JVC 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 JVC annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

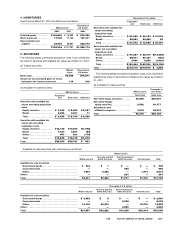

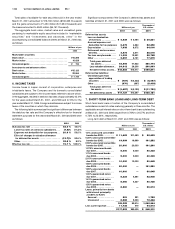

The following summarizes hedging derivative financial instruments

used by the Companies and items hedged:

Hedging instruments: Hedging items:

Forward exchange contracts Foreign currency trade receivables

and option contracts and trade payables, future transaction

denominated in a foreign currency

Interest rate swap contracts Interest on bonds and notes

The Companies evaluate hedge effectiveness by comparing the

cumulative changes in cash flows from or the changes in fair value

of hedged items and the corresponding changes in the hedging

derivative instruments.

The following tables summarize market value information as of

March 31, 2001 of derivative transactions for which hedge accounting

has not been applied:

Millions of yen

Contract Market Recognized

March 31, 2001 amount value gain (loss)

Swap contracts:

Receive fix/pay floating . . . . ¥5,000 ¥(1) ¥(1)

Pay fix/receive floating . . . . . 5,000 1 1

Thousands of U.S. dollars

Contract Market Recognized

March 31, 2001 amount value gain (loss)

Swap contracts:

Receive fix/pay floating . . . . $40,323 $(8) $(8)

Pay fix/receive floating . . . . . 40,323 8 8

The outstanding contract amounts of derivative financial

transactions, their book values and their market values at March 31,

2000 were summarized as follows:

Millions of yen

Contract Market Unrealized

March 31, 2000 amount value gain (loss)

Forward exchange contracts:

To sell U.S. dollars . . . . . . . . . . ¥51,691 ¥51,430 ¥ 261

To sell Euros . . . . . . . . . . . . . . 14,828 13,909 919

To sell Sterling pounds . . . . . . 3,883 3,718 165

To sell Canadian dollars . . . . . 2,500 2,399 101

To sell Singapore dollars . . . . 2,400 2,347 53

To sell Others . . . . . . . . . . . . . . 596 562 34

To buy U.S. dollars . . . . . . . . . 15,342 15,037 (305)

To buy Singapore dollars . . . . 312 312 0

To buy Thai bahts . . . . . . . . . . 1,570 1,604 34

Millions of yen

Contract Book Market Unrealized

March 31, 2000 amount value value gain (loss)

Option contracts:

Call:

To sell U.S. dollars . . . . . . ¥12,965 ¥49 ¥132 ¥(83)

To sell Euros . . . . . . . . . . 2,153 16 10 6

Put:

To sell U.S. dollars . . . . . . 3,749 20 111 (91)

To sell Euros . . . . . . . . . . 985 11 9 2

Call:

To buy U.S. dollars . . . . . 1,260 —11 11

Put:

To buy U.S. dollars . . . . . 12,938 74 203 129

To buy Euros . . . . . . . . . . 2,153 27 25 (2)

Millions of yen

Contract Market Recognized

March 31, 2000 amount value gain (loss)

Swap contracts:

Receive fix/pay floating . . . . ¥9,561 ¥(10) ¥(10)

Pay fix/receive floating . . . . . 5,000 2 2

The forward contracts on the foreign currency receivable and

payables translated into Japanese yen at the forward exchange rate

on the accompanying consolidated financial statements were not

included in the above amounts.

The fair value of forward exchange contracts are estimated based

on market prices for contracts with similar terms.

The fair value of option contracts and interest rate swap contracts

are estimated based on the quotes obtained from financial institutions.

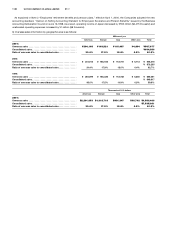

13. LEASE INFORMATION

The Companies lease certain buildings and structures, vehicles,

machinery and equipment and other assets under non-capitalized

finance and operating leases. Finance leases which do not transfer

ownership to lessees are not capitalized and are accounted for in the

same manner as operating leases. Certain information for such non-

capitalized finance and operating leases is as follows.

Lessee:

(1) A summary of assumed amounts of acquisition cost, accumulated

depreciation and net book value at March 31, 2001 and 2000 is as

follows:

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

2001:

Buildings and structures . . . ¥1,975 ¥1,023 ¥952

Vehicles, machinery and

equipment . . . . . . . . . . . . . . 9,119 3,341 5,778

Tools, furniture and fixtures . 11,361 5,446 5,915

Leasehold rights . . . . . . . . . . 122 56 66

Software . . . . . . . . . . . . . . . . . 115 83 32

¥22,692 ¥9,949 ¥12,743

Millions of yen

Acquisition Accumulated Net book

cost depreciation value

2000:

Buildings and structures . . . ¥2,035 ¥1,226 ¥809

Vehicles, machinery and

equipment . . . . . . . . . . . . . . 5,738 2,849 2,889

Tools, furniture and fixtures . 11,699 5,742 5,957

Leasehold rights . . . . . . . . . . 109 66 43

Software . . . . . . . . . . . . . . . . . 167 103 64

¥19,748 ¥9,986 ¥9,762

Thousands of U.S. dollars

Acquisition Accumulated Net book

cost depreciation value

2001:

Buildings and structures . . . $ 15,927 $ 8,250 $ 7,677

Vehicles, machinery and

equipment . . . . . . . . . . . . . . 73,540 26,944 46,596

Tools, furniture and fixtures . 91,621 43,919 47,702

Leasehold rights . . . . . . . . . . 984 452 532

Software . . . . . . . . . . . . . . . . . 928 669 259

$183,000 $80,234 $102,766

< 36 VICTOR COMPANY OF JAPAN, LIMITED 37 >