JVC 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

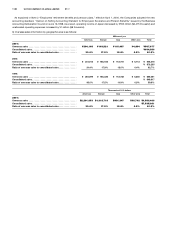

Total sales of available-for-sale securities sold in the year ended

March 31, 2001 amounted to ¥16,160 million ($130,323 thousand)

and the gains amounted to ¥1,450 million ($11,694 thousand) and

the losses amounted to ¥640 million ($5,161 thousand).

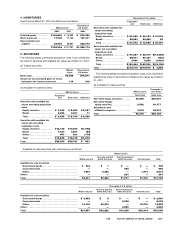

The aggregate book value, market value and unrealized gains

pertaining to marketable equity securities included in “marketable

securities” and “investments and advances, other” in the

accompanying consolidated balance sheets at March 31, 2000 was

as follows:

Millions of yen

2000

Marketable securities:

Book value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥15,295

Market value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16,029

Unrealized gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 734

Investments and advances other:

Book value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥15,120

Market value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,864

Unrealized gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ¥ 7,744

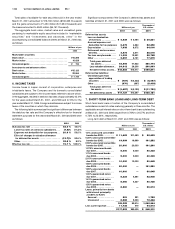

6. INCOME TAXES

Income taxes in Japan consist of corporation, enterprise and

inhabitants taxes. The Company and its domestic consolidated

subsidiaries are subject to the income taxes referred to above which,

in the aggregate, resulted in statutory tax rates of approximately 42.0%

for the years ended March 31, 2001, and 2000 and 47.6% for the

year ended March 31, 1999. Foreign subsidiaries are subject to income

taxes of the countries in which they domicile.

The following table summarizes the significant differences between

the statutory tax rate and the Company’s effective tax for financial

statement purposes for the year ended March 31, 2001and 2000 were

as follows:

2001 2000

Statutory tax rate . . . . . . . . . . . . . . . . . . . . . . . . 42.0 % 42.0 %

Lower tax rates of overseas subsidiaries . . . (7.4)% (11.3)%

Expenses not deductible for tax purposes . . 20.0 % 53.0 %

Effect of changes in valuation allowance

for deferred tax assets . . . . . . . . . . . . . . . . . (13.7)% 93.6 %

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 35.8 % 8.2 %

Effective tax rate . . . . . . . . . . . . . . . . . . . . . . . . . 76.7 % 185.5 %

Significant components of the Company’s deferred tax assets and

liabilities at March 31, 2001 and 2000 were as follows:

Thousands of

Millions of yen U.S. dollars

2001 2000 2001

Deferred tax assets:

Loss on devaluation

of inventory . . . . . . . . . . . . ¥4,939 ¥5,464 $ 39,831

Accrued expenses not

deductible for tax purposes 6,479 4,264 52,250

Depreciation . . . . . . . . . . . . 7,938 8,372 64,016

Retirement and severance

benefits . . . . . . . . . . . . . . . . 3,474 2,811 28,016

Tax loss carryforwards . . . . 11,009 12,591 88,782

Other . . . . . . . . . . . . . . . . . . . 9,657 8,121 77,879

Total gross deferred

tax assets . . . . . . . . . . . . 43,496 41,623 350,774

Less valuation allowance . . 24,912 26,206 200,903

Net deferred tax assets . . ¥18,584 ¥15,417 $149,871

Deferred tax liabilities:

Unrealized gain from

appreciation of trading

securities . . . . . . . . . . . . . . ¥(787) ¥(4,223) $ (6,347)

Other . . . . . . . . . . . . . . . . . . . (670) (897) (5,403)

Total gross deferred

tax assets . . . . . . . . . . . . ¥(1,457) ¥(5,120) $ (11,750)

Net deferred tax assets . . . ¥17,127 ¥10,297 $138,121

7. SHORT-TERM BANK LOANS AND LONG-TERM DEBT

Short-term bank loans of certain of the Company’s consolidated

subsidiaries consist of notes maturing generally in three months. The

applicable annual interest rates on short-term bank loans outstanding

at March 31, 2001 and 2000 ranged from 0.78% to 20.57% and from

0.73% to 23.64%, respectively.

Long-term debt at March 31, 2001 and 2000 was as follows:

Thousands of

Millions of yen U.S. dollars

2001 2000 2001

1.5% unsecured convertible

bonds due 2005 . . . . . . . . . ¥11,483 ¥11,483 $ 92,605

0.35% unsecured convertible

bonds due 2002 . . . . . . . . . 19,999 19,999 161,282

0.55% unsecured convertible

bonds due 2005 . . . . . . . . . 20,000 20,000 161,290

1.375% unsecured bonds

due 2001 . . . . . . . . . . . . . . . 5,000 5,000 40,323

1.75% unsecured bonds

due 2003 . . . . . . . . . . . . . . . 5,000 5,000 40,323

2.15% unsecured bonds

due 2005 . . . . . . . . . . . . . . . 10,000 10,000 80,645

1.68% unsecured bonds

due 2006 . . . . . . . . . . . . . . . 20,000 —161,290

1.89% unsecured bonds

due 2007 . . . . . . . . . . . . . . . 10,000 —80,645

1.30% guaranteed notes

due 2001 . . . . . . . . . . . . . . . 5,324 4,561 42,936

1.61% guaranteed notes

due 2002 . . . . . . . . . . . . . . . 5,050 4,327 40,726

1.50% guaranteed notes

due 2005 . . . . . . . . . . . . . . . 8,260 —66,613

Loans, primarily from banks

with interest principally

at 0.86% to 9.20%

Secured . . . . . . . . . . . . . . 221 221 1,782

Unsecured . . . . . . . . . . . . 8,988 9,323 72,484

129,325 89,914 1,042,944

Less current portion . . . . . . 11,732 479 94,613

¥117,593 ¥89,435 $ 948,331

< 34 VICTOR COMPANY OF JAPAN, LIMITED 35 >