JVC 2001 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2001 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.< 20 VICTOR COMPANY OF JAPAN, LIMITED 21 >

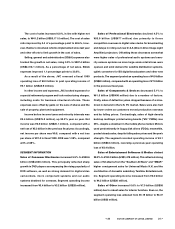

The cost of sales increased 6.8%, in line with higher net

sales, to ¥641.2 billion (US$5,171.0 million). The cost of sales

ratio improved by 0.4 of a percentage point to 68.6%, how-

ever, thanks to structural reforms implemented since last year

and other efforts to limit growth in the cost of sales.

Selling, general and administrative (SG&A) expenses also

tracked the growth in net sales, rising 3.5% to ¥287.4 billion

(US$2,318.1 million). As a percentage of net sales, SG&A

expenses improved 1.1 percentage points to 30.8%.

As a result of the above, JVC reversed a fiscal 1999

operating loss of ¥8.0 billion to post operating income of

¥5.7 billion (US$45.9 million).

In other income and expenses, JVC booked expenses for

a special retirement program and took restructuring charges,

including costs for business structural reforms. These

expenses were offset by gains on the sale of shares and the

sale of property, plant and equipment.

Income before income taxes and minority interests was

¥9.4 billion (US$76.2 million), up 55.2% year on year. Net

income was ¥2.5 billion (US$20.1 million), compared with a

net loss of ¥5.3 billion in the previous fiscal year. Accordingly,

net income per share was ¥9.8, compared with a net loss

per share of ¥21.0 in fiscal 1999. ROE was 1.38%, compared

with –2.68%.

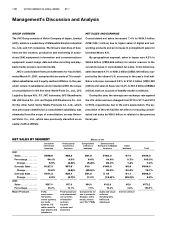

SEGMENT INFORMATION

Sales of Consumer Electronics increased 5.5% to ¥598.6

billion (US$4,828 million). This principally reflected sharp

growth in DVD players accompanying the rising popularity of

DVD software, as well as strong demand for digital video

camcorders, micro component systems and car audio

systems destined for overseas. Segment operating income

increased from ¥0.4 billion to ¥3.2 billion (US$26 million).

Sales of Professional Electronics declined 4.5% to

¥83.9 billion (US$677 million) due primarily to fierce

competition overseas in digital video decks for broadcasting

and delays in rolling out new D-ILA (Direct-Drive Image Light

Amplifier) projectors. Offsetting these decreases somewhat

were higher sales of professional audio systems and secu-

rity camera systems as more large-scale retail stores were

opened, and solid demand for satellite distribution systems,

uplink converters for BS digital broadcasters and other new

products. The segment posted an operating loss of ¥4.9 billion

(US$40 million), compared with an operating loss of ¥7.9 billion

in the previous fiscal year.

Sales of Components & Devices decreased 5.1% to

¥61.5 billion (US$496 million) due to a number of factors.

Firstly, sales of deflection yokes dropped because of a slow-

down in demand in the U.S. PC market. Sales were also hurt

by lower orders as customers moved production overseas

and by falling prices. Contrastingly, sales of high-density

build-up multilayer printed wiring boards (“VIL” PWBs) rose

35%, despite a downturn in the mobile phone market. Motors

used predominantly in floppy disk drives (FDDs), meanwhile,

posted steady sales, despite falling sales prices and the yen’s

strength. The segment recorded operating income of ¥4.1

billion (US$33 million), reversing a previous-year operating

loss of ¥2.4 billion.

Sales of Entertainment Softwares & Medias climbed

28.2% to ¥183.3 billion (US$1,478 million). This reflected strong

sales of hit albums from the “Southern All Stars” and “SMAP,”

higher consignment sales for Universal Music K.K. and the

contribution of domestic subsidiary Teichiku Entertainment,

Inc. Segment operating income increased from ¥3.0 billion

to ¥4.5 billion (US$36 million).

Sales of Other increased 0.6% to ¥7.0 billion (US$56

million) due to robust sales for interior furniture. Even so, the

segment operating loss widened from ¥0.19 billion to ¥0.37

billion (US$3 million).