . 110 887

¥111 $895

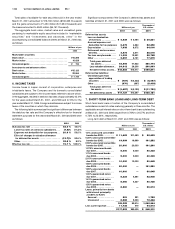

9. EMPLOYEES’ SEVERANCE AND RETIREMENT

BENEFITS

As explained in Note 2, Significant Accounting Policies, effective

April 1, 2000, the Companies adopted the new accounting standard

(“Opinion on Setting Accounting Standard for Employees’ Sever-

ance and Retirement Benefits”). Liability for employees’ retirement

benefits included in liabilities in the consolidated balance sheet and

the related expenses for 2001, which were determined based on

the amounts obtained by actuarial calculations, were as follows:

Thousands of

Millions of yen U.S. dollars

Projected benefit obligation:

Projected benefit obligation . . . . . . . ¥(226,706) $(1,828,274)

Unamortized prior service costs . . . (8,899) (71,766)

Unamortized actuarial differences . . . 16,097 129,815

Less fair value of pension assets . . . 159,855 1,289,153

Less unrecognized net transition

obligation . . . . . . . . . . . . . . . . . . . . . 38,907 313,766

Liability for severance and

retirement benefits . . . . . . . . . . . . . . . ¥ (20,746) $ (167,306)

Serverance and retirement benefits

expenses:

Service costs . . . . . . . . . . . . . . . . . . . ¥ 7,044 $ 56,806

Interest costs on projected benefit

obligation . . . . . . . . . . . . . . . . . . . . . 8,923 71,960

Expected return on plan assets . . . . (4,499) (36,282)

Amortization of net transition

obligation . . . . . . . . . . . . . . . . . . . . . 2,779 22,411

Serverance and retirement benefits

expenses . . . . . . . . . . . . . . . . . . . . . . . ¥ 14,247 $ 114,895

Not included in the above table is special retirement payments

amounting to ¥3,595 million ($28,992 thousand), which was

expensed in 2001.

The discount rate and the rate of expected return on plan assets

used by the Company are 4.0% and 3.0%, respectively. The

estimated amount of all retirement benefits to be paid at future

retirement date is allocated equally to each service year using the

estimated number of total service years. Prior service costs are rec-

ognized in income or expense using the straight-line method over

10 years, and actuarial gains and losses are recognized in income

or expense using the straight-line method over 10 years commenc-

ing with the succeeding period.

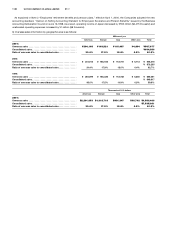

10. CONTINGENT LIABILITIES

The contingent liabilities of the Company and its consolidated sub-

sidiaries at March 31, 2001 were as follows:

Thousands of

Millions of yen U.S. dollars

As endorser of export bills

discounted with banks . . . . . . . . . . . . . ¥24,901 $200,815

As guarantor for loans to employees . . 16,497 133,040

As guarantor for loan to affiliated

company and lease obligations of

affiliated company and others . . . . . . . 3,523 28,411

¥44,921 $362,266

11. STOCKHOLDERS’ EQUITY

Under the Commercial Code of Japan (the “Code”), at least 50% of

the issue price of new shares, with a minimum of the par value thereof,

is required to be designated as stated capital. The portion which is to

be designated as stated capital is determined by resolution of the

Board of Directors. Proceeds in excess of the amounts designated

as stated capital are credited to additional paid-in capital.

Under the Code, certain amounts of retained earnings equal to at

least 10% of cash dividends and bonuses to directors and corporate

auditors must be set aside as a legal reserve until the reserve equals

25% of common stock. The reserve is not available for dividends but

may be used to reduce a deficit by resolution of the shareholders or

may be capitalized by resolution of the Board of Directors. The legal

reserve is included in the retained earnings.

The maximum amount that the Company can distribute as dividends

is calculated based on the unconsolidated financial statements of

the Company and in accordance with the Code.

12. DERIVATIVE FINANCIAL INSTRUMENTS

The Company and its consolidated subsidiaries uses derivative

financial instruments in the normal course of their business to manage

the exposure to fluctuations in foreign exchange rates and interest

rates. The primary classes of derivatives used by the Company and

its consolidated subsidiaries are forward exchange contracts, option

contracts and interest rate swap contracts.

These derivative financial transactions are executed and managed

by the Company’s accounting department and are authorized by the

Director responsible for accounting matters under the supervision by

the Board of Directors.

< 34 VICTOR COMPANY OF JAPAN, LIMITED 35 >